Dream Impact Trust (MPCT.UN or Impact) has attracted renewed attention on a “skate to where the puck is going thesis”. MPCT is positioned to benefit from Federal, Ontario, and Toronto incentives for development of new affordable housing.

Unfortunately my analysis of Impact’s 49 Ontario Street project shows that at best, the incentives would barely support the property’s current $140mm carrying value. Under conservative assumptions the property might only be worth $50-70mm. I welcome feedback on my inputs and calculations. I have seen optimistic chatter, but no tangible detail. If correct, then my analysis has negative implications for Impact’s other nearby developments at Quayside and Victory Silos.

Without a transformational gain from 49 Ontario, or any gain at all, Impact will struggle with crippling leverage, a crippling management agreement, heavy exposure to the depressed Toronto development market, and no access to equity capital. I believe the prudent path is to restructure now to ensure that Impact can preserve the value of its core assets through challenging market conditions.

Topics:

This article does not contain a recommendation, a pick, or even a valuation for Dream Impact. I learned a lot from researching it and I hope readers learn something too, even if they disagree with my opinions.

49 Ontario Street (49O)

Impact owns 100% of the land assembly on which it has proposed a residential development of approximately 800,000sf. Impact CEO Michael Cooper’s most recent comments:

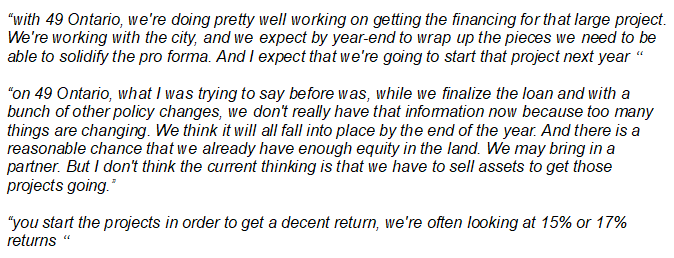

Starting points for analysis:

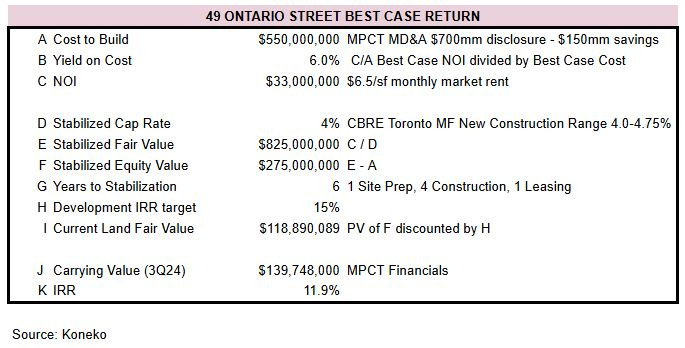

$700mm Cost to build has been reported in MPCT’s financial statements. No further explanation is available, however I estimate this includes hard construction cost of $400-450mm, plus soft costs (govt fees, interest, design, marketing, project management) of $250-300mm. The construction cost is fixed. I estimate soft cost savings of $100-150mm from the government initiatives. I believe the $700mm does not attribute any cost to the land held by MPCT. Some helpful insights into development costs are in this BILD report (Purpose Built Rental Housing In The Greater Toronto Area)

5% Yield on Cost was disclosed by Michael Cooper in the Dream Unlimited 3Q24 conference call.

Cooper directly stated that he wanted to be thoughtful and I believe he’s trying to balance the desire for investors to have a number with the political sensitivity of earning profits with the benefit of significant government assistance. “5 cap” is the clearest information he has provided about project returns and I show below that it seems realistic.

