- This Hong Kong & China real estate company generated a return for shareholders (NAV appreciation + dividends) of 845% from 12/31/03 to 6/30/17, an annual IRR of 18%

- Shares trade at a 58% discount to book value and the fair value of the company’s assets is higher than book

- The company’s real estate sales earn a very high gross margin due to low historical land acquisition costs

- The company has low leverage (16% gearing ratio), 4.6 P/E (2017E), and a 2.3% dividend yield.

K Wah International (KWHAF) (HKEX:0173) is a well-known developer of luxury residential real estate in Hong Kong and selected Chinese cities (Shanghai, Guangzhou, Nanjing, and Dongguan). The company also has a valuable 3.8% stake in Macau casino operator Galaxy Entertainment (GXYEF) (HKEX:0027) which was spun off from K Wah in 2005.

Investors unfamiliar with K Wah may be amazed by the financial metrics mentioned above, but this is not an undiscovered story. Everybody in Hong Kong knows about K Wah, Galaxy, and their Chairman Lui Che Woo who ranks #6 on Forbes list of the richest people in Hong Kong. K Wah stock has traded at a large discount to book value for years and may continue to do so in the future, but it’s not a “value trap” if the value is growing. Even if the valuation multiples remain low, long-term investors will be rewarded through accumulation of strong earnings and dividends.

Premier Value Compounder at a Bargain Price

Analysts and investors do not give K Wah sufficient credit for its superior long-term value creation. Comparing K Wah with 5 other Hong Kong real estate conglomerates whose Chairmen share the Forbes Hong Kong rich list shows that K Wah has delivered the highest return for shareholders, yet trades at the lowest valuation:

- The NAV return demonstrates value delivered to public company shareholders.

- The 12/31/03-6/30/17 period is selected to assess management performance through two bull markets and one bear market.

- Price/Book shows the extent to which value is recognized by the current share price. Each company has a slightly different business mix. Arguments can be made that each is worth more than balance sheet book value. Operating assets like hotels, utilities, and real estate under development are not carried at fair market value.

The average analyst estimate is for K Wah to report FY17 EPS of HK$0.93 and FY18 EPS of HK$1.22. Those numbers largely reflect the recognition of revenue and profit upon delivery of homes for which contract sales have already been reported. The share price does not give the company sufficient credit for the long-term investment strategy which is generating those earnings and which may continue to do so for many years.

The sources of K Wah’s value creation are detailed in the next three sections …

K Wah’s Real Estate Development

Approximately 47% of the company’s net assets are allocated to property under development (27% Hong Kong and 19% China) which is carried at cost. The savvy timing of K Wah’s land acquisitions and property sales leads to consistently high gross margins:

A reference for gross margins from China real estate development was suggested in this Koneko article:

K Wah has achieved high margins by sticking to a few strong markets and using a long development cycle to increase exposure to land price appreciation and holding completed units for sale when conditions are most favorable.

- The green sections indicate land acquired in 2012 or earlier with a large block in Guangzhou even dating back to the early 1990s

- Completed but unsold space is retained at the discretion of the company in order to capture price appreciation.

- The Windermere project in Shanghai illustrates the company strategy. This large block of land was acquired in suburban Shanghai in early 2010, construction of luxury villas completed in 2014, and will soon be offered for sale.

All development properties are recorded at cost on K Wah’s balance sheet. K Wah stock provides investors with the opportunity to invest in this vintage landbank with perfect hindsight – buy at a discount to the land values from 5, 10, or even 20 years ago.

Low leverage and low financing costs are essential to K Wah’s long-term strategy. The company’s gearing ratio (Net Debt / Equity) at 6/30/17 was just 16% and the company’s average cost of funds was just 2.1%. The company is well positioned to take advantage of opportunities that may be created by cyclical downturns.

K Wah’s Investment Property

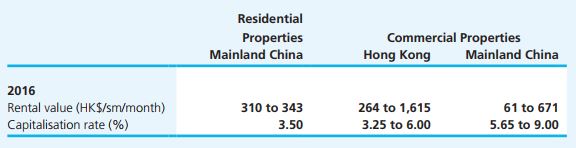

Approximately 27% of the company’s net assets are allocated to property retained for investment. These assets are recorded at “fair value” which I believe has been calculated conservatively. The Annual Report discloses the range of cap rates applied:

I believe the fair value of the residential properties is a cap rate in a range of 2-3%. I believe the company’s most valuable commercial property is the K Wah Centre in Shanghai where limited space is available at rates around 8-10 RMB/sqm/day. The building could probably be sold at a rental yield of 4-5%, a premium to the carrying value of at least 5.65%. For reference, SOHO recently announced the sale of its SKY SOHO Project in Shanghai at a rental yield of 3.6%.

