Topics:

Far East Consortium's International Real Estate At 83% NAV Discount Will Benefit From China Re-Opening (12/16/22)

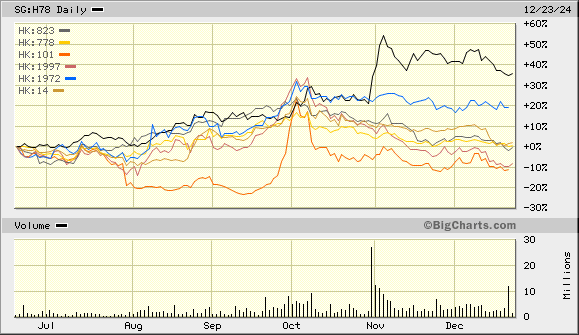

I believed that FEC’s 32 international hotels marketed to Chinese and Asian travelers would benefit from a post-COVID recovery. Unfortunately, the Chinese economy was only strong for about one quarter and since then depressed consumer sentiment has limited travel spending. FEC’s NAV is -6% since the article was posted, the share price is -53%, and the discount has expanded to 92%. The company paid $0.25 in dividends and insiders have purchased 308mm shares.

A majority of FEC’s assets are outside of Hong Kong with major residential developments in the UK and Australia. The small NAV drop in the past 2 years is mostly due to depreciation of the GBP and AUD rather than property-level losses. But investors may remain cautious about FEC, and other Hong-Kong listed real estate companies, until the revenue and income numbers begin rising.

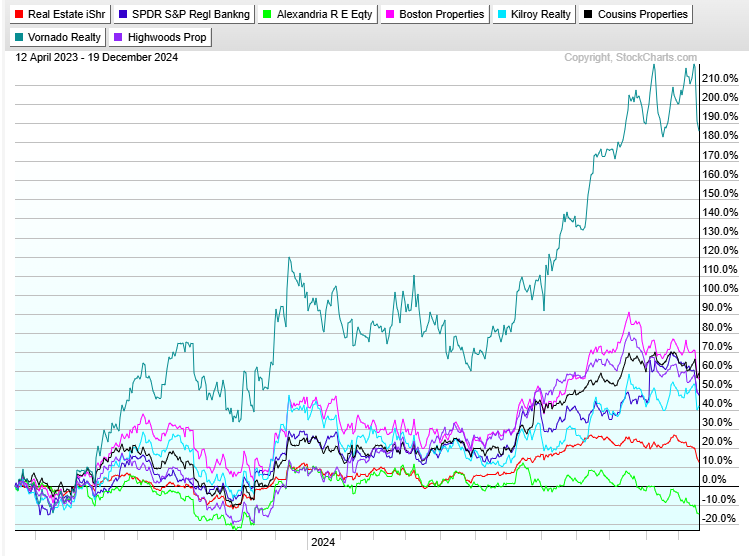

Office REITs: Into Darkness (04/12/23)

“Office REITs appear “cheap” with valuations near long-term lows, however high vacancy rates will depress rents while financing costs have risen and credit availability has tightened. REITs will be pressured to deleverage through asset sales at low valuations and possibly through dilutive sale of equity in their company or properties.”

The article was sort of correct for 2023 until the Fed policy easing in late 2023. Surprises:

Insider activity never provided a buy signal

“Smart Money” and major institutions have not committed to the sector

Recession that would have curbed employment and office demand has not emerged

Top quality properties have maintained low vacancy and premium rents without significant competition from lower quality buildings.

I correctly suggested that BXP was well positioned with quality properties and a strong balance sheet and that the banking sector was more attractive than real estate due to high insider buying.

Arlington Asset Investment: Mortgage REIT at a 60% NAV Discount and Positioned For Sale or Liquidation (5/19/23)

This value trap unlocked fast. Ellington Financial acquired AAIC for 0.3619 EFC + $0.09.

