- Sohu will receive $1,179mm in cash ($30/SOHU) from Tencent’s privatization of Sogou, their jointly controlled search and AI business (LINK).

- Sohu’s Changyou gaming business could easily demonstrate value of $57/SOHU through a 2021 listing in Hong Kong or China.

- Sohu’s media business (news and video) continues to lose money and along with corporate overhead may have a negative value of $17/SOHU.

THE SOGOU BUYOUT

Tencent formed a strategic partnership with Sohu in 2013 through which it invested US$448mm to acquire a 39% equity interest and a 52% voting interest in the Sogou. Sogou has become the default search engine for various Tencent internet products and on a trial basis Sogou is currently operating a search function within the wechat application.

Acquisition of Sogou provides these benefits to Tencent:

- High familiarity with the product – no further due diligence required

- Consolidates control over a core functionality of Tencent products

- Facilitates integration of Sogou’s artificial intelligence applications including speech recognition, language translation, and computer vision

The deal terms appear fair:

- The $9/ADS price is 39X 2019 earnings

- Sohu Chairman Charles Zhang negotiated on an arms-length basis and pledged his personal 6% stake in Sogou in favor of the transaction

- A competing bid is impossible due to Sogou’s strategic dependence on Tencent and Tencent’s 52% voting interest in Sogou.

The directors of Sogou and Sohu have hired advisors to review the bid, but I expect it to go through before year-end at $9. Public shareholders of Sogou control only 2% of the voting power so I believe that once Sohu approves the deal it can be completed without a shareholder vote and without dissent rights.

THE CHANGYOU IPO

Changyou was privatized by Sohu in April 2020 at a bargain valuation of $583mm. I suggested last year that Changyou could earn at least $150mm in 2020, but this guess appears to have been overly conservative because Changyou’s gaming business earned $178mm in 2019 without any new hits.

Changyou continues work on on the next major mobile game release in its Tian Long Ba Bu (天龙八部) (TLBB) MMORPG franchise. One round of testing was conducted in May and another will begin on 8/7. A official launch date has not yet been projected. This Tian Long Ba Bu – Return (天龙八部·归来 ) game will tap into a current trend for game nostalgia by incorporating some design and gameplay elements drawn from the PC-based TLBB game ten years ago.

Success is never guaranteed in a popular media business, but prospects for the new game are excellent based on:

- enormously popular IP which has been the source for multiple TV and film adaptations

- success of prior TLBB games including new mobile games launched in 2014 and 2017 and even the lite version launched in 2019

- the PC game nostalgia factor

Since the Changyou privatization was announced there has been speculation that the company would follow peers by relisting in Hong Kong or China. Sohu Chairman Charles Zhang has always answered that it is under consideration. Peer valuations suggest that Changyou would trade for at least a 20 P/E multiple

Relisting in Hong Kong would be simpler because it would not require any corporate restructuring. Relisting in China would probably receive a higher valuation. 1H21 would be the ideal time to launch an IPO using full year 2020 financial results and what is likely to be elevated popular attention around the new TLBB game. Under conservative earnings assumptions Sohu’s stake would be worth $57/SOHU

If earnings jump to $225mm then Changyou could be worth $85/SOHU.

SOHU MEDIA

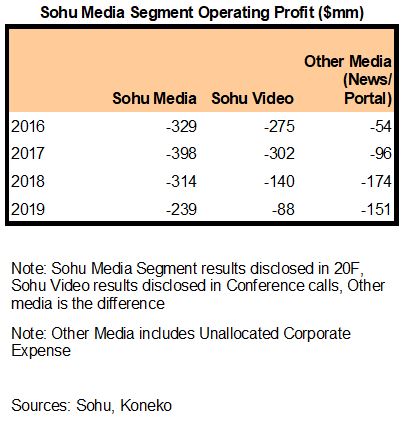

Sohu has endured 8 years of losses due to intense competition in its news and video operations. Over the past 2 years Sohu has reduced media losses by concentrating on lower cost production of proprietary content and not renewing expensive external licenses.

Sohu’s video business is a distant fourth behind industry leaders iQiyi, Tencent, and Youku. Losing less money is certainly progress, but it’s difficult to see whether Sohu will be able to find a market niche offering potential for long-term stability and profitability. Charles Zhang promised that video was on the verge of breakeven, but the COVID epidemic was highly disruptive to advertising revenues despite increased user engagement. Video losses still dropped to just $11mm in 1Q20.

The Media segment would have a negative value of $675mm ($17/SOHU) based on these assumptions

- Unallocated Corporate Expense and new business initiatives consume $50mm/year

- News/Portal (excluding corporate) reaches breakeven in 2025

- Video reaches breakeven in 2020

- Future losses are discounted at a rate of 10%

SOHU CORPORATE

Sohu wisely completed a corporate restructuring in 2018 that positioned all of its assets under a Cayman Islands parent company. As a result it will owe no corporate tax on proceeds from the Sogou merger or from the deemed gain on a Changyou IPO.

Sohu will report earnings on August 10 and it will be very interesting to hear comments on the expected use of the Sogou proceeds. Possibilities include:

- Special Dividend. Under Sohu’s control Changyou had a strong record of sharing value with investors through 3 special dividends ($4/ADS, $9.40/ADS and $9.40/ADS)

- Share Buyback. Sogou announced a $50mm share buyback plan in August 2019 and followed through with purchase of $42mm of shares by year-end.

- Investment in Media business. It will no longer be necessary for Sohu to fund media losses with cash from Changyou, but the sudden availability of so much money could lead to a relaxation of financial discipline.

Privatization of Sohu is very unlikely.

- Charles Zhang has consistently said that Sohu will retain its US listing.

- The ideal time for privatization would have been in 2018 prior to the value creation of the Sogou sale and Changyou privatization. Now the company’s value is much clearer and a privatization would be much more expensive.

- Charles Zhang is the largest shareholder of Sohu with a 26% stake, but he does not have any super-voting shares and there are significant institutional minority shareholders. It would not be possible to push through a bargain priced buyout.

Sohu has significant hidden value in Beijing real estate that it acquired in 2006-2010 as detailed in this article. These office buildings are currently used for Sohu, Changyou, and Sogou operations so they cannot be considered surplus financial assets, but they should provide some valuation support if operations were to deteriorate.

Disclosures and Notes

At the time of publication the author was a shareholder of Sohu. The author does not make any recommendation regarding investment in the company. Investors should verify any facts in the article they deem relevant to their own decision about investment in either company.

Changyou and Sohu have never confirmed to investors that a new TLBB game is under development. It might fail to launch or it might fail after launch.

Changyou has not made any formal preparation for an IPO. If markets and peer valuations decline then it might be difficult to sell shares or their valuation could be substantially lower than suggested in this article.