Fair Value Cap Rate for Toronto Multifamily New Construction 4.00-4.75% (CBRE 3Q24 Canada Cap Rate Report)

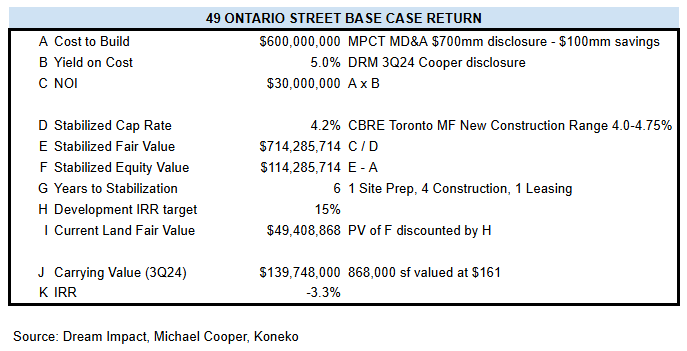

Project size is described as “800,000 sf of residential density” in the 3Q24 Financial statements. The 2Q23 financial statements described “approximately 809,000 sf of residential gross floor area (or 1,250 residential units) and 68,000 sf of commercial space”. The zoning application documents approved by the City of Toronto show 692,905 residential sf and 175,595 commercial sf (868,410 sf total).

Impact has said 800,000 so many times that it must be right, even though I don’t see it in the documents. Impact stopped mentioning the office space.

Current Carrying Value. A quirky sensitivity range disclosure in MPCT’s financial statements shows the project is being carried at a value between $159-165 per square foot. I assume the total value is based on the 2023 approved density of 868,000sf times the $161/sf midpoint of the sensitivity note.

Using these inputs results in a base case IRR of -3.3%, even after assuming a $100mm benefit from government concessions. MPCT’s 3Q24 financials may be carrying the project at $90mm over its fair value. Uh oh …. watch out for that puck!

So the good news is that MPCT is not going to cause a political problem by earning excessive profit! But these numbers look like exceptionally bad news for MPCT. The softest input was the “5 cap” mentioned by Michael Cooper. That implies an average 49O monthly residential rent of $5.10/sf, of which the market rate units would be about $5.80/sf

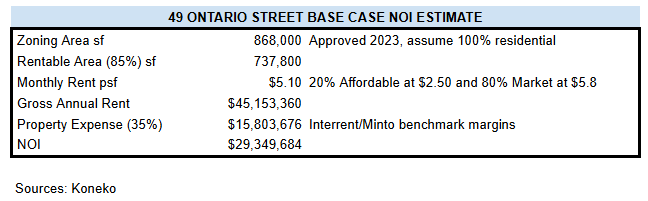

That would be stabilized 2031 rent so it’s reasonable to assume it would be 20% higher than current levels (3% increase compounded for 6 years). However with Toronto 2BR apartment rents -10.4% in the past year (Rentals.ca December 2024), widespread leasing incentives, a surge of investor condo completions over the next two years, and an immigration policy shift intended to shrink population (and rental demand) for the next two years, it’s hard to be optimistic about multifamily rents. See my recent Canadian REIT Valuations report for additional comments. Currently offered market rents for nearby properties (Apartments.com search results including 2 Dream properties in blue):

Taking a more optimistic view of every line item:

Impact tried without success to attract a partner for this project for over a year. An investor with low cost of capital and an optimistic view of future Toronto apartment rent might invest at this $119mm valuation. Even with the enormous government incentives, I would be surprised if a partner invested at the valuation where Impact has been carrying the property. If any reader has different inputs for any of the valuation parameters then I would love to hear them.

In 2023 Impact took an $80mm loan secured by its 49O interest. My Base Case Value for the property is below the loan value. My Best Case Value covers the loan value but 6 years of loan interest would eat away at the project return. A key factor in Impact’s willingness to advance the project, even at minimal return, would be the willingness of CMHC to refinance the $80mm land loan as part of the project funding. If 49O is a high risk low return project AND Impact still has $80mm of High cost short-term debt then the Trust is dangerously weak.

As a long-term shareholder of Dream Unlimited, I would love to prove to myself, and share with you, an analysis that 49O is going to be a great success. But I can’t make the numbers work. I think MPCT will still be motivated to sign a development agreement so the key factors I will look for when a deal is announced:

Government support. The ACLP financing at GOC 10-year rate and City of Toronto fee concessions are known. Dream’s Lebreton Flats development in Ottawa received additional government support. MPCT might be able to negotiate for similar extra incentives at 49O.