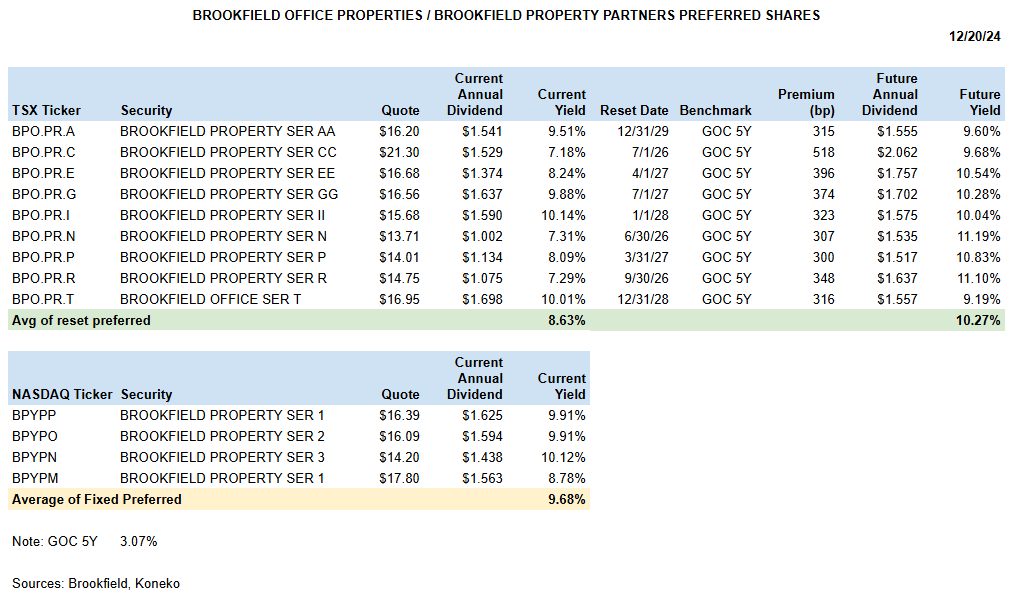

Brookfield Office Properties Reset Preferred Shares (12/29/23)

The thesis was that the TSX-listed preferred shares originally issued by Brookfield Office Properties traded at a significantly higher yield than equivalent Nasdaq-listed preferred shares issued by Brookfield Property Partners. By March the relative value opportunity had closed. Subsequent gains reflect increased investor comfort with the issuer. The 9 reset series have had an average gain of +78%, plus distributions, since the article was posted.

Brookfield Property remains complex, highly leveraged, and has negative operating cash flow. These preferred yields are still high, but it’s very challenging to estimate a fair value.

Morguard REIT: Will This Value Trap Spring Open After Large Insider Buying? (01/24/24)

“Despite weak operating results, the value of MRT is supported by growth potential at many of its properties and as the surrounding communities expand that potential will increase over time. Morguard will not lose money by delaying development and that’s what it will probably continue to do.

If you buy MRT units at their current discounted price then they are highly likely to be worth more in 5-10 years, but if you are anticipating a catalyst such as privatization to quickly unlock that value then you may be disappointed. It’s an appealing investment for an individual or family office, but difficult for an institution subject to frequent performance evaluation.”

No significant change. See Canadian REIT Valuations for my latest thoughts.

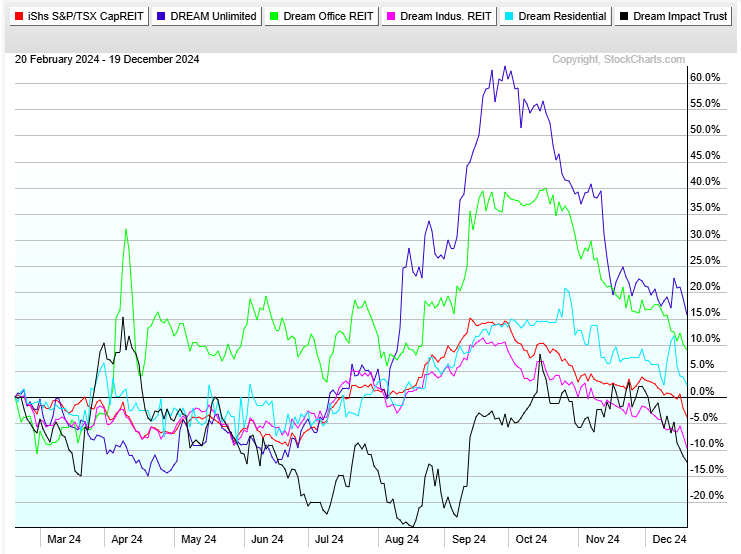

Dream Unlimited & Dream REITs: A Fresh Look At Opportunities To Maximize Shareholder Value (02/20/24)

“A good guideline with insider controlled conglomerates is to invest with the insiders because they will maximize your returns when you hold the same security.”

Despite its recent weakness, Dream Unlimited has substantially outperformed its managed entities and the Canadian REIT sector. Growing asset management revenues and booming results from the Western Canadian land and housing have offset weakness in GTA development. Dream should end the year in a strong financial position with 4Q after-tax proceeds of about $150mm from the sale of the Arapahoe Basin ski resort, plus committed 4Q land sales of $112mm (with an additional $78mm already committed for 2025).

Dream Industrial - Investors aren’t giving any credit to its recently unveiled data centre development opportunities. I would like to see an NCIB. See Canadian REIT Valuations for more detail.

