Great Ajax (AJX) is transitioning to a commercial lending strategy under new management by Rithm Capital (RITM). I estimate a one-year price return of 43% from narrowing of the NAV discount as the company pursues an attractive market opportunity led by a manager with a strong performance record.

Key points:

The new commercial mortgage business plan - Rithm has described the plan in only general terms

AJX legacy business model - the REIT incurred sharp losses due to an unexpected rise in interest rates rather than poor credit

The restructuring - AJX has substantially deleveraged and I estimate a current NAV of $5.26/share

Valuation benchmarks - RITM has delivered sector leading long-term returns. AJX is likely to trade at an NAV discount of 0-20% once the portfolio transition is complete.

The next year - it may take time to transform AJX and for investors to understand the new company and its potential. There may be an overhang of shares from investors who bought into the legacy business at much higher prices and institutions who received shares through restructuring actions.

Risks - potential further decline in portfolio value and uncertainty over the future direction of the company are already reflected in the AJX share price. Remaining risk is some sort of misrepresentation or fraud.

The New AJX Commercial Mortgage Business Plan

Rithm has not commented in detail on its plans for AJX, but described the opportunity in commercial mortgages:

RITM’s 1Q24 conference call briefly explained:

“Great Ajax, it's a platform that's going to be externally managed, assuming that shareholder vote is affirmative for us. The idea is to grow that into a publicly traded commercial real estate REIT that has no legacy commercial real estate exposure with the management fees that will flow into NewCo, which will be a management company.

… it's really going to be a clean platform probably $250 million of equity that we'll be investing in commercial real estate with a teens type mandate, and it will be a clean platform relative to some of the other folks. A lot of work to on that one, but that's the intention.”

Through several months of negotiations with AJX, RITM indicated that it intended to use AJX as a vehicle for listing of its Newrez mortgage origination and servicing business. That structure would have required issuance of a very large number of new AJX shares because Newrez has $15Bn of assets and $4.1Bn of equity (compared to about $250mm of AJX equity). RITM changed plans in February 2024 because “certain events regarding the closing by Rithm of a separate transaction [probably the acquisition of Specialized Loan Servicing], among other items, could significantly delay the Transaction.”

It’s possible that RITM could accelerate the AJX business transformation by purchasing more of the legacy NPL/RPL loans and/or selling RITM owned commercial mortgage assets to AJX in exchange for an additional equity stake. These steps would quickly create a cleaner AJX investment thesis with an established commercial loan portfolio generating attractive quarterly earnings.

RITM has a goal to “spin off” its Newrez mortgage business and many analysts have assumed this would occur through an IPO and or distribution of Newrez shares to current RITM holders. Listing Newrez through a reverse merger with another public entity could still be an attractive alternative.

The Flawed Legacy Business Model And Balance Sheet

Great Ajax acquired non-performing and poorly performing residential mortgages at a small discount to face value and a large discount to collateral value. There were two profitable paths to resolution:

AJX would work with borrowers to encourage them to build a consistent payment record that would enable a loan to be refinanced at a better rate and/or proceeds. The existing mortgage held by AJX would be repaid at full value.

If a loan remained non-performing then AJX would recover its investment through foreclosure and sale of the collateral.

AJX Portfolio characteristics at 12/31/23

Average Coupon - 4.51%

Year of Origination - 87% from 2008 and before

Average LTV - 41.5%

Average Balance - $191k

The low LTV and long time since origination mean that AJX has minimal risk of credit losses. The problem encountered in the past two years has been that borrower performance improved significantly due to the strong consumer economy and home price appreciation, but loan prepayments declined due to the sharp rise in interest rates. The percentage of loans that had made 24 consecutive timely payments rose from 54% at 12/31/18 to 77% at 12/31/23. The effective duration of the below market rate loans held by AJX lengthened.

AJX last reported the effective yield on its portfolio was 5.2% at 9/30/23. The loans were financed with a mixture of securitizations and repo. Combining all assets and financing, AJX had combined Net Interest Margin of -0.5% in 3Q23.

Securitization debt of $425mm at 9/30 had an average cost of 2.7% providing AJX with an attractive net margin.

Repurchase debt of $392mm at 9/30 had an average cost of 7.4% providing AJX with an extremely unattractive margin.

