2/1/18 Update: Liquid Assets (cash+investments+loan) at 12/31/17 were $1127mm or $21.06/ADS.

- Chairman Charles Zhang offered to acquire all outstanding shares of Changyou at a price of $42.10/ADS

- The offered price is significantly below the average valuations of competing companies (27.7 P/E for US/HK listed and 36.9 P/E for China listed)

- The offered price does not fairly compensate Changyou shareholders for the company’s strong financial position ($19/ADS in liquid assets) and consistently positive operating cash flow.

- Fair value is hard to determine until the success of Changyou’s current game launches is clear, but should be at least $53/ADS based on 10X base operating earnings ($34) plus the value of cash and investments ($19).

- Shareholder value should be maximized by negotiation of a sale after release of 1Q18 results

Changyou is a mid-sized Chinese PC/Mobile gaming company which was spun off from Sohu through a 2009 IPO. Sohu continues to hold a 68% interest in Changyou and Charles Zhang is Chairman of both companies. Sohu is not a party to the buyout offer and would receive cash for its stake in Changyou. The offered price is clearly inadequate, but a transaction at a higher price could be a win-win outcome with benefits for all parties. Implications of the offer and other recent developments for Sohu are described in a companion article.

Changyou’s business is documented in great detail in its 20-F filing. The company has one well established franchise (Tian Long Ba Bu 天龙八部) on which it has based a series of hit games since 2007.

Latest version of TLBB MMORPG game

The Offer is below the average valuation of comparable companies:

Changyou trades at a much lower P/E multiple than China listed game developers including Perfect World and Giant which formerly traded in the US. The products and the game market are much better understood by local Chinese investors and companies are able to operate without the awkward Variable Interest Entity structures. The valuation disparity provides strong impetus for privatization of Changyou followed by a future listing in China.

The offered price does not fairly compensate Changyou shareholders for the company’s strong financial position ($19.14/ADS in liquid assets) and consistently positive operating cash flow.

Changyou has reported strong operating cash flow every year since its IPO:

Changyou has accumulated $1,029mm of financial assets that are not required for continued operation of its business:

The company would be in even stronger condition if it had not wasted $188mm on acquisitions which were subsequently written off. Allocation of cash to these purchases, plus loans to parent company Sohu, demonstrate clearly that Changyou’s successful game business does not need to reinvest the cash which it generates every year. Shareholders would benefit if the cash were used in support of a fair privatization transaction or through payment of a substantial annual dividend.

Changyou paid a special dividend of $3.80/ADS in 2012, but none since then.

Fair value is hard to determine until the success of Changyou’s current game launches is clear, but should be between $53-94

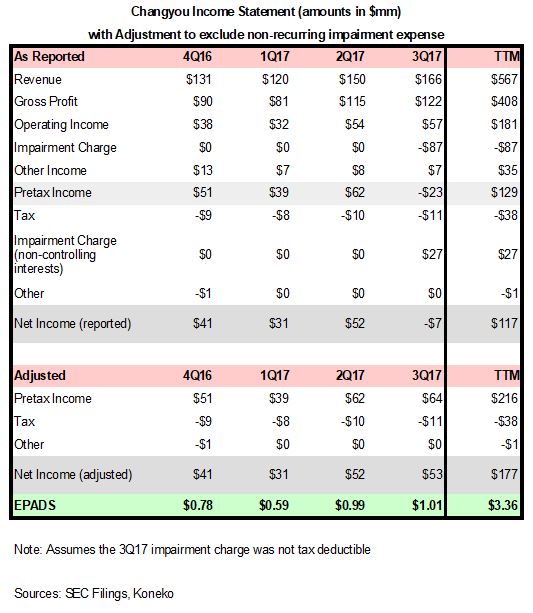

Changyou has earned net income of $3.36/ADS in the trailing 12 months after adjustment to exclude the $87mm impairment expense related to the Mobotap acquisition.

The average analyst forecast for 2018 EPADS is $3.49. A benefit of the TLBB franchise is that it provides stability because revenues can be generated more easily and predictably from updates and expansions than from completely new games. However reliance on one franchise makes it harder to grow. The company believes that its experience in managing a franchise over many years can be profitably applied to new games. The company has several new games scheduled for release in coming months. If these are successful then revenues and profits could rise significantly.

New mobile game: Dao Jian Dou Shen Zhuan (刀剑斗神传)

New mobile game 那一剑江湖

New PC Fantasy Game: Man Huang Sou Shen Ji 蛮荒搜神记

Until the degree of success from these new games is more evident it is difficult to know whether they will bring future earnings significantly above the recent run rate. The timing of Chairman Zhang’s buyout offer hints that he may have hoped to complete in deal during 2017 and capture the expected profits from these games for himself.

Fortunately the buyout offer has made no apparent progress. It would be in the best interest of Changyou shareholders (including Sohu) to negotiate the sale of the company after release of 1Q18 earnings. At that time it will be more clear whether the company has a stable low-growth business managing the TLBB franchise or if it has built a more diversified and higher growth business. This example shows the possible impact on the value of the company:

Changyou Shareholder value should be maximized by negotiating a sale after 1Q18 results

A win-win outcome should reflect these considerations:

- Sale should be made after all parties can make a fair assessment of the potential of the current slate of game launches

- Changyou shares are unlikely to ever be valued as highly in the US as they would be in China. An acquirer of Changyou should pay a fair control premium, but need not pay a multiple comparable to Shenzhen listed competitors.

- Changyou should maintain some form of strategic partnership with Sohu for production of video content related to the same Intellectual Property used in Changyou games.

If a buyer is unwilling to pay a fair price then Changyou should adopt a policy of paying out a majority of operating cash flow as dividends. Changyou has proven that its core business can be successful without reinvestment of earnings and diversification attempts have been failures.

Disclosures:

The author is a shareholder of Changyou and Sohu. The author does not make any recommendation regarding investment in either company. Investors should verify any facts in the article they deem relevant to their own decision about investment in either company. The author has not played any Changyou games.

2 thoughts on “Changyou’s Buyout Price Should be Raised to at least $53”