Dream Office - Could deliver a top return in 1H25 with completed capex program, accelerating RTO, and ownership dynamics. See Canadian REIT Valuations for more detail.

Dream Residential - Strong management team and solid assets with an organic value-add strategy, but deeply discounted valuation due to small scale and low liquidity. Management is fully aware of the challenges and hoped that sector distress would create an accretive acquisition opportunity, but bargains did not really emerge. If you are comfortable with the Pauls/Dream management then it’s a low risk holding at this price level while they search for a way to grow the company.

Dream Impact - Not viable with crippling management agreement and indebtedness. Unable to create value through development because 5% yield on cost of new projects drops to 4% after the management fee (1% of assets). Dream should fix it or fold it (see Dream Impact Trust: Watch Out For That Puck! 12/16/24 for more detail).

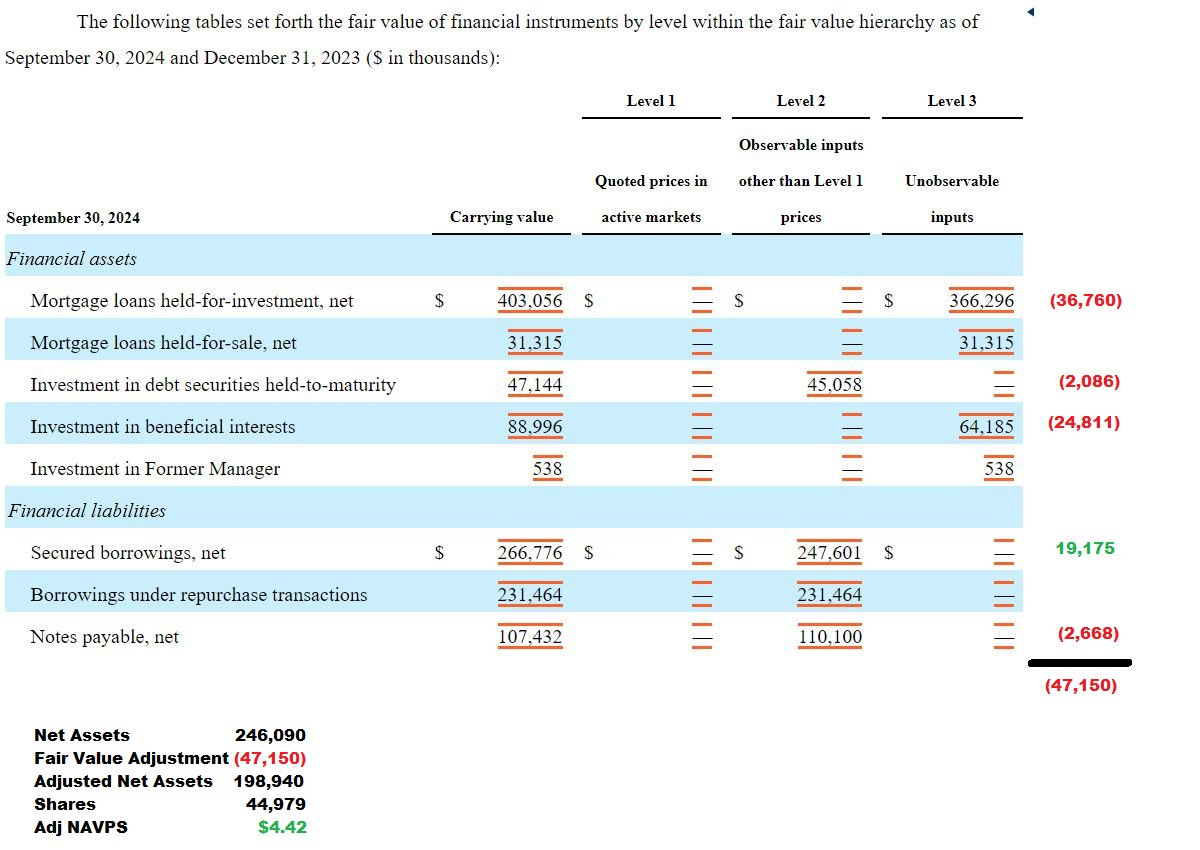

Great Ajax: Darkness, Take Me To Dwell In You (06/10/24)

Great Ajax has been rebranded as Rithm Property Trust. The legacy portfolio has largely been cleaned up and Rithm hopes to be invested in new commercial property assets by year-end. The conference call mentioned opportunities from bank loan sales: “once a bank takes impairment on an asset, they want out. So you look at the very large banks that are sitting on a number of these assets. If they can get out, they're going to get out. And when you look at the banking system today and you look at their quarterly earnings, they make so much money. So to be able to clean up balance sheet and not hold capital against distressed assets, I think you'll continue to see it come out”.