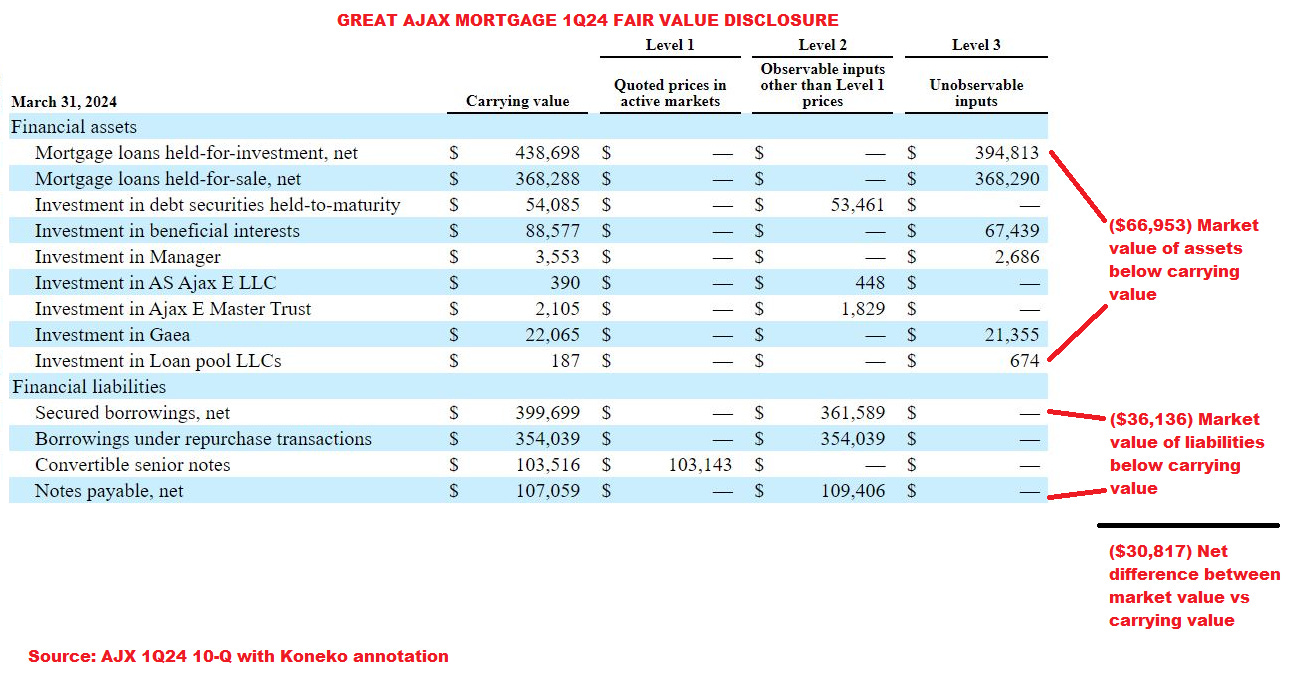

AJX book value obscured the deteriorating economics of its portfolio by reporting most of its loans as “Held-to-Maturity” at cost less a minimal allowance for credit losses. The significant decline in the fair market value of the loans (due to their below market rates) was only disclosed in financial statement footnotes. At 12/31/23 the fair values were $66mm below carrying value and then asset sales and impairments brought the difference down to $31mm at 3/31/24.

In addition to negative interest margin on its portfolio, AJX also had significant corporate level financing expense including $39mm of very costly 2020 rescue securities still outstanding at 12/31/23:

Preferred A paid a fixed coupon of 7.25% until 4/6/25 at which point it would rise to 5yr UST +6.00% with an additional 0.50% each year the preferred remains outstanding up to a maximum rate of 10.50%.

Preferred B paid a fixed coupon of 5.00% until 4/6/25 at which point it would rise to 5yr UST +6.00% with an additional 0.50% each year the preferred remains outstanding up to a maximum rate of 10.50%.

Warrants exercisable anytime after 7/6/23 for cash equal to the difference between the fixed dividends paid on the A and B preferred and 18%. The fair value of this liability was recognized at a value of $16.6mm at 12/31/23.

AJX also had $104mm of notes maturing in April 2024 that would be difficult to refinance. Without a significant restructuring and new financing the REIT would have had a “going concern” warning in its 2023 financial statements leading to further limitations on its ability to conduct business.

The Restructuring (So Far) And Pro-forma NAV

After Ellington Financial terminated its agreement to acquire Great Ajax last fall, AJX began a review of strategic alternatives resulting in the agreements with Rithm. Key elements:

Termination of the management agreement with Thetis - termination letter delivered on 2/26/24 and agreement reached to pay the termination fee of $15.5mm entirely in shares.

Sale of $50mm in loans in 1Q24, plus $217mm in April, and additional sales planned in May. Activity disclosed through 4/30 indicates available cash of about $70mm.