The retention of some apartments from the company’s real estate developments for leasing is a way to extend holding periods and maximize the long-term value that began from the land acquisitions many years ago.

Galaxy Entertainment

Approximately 24% of the company’s net assets are represented by ownership of 162mm shares of Galaxy Entertainment Group which is a leading casino operator in Macau. Galaxy was acquired by K Wah from Dr. Lui in 2004, spun-off in 2005 into its own listing, and opened the Starworld casino in 2006. Since 2007 Galaxy has held a landbank of over 1mm sqm for long-term growth. Its Phase 2 expansion opened in 2015 and Phases 3&4 will be developed in coming years. The gaming business in Macau has become more cyclical in recent years, but Galaxy’s future growth plans will focus on family style resorts and entertainment. The company has also been studying the potential to develop casinos in Japan and other Asian countries.

K Wah’s balance sheet records the fair market value of its retained 3.8% stake (162mm shares) in Galaxy. The 23% rise in Galaxy’s price since the 6/30/17 valuation will boost K Wah’s year-end book value, but Galaxy’s current valuation over 15X EBITDA seems to fairly reflect its market position and near-term growth potential. Long-term appreciation will depend on how the company is able to develop its large landbank.

In 2013-2014 K Wah shares were perceived as a proxy for investment in Galaxy and the booming Macau market. Since then investors may have failed to appreciate that rather than being a unique one-time success, K Wah’s interest in Galaxy was just one example of a successful long-term investment strategy which is also generating exceptional returns in other markets (e.g. Guangzhou, Hong Kong, and Shanghai).

Risks

- US OTC trading under symbol KWHAF is illiquid. Hong Kong trading under symbol 0173 is active with turnover averaging 4.4mm shares/day

- Chairman Lui Che Woo controls 62% of K Wah shares. He is 88 years old and his 4 children are all senior company executives. Outside shareholders have limited influence. Investors should not expect any significant corporate transactions such as privatization or spin-off of K Wah’s remaining shares of Galaxy.

- The company’s primary markets have been very strong over the past 15 years. If home prices in these cities fell then the value of K Wah’s property would decline.

- Real estate values in Hong Kong and China have been supported by low interest rates. If interest rates rose significantly then property values could fall.

Additional Information

Disclosure

The author is a shareholder of K Wah International. The author does not make any recommendation regarding investment in the company. Investors should verify any facts in the article they deem relevant to their own decision about investment in the company.

Thanks for this article, its very interesting and well researched. Ive been looking into this company myself, and agree that its undervalued, but also that it has remained so for a long time. Are you aware of any reason for it to be undervalued in relation to similar companies? and do you see any coming catalysts for change?

LikeLike

Hi Andrew. Thanks for your comment.

Many family controlled companies listed in Hong Kong trade at low P/E and P/B Multiples, but most are value traps due to mediocre returns.

My impression is that institutional analysts and investors in HK focus on trying to forecast real estate cycles themselves rather than looking at the long-term record of a company through multiple cycles. Each company has different exposure to retail, office, hotel and residential sectors so at any time some companies have a brighter near-term outlook than others. Sometimes HK exposure looks smarter and sometimes China exposure looks smarter. Sometimes developers are in favor and sometimes landlords are in favor. I have not seen anybody else do a long-term return analysis of HK companies similar to the one I presented in this article.

My thesis is that a re-rating of K Wah may not happen, but that investors will enjoy capital appreciation as the value of the company compounds. As an example, on 12/31/03 K Wah’s share price was HK$1.32, a small premium to the HK$1.28 book value on that date. Since then the company paid HK$1.77 in dividends (cash + spinoff of Galaxy valued at opening price in 2005) and the share price rose to HK$4.85. Long-term investors earned an attractive return even though the valuation relative to book value and peers got a lot worse. It’s very unlikely that the valuation will continue to decline, but I cannot offer any catalyst for it to get better.

LikeLike

Thats very helpful: I appreciate your detailed, and honest reply.

LikeLike