Management seems very aware of the need to select accretive transactions and find a way to grow the capital base. That carries a risk of dilutive equity issuance, but Magnetar Capital converted its preferred equity position at $4.87 and Rithm Capital invested at that same price so I would be surprised if common equity were issued at a large discount to that level.

The fair value disclosures in the 3Q24 10Q show that marking all assets and liabilities to current market value would drop NAV to $4.42/share. The 12/18 closing price of $3.00 was a 32% discount and seems like an attractive opportunity.

Hong Kong Landlords Equity Implied Cap Rates (06/19/24)

“Hong Kong has some of the world’s most expensive real estate properties and some of the world’s cheapest real estate equities.”

“HongKong Land is attractive due to Trophy quality portfolio, financial strength, and strong shareholder return (buybacks + dividends) driven by its parent company (Jardine Matheson)”

Hong Kong’s economy, financial markets, and tourism remain depressed. Despite very low valuations, investor sentiment remains heavily affected by uncertainty about prospects for China.

HongKong Land has performed well with a US$1Bn retail renovation program in partnership with leading luxury partners and a new ten-year strategic plan to double earnings, dividends, and AUM.

I hoped to update these valuations for 1H24 results, but HKL does not publish an financial statement with the disclosures needed for valuation inputs so I’ll have to wait for year-end.

Noah Holdings: China's Largest Private Wealth Management Company (07/02/24)

Noah has delivered an excellent return from an ex-dividend price of $7.65/share when posted. The company has continued to grow its international private client business while mainland activity remains subdued. If China markets recover then the company’s onshore private equity asset management business is well positioned to profit from increased corporate activity (fundraising, IPOs, and M&A).

In December a Hongshan Capital (formerly Sequoia China) fund which invested in Noah in 2007 has been selling its position. Noah itself has been repurchasing shares every day through the $50mm buyback authorized in August.

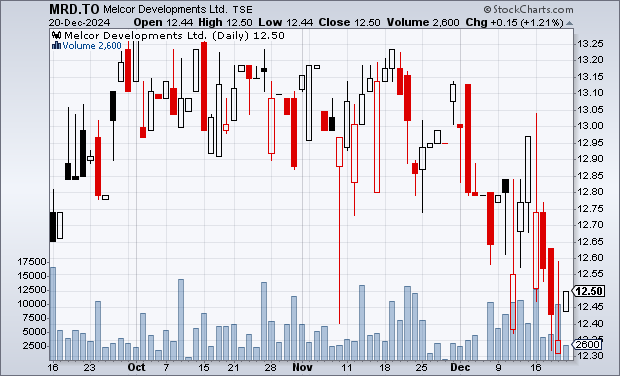

Melcor Developments: Is It Worth Investing In This Alberta Land Business That May Always Be Undervalued? (09/16/24)

Melcor raised the price of its privatization offer for Melcor REIT to $5.50 and announced a new 90-day go-shop period. Concerned unitholders FC Private Equity and Telsec Property stated their continued opposition to any transaction below $6.94, but if they participate in the go-shop process then they will have to sign an NDA and be unable to comment further.

The outcome of the privatization is not a significant risk for Melcor Developments investors:

If privatization succeeds then MRD will retire the public REIT units at a $41mm discount to their book value, realize overhead savings, and retain the cash flow that would previously have been distributed to REIT unitholders.

If privatization fails then MRD will retain the long-term strategic opportunity to sell stabilized commercial property to the REIT which will finance through public equity issuance and pay management fees.