Square footage. The 2023 zoning approval was for 693k residential (or maybe 800k, or maybe 809k) and 176k office (or maybe 68k). Maybe MPCT can resubmit for a 100% residential project, possibly with higher density. Or maybe an “Impact” user can commit to take the office space on win-win terms.

Land Loan. If CMHC is willing to refinance the existing $80mm land loan then it would be an important benefit for MPCT.

Timeline. I guessed that it would take 6 years to reach stabilized occupancy. If MPCT can do it faster then the IRR would improve, if the IRR is positive.

Quayside & Victory Silos

Impact has highly leveraged exposure to the worst market in North America for residential development. H&R REIT CEO Tom Hotstedter said on his 3Q24 cc: “Anyplace is better than Toronto”. H&R has reduced the “fair value” estimate of its super-prime downtown development sites to $140 per buildable square foot. Hofstedter said with regret that H&R’s 140 Wellington West might be 10 years away from development.

If 49O can’t be valued based on an agreed development plan, then there’s no way it’s worth as much as the H&R locations and MPCT could be forced to record a significant impairment in its 4Q24 financials. In September MPCT sold its 10 Lower Spadina property for $23.7mm and the buyer quickly filed plans for a 348,359sf redevelopment. MPCT’s realized sale price was less than $70 per buildable square foot and that’s probably a good benchmark for the current fair market value of 49O as a development site. 49O has approved zoning and that used to be worth a premium, however that has probably shrunk because there are a growing number of zoned sites waiting for improved economics and development capital. 49O might be worth a bit more than 10LS because it’s above the barrier created by the CN rail tracks and the Gardiner expressway, but if you believe that then you have to believe that MPCT’s projects below the barriers are worth less…

MPCT has a 12.5% interest in the Quayside development site. Dream and MPCT have not disclosed the terms under which it “won” the competitive bidding process under stronger market conditions in 2022-2023. I have heard that Waterfront Toronto was seeking an initial payment over $300mm, additional payments when sites moved into development, and high ESG requirements that would impose additional costs. I haven’t been able to find documents supporting these terms, but MPCT’s financial statements show Quayside with a value of $274mm at 9/30/24 and Michael Cooper mentioned that an additional payment was due in 2025 so they seem realistic. MPCT optimists who see Quayside as a major catalyst, what numbers are you using?

MPCT and Dream have not disclosed anything about the $187mm of liabilities in the Quayside JV. If they are short maturity high cost land loans then the venture would greatly benefit if it were able to shift some to CMHC development financing. If the liabilities are deferred payment obligations to Waterfront Toronto then there might be flexibility to negotiate improved terms. The most recent news has been Phase 1 zoning approval with increased density.

Dream/MPCT acquired the Victory Silos site in partnership with Great Gulf in 2016. At the time Dream said: “The transformation and revitalization of this section of the waterfront is currently under way and is targeted to be completed over the next decade totally changing the face of this formerly industrial precinct.” 8 years later it still looks like it will take a decade. The Waterfront East LRT extension is still at a planning stage. Google abandoned Quayside and it was auctioned to Dream. Despite the lack of development, the value of the Victory Silos site has risen substantially since acquisition and in 2023 the JV borrowed $150mm secured by the land. The loan principal is equivalent to $125 per buildable square foot and the property may not be worth that much in 2024. Equity accounting treatment means that MPCT has not disclosed the loan term or maturity. If it were called on to pay down some of the balance for a renewal then the Trust could be in trouble.

Other Assets (Canary & Zibi)

I was impressed by a recent visit to Dream’s Canary and Distillery District developments. These are large newly developed planned communities close to downtown. Control of the entire area enables Dream to create a consistently pleasant neighborhood design, curated retail, and attractive public spaces. The area has a completely different feel from Downtown West where every block is a different condo tower. Rental properties in Dream’s districts should retain their value for 50-100 years, the neighborhood wont change because Dream controls the entire area.

A portfolio of stabilized commercial assets like this would be much more attractive than individual buildings scattered around the city. Why is Impact holding these other assets?