Exchange of all Series A and Series B preferred shares for common shares at a valuation of $4.87/share and exchange of all the put warrants for common shares at a valuation of $4.70/share. Well regarded credit investment fund Magnetar Capital became AJX largest shareholder with a 21.5% stake.

Credit Agreement with RITM enabling AJX to draw up to $70mm at a rate of 10.0% plus 5-year warrants to purchase AJX shares at $5.36. Not yet drawn as of 5/30/24.

Purchase of $14mm of AJX shares by RITM (2.87mm shares at $4.87). Not yet issued as of 5/30/24.

New Management Agreement with RITM with a base fee of 1.5% of Equity plus an incentive fee at 20% of Earnings over an 8% hurdle. Not yet executed.

New investment strategy focusing on Commercial Mortgage lending. Not yet implemented.

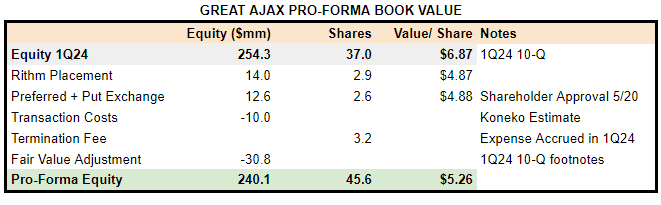

I estimate the disclosed and pending events result in net asset value of $240mm ($5.26/share).

Financial statement book value may be higher if the fair value adjustments are not realized through sales or impairments.

Net asset value could be further reduced if the $21.4mm fair value of the AJX 22% stake in Gaea Real Estate is overstated. Gaea is a private company formed by AJX’s former manager for investment in net lease veterinary real estate, multifamily residential, and mixed use properties. At 3/31/24 it had $169mm of assets and $70mm of debt so it does not appear to have high structural risk.

Rithm commented on its conference call that AJX would have $250mm in equity so I’m in the right ballpark. The Rithm credit agreement (not yet drawn) with AJX requires it to have a minimum net asset value of $240mm.

Valuation Benchmarks

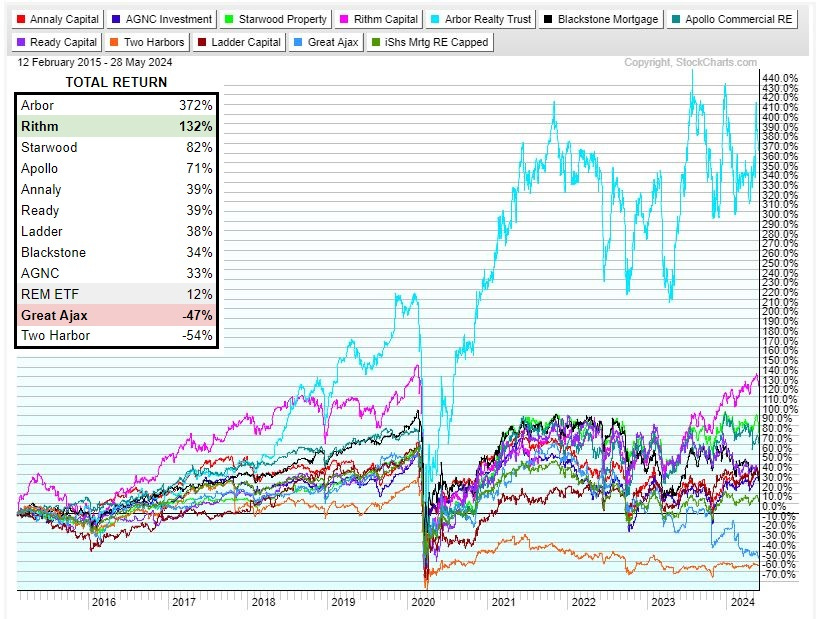

Great Ajax delivered a cumulative total shareholder return of -47% since its 2015 IPO. Over the same period Rithm’s return beat every peer except Arbor.

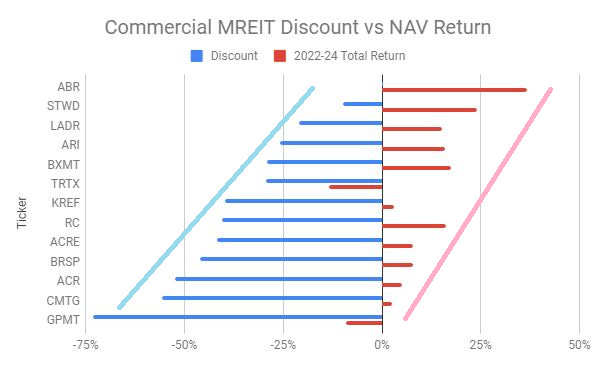

Market valuations of the commercial mortgage REITs that will be peers for the new AJX strategy demonstrate a logical correlation between NAV returns and NAV discount. Note that current sector discounts for even the best firms like Starwood reflect investor concerns over losses on existing commercial loans that AJX will not face because it will launch its new strategy with no legacy exposure. AJX will be better positioned than any peer to take advantage of the current attractive lending environment (higher rates, higher spreads, lower LTV, and better protections).