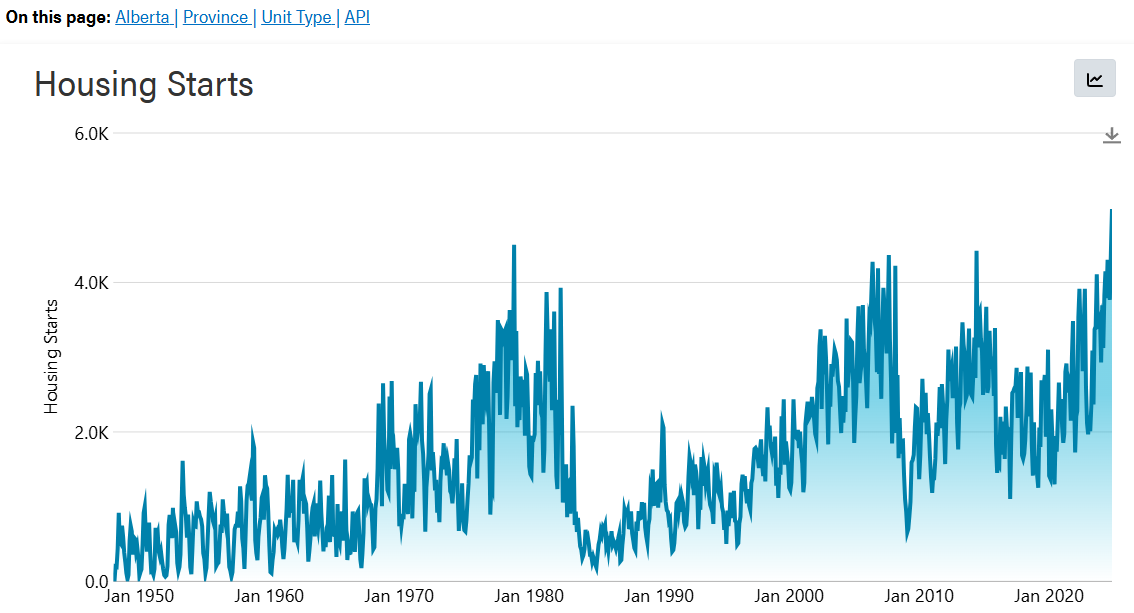

In October Melcor launched its Goldwyn community north of Calgary, 47 years after acquiring the land. Its an example of the value accumulated through the company’s very long-term vision. The Alberta housing market remains exceptionally strong due to appealing affordability and population flows.

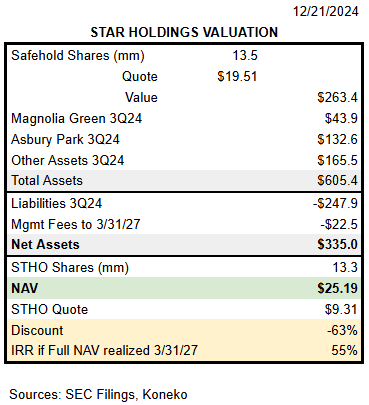

Star Holdings: Sugarman, Won't You Hurry? (10/28/24)

Since publication the NAV discount has expanded

A few developments:

STHO 3Q24 10Q showed the final two condos at Asbury Ocean Club were sold.

Oaktree sold its stake and 463 Capital bought most of the shares.

Sold 31 Magnolia Green lots in 3Q24 for $6.1mm (avg $198k/lot). The September Resident Newsletter mentioned having more lots ready for sale:

Magnolia Green received Zoning Approval in October for modification of the restrictions on development of the commercial center. The change provides greater flexibility, but not a change in overall density. I infer from the zoning application that STHO has a plan for what happens next to realize the value of these sites.

The Asbury Park Planning Board approved STHO’s Delta Townhouse development in October.

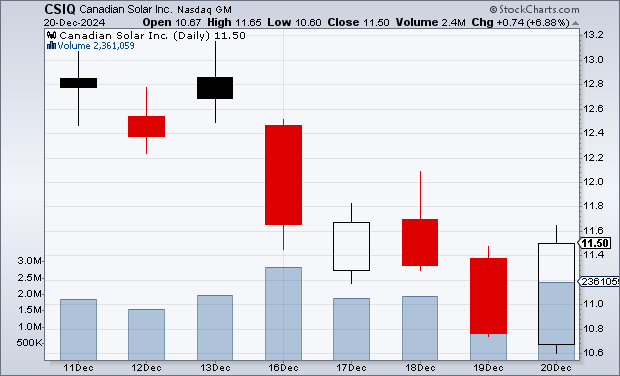

Canadian Solar: 87% NAV Discount, But Is There Any Upside? (12/11/24)

There has been no meaningful news in the past 10 days. Over the next two years CSIQ should benefit from surging storage revenues/profit, progress of Recurrent Energy towards being a low risk utility business with its own US listing, and clarity about US tariffs/taxes.

Disclosures & Notes

At the time of publication the author held shares of Far East Consortium, Brookfield Office Properties Preferred, Dream Unlimited, Dream Office, Dream Residential, Jardine Matheson, Rithm Property, Noah Holdings, Melcor Developments, Star Holdings, and Canadian Solar). These holdings vary greatly in size and may change at any time. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from regulatory filings and other sources prior to making any investment decisions. The author believes all information in in the article is accurate as of the date of publication. Any factual errors in the article will be correctly as promptly as possible.

Very interesting , thank you.

You might want to look at MPO.L, similar to some of the situations you have here.

Thanks, enjoy the holidays and I look forward treading you 2025 articles