Impact and Dream have offered a prime block in their Zibi development for sale. Michael Cooper explained that proceeds would “substantially pay down” a land loan at the site. It’s unfortunate that Impact has to offer this parcel under weak market conditions, but deleveraging is prudent. The Zibi development sites are currently valued at $357mm (50% MPCT and 50% DRM) and I have no idea whether MPCT is likely to recognize a gain or loss on this sale.

Leverage

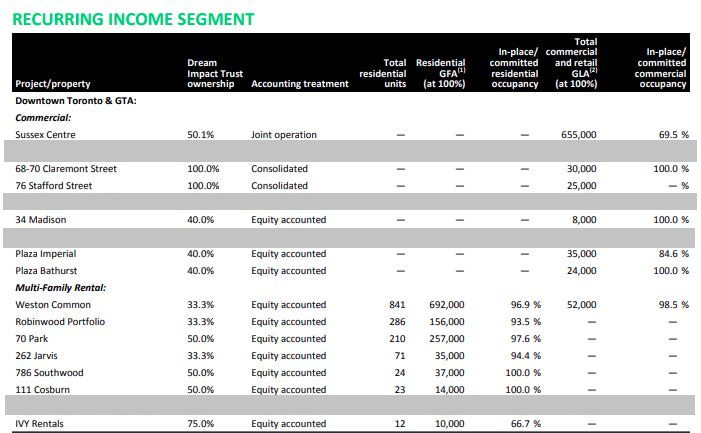

Impact’s high leverage increases risk for unitholders and leads to a widespread misunderstanding of its valuation. Many of Impact’s assets are held through unconsolidated equity interests and those off-balance sheet entities have considerable debt with undisclosed terms.

Consolidating Impact’s proportionate share of those assets and liabilities gives a clearer picture of Impact’s leverage:

MPCT trades at a larger discount to book value than any REIT (see Canadian REIT Valuations And 2024 Opportunities - December Update), but on an enterprise value basis several REITs are cheaper. Some MPCT investors believe they are buying its assets at an 82% discount, but the true discount is only 20%.

One objection to my criticism of Impact’s leverage was that high debt is typical for development projects. MPCT itself says: “For active development projects with traditional construction facilities in place, leverage ratios are typically between 50% and 65%.” However, MPCT has high debt on projects that are still at a planning stage where no development has taken place (Victory, Quayside, Zibi). Billions of dollars will be needed to build out this pipeline. This list doesn’t even include 49 Ontario which is still reported as a “Recurring Income” asset.

MPCT’s debt/equity ratio of 39.7% at 9/30/24 was not far below the 45% financial covenant in its debt agreements. The trust’s balance sheet could not support $600mm of new debt to pay for 49 Ontario (although it would only grow to that level over time). MPCT’s unitholder equity of $408mm at 9/30/24 could not support a significant impairment of the fair value of 49 Ontario and other development assets, if one were necessary.

Management Agreement

Impact is incurring over $15.3mm in annual fees payable under its management agreement with Dream Unlimited plus an additional $2.4mm of annual direct overhead. MPCT cannot survive with expenses running at 4.3% of NAV. The trust has temporarily been paying for its excessive G&A through heavy equity dilution like a junior mining shitco. This share issuance is running 0.75% per quarter and saves cash to maintain solvency while the trust’s balance sheet is under strain, but the arrangement cannot be a long-term solution.

The agreement is a valuable asset for DRM which estimated the NAV attributable to its Asset Management segment at 18XFFO.

The fair value of the management contract assets to DRM must be matched by an equivalent liability adjustment at the managed entities. Using DRM’s valuation methodology, the contract is a $140mm liability for MPCT:

One objection to my observations about the management agreement was that higher fees are reasonable for development assets. Regardless of whether or not that would be correct, MPCT’s high fee expense has nothing to do with development:

The agreement makes it nearly impossible for MPCT to grow its way to health because 1% of the value of any new assets will be paid as management fees. If $600mm is invested to build 49O then it will increase annual fee expense by $6mm. Does MPCT’s leadership even understand that Cooper’s “5 cap” drops to a 4 cap after the management fee?

