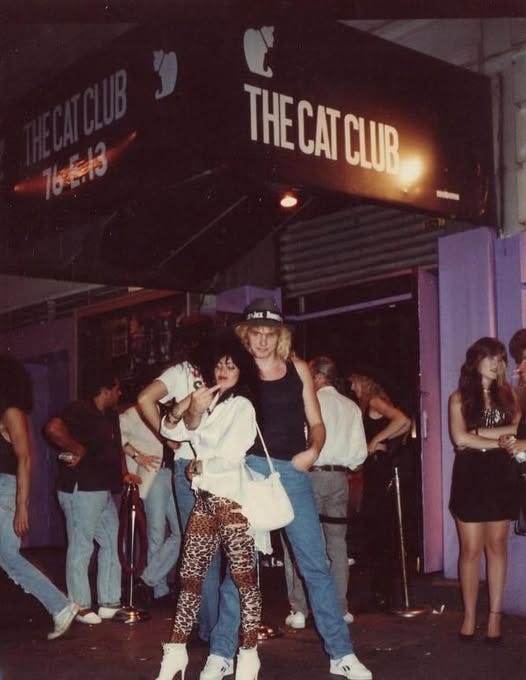

The Cat Club Will Soon Be Members Only

Most future Koneko Research content will be available exclusively or for an exclusive period to paid subscribers:

Canadian REIT Valuations Data – always exclusive.

Canadian REIT Valuations Commentary – exclusive text, but I may share free excerpts.

Deep Company Profiles – exclusive text, but I may share free excerpts. Examples would be write-ups of Morguard REIT and Melcor Developments.

Investment Ideas – exclusive for a limited period. Examples would be write-ups on Star Holdings, Arlington Asset, and Brookfield Office Preferred.

Cat Pictures – Just trying to put a bit of fun into every article.

Here’s a link to a 20% launch discount (until 1/31/25) if you don’t want to read my long boring explanation ….

Koneko Research began as a way to share information that I prepared for my own use. In the past year I have gone beyond that to fill out Canadian REIT Valuations as a complete product based on these elements:

Asset Value Measurement and Asset Value Creation.

Equity Implied Cap Rates calculated for comparison with IFRS cap rates and cost of debt.

Minimal attention to FFO. Brokerage analysts do a good job of income statement modeling so there's no need, or opportunity, for me to provide new information or perspectives.

Minimal attention to dividends. Dividends transfer value rather than create value. Dividend rates are a discretionary management decision that may not signal anything meaningful about issuer valuation. There's an overabundance of dividend-themed commentary. I don’t care about an absolute dividend yield (4-6-8-10%), but distributions can be a helpful governance signal, especially at insider-controlled companies.

Original Research beyond company press releases, conference calls and presentations. I hope that already well-informed investors can find useful new information in every piece I write.

Social media has an overwhelming flow of stock picks. Many of these sound compelling, but as an investor the volume is impossibly more than I can digest. I believe that sector analysis such as Canadian REIT Valuations is uncommon. Brokerage analysts are focused, but ultimately their employers are compensated by the issuers through underwriting and advisory fees so the analysts are constrained in what they can publish. I hope that my work provides fresh perspectives to readers who may already have access to some or all broker research.

Investment Ideas and Deep Profiles will be posted whenever they are ready. These articles usually stew for several months, or even years, as I accumulate information. Rather than committing to a fixed publication schedule, each idea will wait until I am confident that I have something meaningful to share.

Portfolio and Recommendations: My initial preference is to share information that knowledgeable investors can use in forming their own investment decisions. I realize that people love picks so for the past year Canadian REIT Valuations wrote that H&R and Primaris offer the best balance of risk vs reward. They both outperformed the sector with minimal drama. Based on discussions with paying subscribers and understanding of your interests I may adjust my approach to recommendations.

My personal portfolio perspectives: I'm wary of the psychological impact of excessive exposure to any position. At a certain point you lose objectivity. I own about 50 stocks and have a hard rule that I will not add to any position that reaches 10%. For me, a high conviction position is a 5% allocation. A 2% allocation is comfortable. I have positions less than 1% that may be growing towards 2-5-10%, or shrinking towards zero, or under study. I have some very illiquid holdings where I'll buy what I can - that might end up being a 0.5% allocation or 5%. I also consider the degree of risk when I size a position - a highly speculative 1% position might carry the same volatility as a higher quality 5% position. My approach may not be right for your situation.

Pricing:

Regular - US$250 Annual or US$50 monthly. Monthly pricing might be an attractive option if you are only interested in one report.

Launch Promotion - a permanent 20% discount if you subscribe through THIS LINK by January 31, 2025

Thank you for your interest in Koneko Research! The first paywalled post will be a Canadian REIT Valuations data update for YE24 published on Monday 1/6/25.

The Cat Club was an NYC venue at 76 East 13th Street that hosted metal acts in the 1980s. Now the location is the Hyatt Union Square.