RITM’s excellent long-term return suggests that it will be able to deliver better than average performance for AJX resulting in a better than average valuation. I estimate a base case price return of +43% over the next year based on a 10% discount to an unchanged portfolio value. This excludes additional return from earnings which should be positive, but are difficult to forecast due to the uncertain pace of the portfolio transition.

Key Events Over The Next Year

Formal launch of Rithm management. When the new management contract is signed AJX will probably provide an update on the status of the portfolio, Net Asset Value, and an explanation of the new strategy.

Wind-down of legacy portfolio. Rithm has extensive experience and an outstanding record in management of residential mortgage assets. RITM’s 1Q24 10-Q disclosed that it was the purchaser of a $245mm loan pool sold by AJX. Additional transactions between RITM and AJX could accelerate the transition of the AJX portfolio.

Dividend Policy. Rithm will want to build a record for AJX as a payor of reliable and increasing dividends. That could be most easily accomplished by launching the new strategy with a low or zero dividend. AJX paid total dividends of $0.76/share in 2023 of which only $0.14/share was taxable with the remainder return of capital. 2024 dividends already paid of $0.16 may already exceed this year’s taxable income and therefore AJX would not be obligated to pay any additional amount. Yield focused investors are potential sellers of AJX shares in coming months.

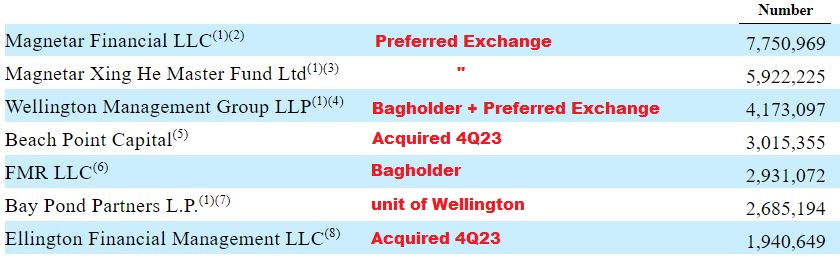

Turnover of Shareholder Base. 7mm shares voted against the preferred exchange and approval of a new management agreement with Rithm. I view passage of those items as very positive for Great Ajax, but those opposed are potential sellers of AJX shares in coming months. AJX has also issued shares over the past year to several institutional holders who are not likely to be longer long-term investors in the new business:

Index Membership. Great Ajax is not currently in any significant indices and ETFs hold just 1% of the outstanding shares. For comparison Angel Oak Mortgage REIT has 6% ETF ownership and Nexpoint RE Finance has 5% ETF ownership. The completed share issuance from the AJX preferred exchange is probably already sufficient for its market cap to qualify for Russell 2000 addition in 2025.

Risks

The new management agreement with RITM was approved by AJX shareholders on 5/20/24, but has not yet been completed.

The only significant closing condition that may not yet have been satisfied is that AJX committed to dispose of its related party servicer (Gregory).

The agreement is extremely attractive for RITM because it is gaining $240-250mm of AUM in a permanent capital vehicle with significant growth potential at no cost except for an equity investment at a discount to NAV. However RITM is not contractually bound to complete the agreement and could walk away without penalty.

If AJX engaged in material misrepresentation or fraud then the impact is uncertain. It would be bad, but difficult to forecast.

If RITM were to walk away then AJX shareholders would still benefit from the substantial deleveraging that has taken place along with the elimination of the crippling burden of the preferred and warrants.

AJX remaining portfolio risk seems limited since improved borrower performance already reflects market developments (home price appreciation and higher interest rates).

Disclosures & Notes

At the time of publication the author held shares of Great Ajax and Rithm Capital. This disclosure should not be interpreted as a recommendation to purchase any of these securities and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Perhaps the name Ajax hinted at a disappointing fate for AJX investors:

Koneko strikes again! 🏆🐈⬛🏆

Enjoy some extra views. This got linked in our chat (which I fully support). I don't know if Substack knows how to attribute views that come from the Rocket Chat server, so if you see a stange source for a chunk of views...

I'm tired tonight so I haven't read yet, but I'll be back to read and enjoy this piece. Thanks for writing.