Fix It Or Fold It

In March I wrote that Dream Impact is not viable without changes to its crippling management agreement, failed strategy, heavy debt, and ineffective leadership. There have been a few hints of progress:

Management Agreement - MPCT’s accounting treatment made it difficult to understand the dilution resulting from paying fees in units. It would be hard for the trust to ask unitholders to fix a problem that has been hidden from them. The trust’s 1Q earnings release made the equity issuance very clear.

Strategy - Impact has largely stopped talking about “Impact”. It removed the “Impact” labelling from its list of assets so the ultra-luxury Forma condo development is no longer described implausibly as an “inclusive community”. For the time being the strategy just seems to be survival.

Heavy Debt - MPCT’s consolidated debt has increased by $48mm in 9M24, but the trust finally seems to recognize that this is a problem.

Leadership - the main objection to my criticism of the MPCT independent trustees was that their job is meaningless so it doesn’t matter who does it. In recent years H&R and First Capital both made board changes to demonstrate responsiveness to unitholder concerns. New trustees with fresh perspectives and critical thinking would be a useful element of a MPCT restructuring. MPCT’s wine-loving Chairman Amar Bhalla did purchase $51k of units in September.

I suggested that DRM should restructure and recapitalize MPCT and nobody agreed. Since then the trust has made small improvements noted above, but I believe its financial condition has deteriorated due to the external environment. I encourage Dream Unlimited and Dream Impact to consider these steps:

Combination of Impact with DRM’s Western Canadian stabilized properties into a new “Dream Communities” REIT. The entity would hold a diversified national portfolio of high quality multifamily and commercial properties in planned communities developed by Dream (Distillery, Canary, West Don, Quayside, Zibi, Alpine Park, Brighton). Desirable assets, clear strategy, and current cash flow would improve access to new capital.

Restructure the management agreement to one similar to that of Dream Industrial (low base fee plus incentive).

New leadership with experience relevant to MPCT’s new strategy and dedicated primarily to the success of MPCT (rather than serving multiple other Dream entities).

Set a path for disposal of all non-core assets not aligned with the new strategy. These would be “build-to-sell” projects like Forma and acquired assets that were not developed by Dream.

It’s possible that Impact could be privatized by Dream Unlimited. The price would have to reflect the value of the management contract ($140mm by DRM’s method, but I don’t believe it’s worth that much) and impaired market value of Impact’s assets. Similar to Melcor, Dream would suffer reputational damage from buying out public holders at a low price at a low point in the business cycle. But Dream also suffers reputational damage from Impact’s poor performance.

Impact investors talk about the upside from the development assets, but if one or two things go wrong then the trust will default on its debt and be in a crisis. So fix it or fold it. The worst option is to do nothing and let it continue to struggle and make decisions that sacrifice long-term value for the need to deleverage under depressed market conditions.

Impact might announce a blockbuster development agreement for 49 Ontario at any moment that makes my comments look foolish. But it’s hard to make those numbers work.

Disclosures & Notes

At the time of publication the author owned shares of Dream Unlimited and held no position in Dream Impact. These disclosures should not be interpreted as a recommendation to purchase any of these securities. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Comments are welcome on Substack

And Bluesky https://bsky.app/profile/konekoresearch.bsky.social

Regarding 49 Ontario, I think you've made a good attempt at trying to determine its value, but I have some other perspectives:

1) Given that a good development margin is ~15% it's very easy for small errors in cost estimates to radically change the overall value of the project.

2) Downtown TO development land (with approvals in place) has been selling for $180 to $190 per buildable square foot in the last couple years.

3) The recent bank loan of $80M secured by 49 Ontario would not have been made unless the bank was confident there was a large delta with the land value.

4) Developers generally are not going to build if it means destroying the land value of the property. They will wait for better conditions. That creates the conditions for land values to rebound in time.

5) Gov'ts are continuing to remove costs from rental developments to get developers moving because of 4)

5) The fact that Cooper is an experienced developer and is ready to build 49 Ontario is highly suggestive that he sees a path to developing it that preserves the carrying value (~$160 per buildable square foot).

So, my bet, is that the value of 49 Ontario will not be written down. We will find out for sure soon...