Canadian REITs have delivered a -6.4% ytd total return (XRE to 7/5/24) but offer reasons for optimism over the balance of the year:

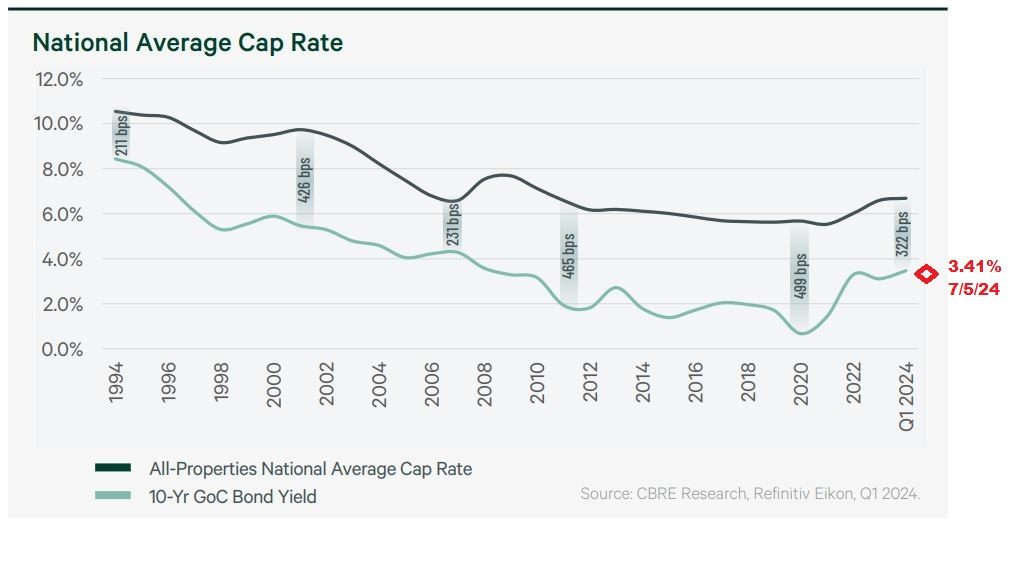

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall.

Insiders at 22 of 35 REITs were buyers in 1H24. 2 REITs had net insider sales.

Financing has remained available with distress limited to a few development projects and one REIT. Commercial mortgage rates at GOC + 150-200bp leave a positive return on leverage for most properties.

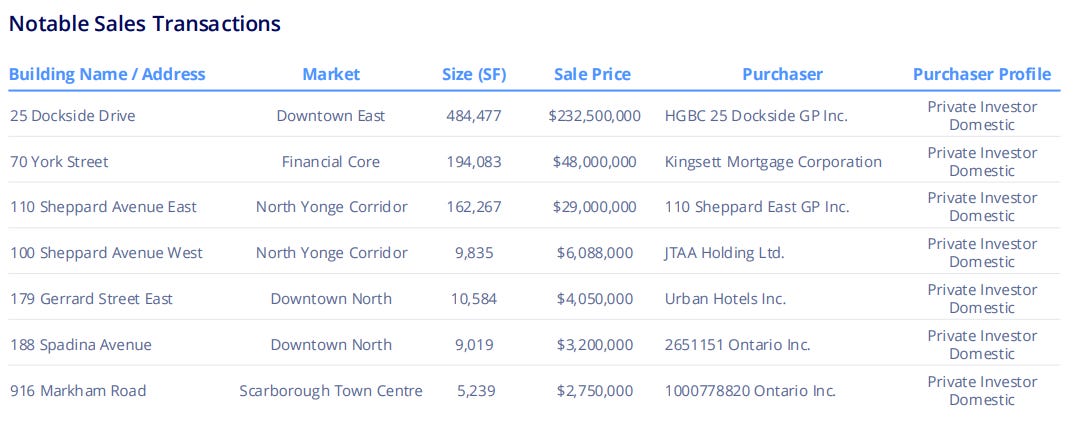

Transaction volume is recovering and REITs that need to sell assets have an opportunity to do so. Private Buyers are available for smaller deal sizes (under $100mm). Institutions and public companies have been on the sidelines. Foreign buyers have made a few large strategic purchases in the past year. Office transactions are most difficult and every case is a special situation that may involve vendor financing or development/conversion potential.

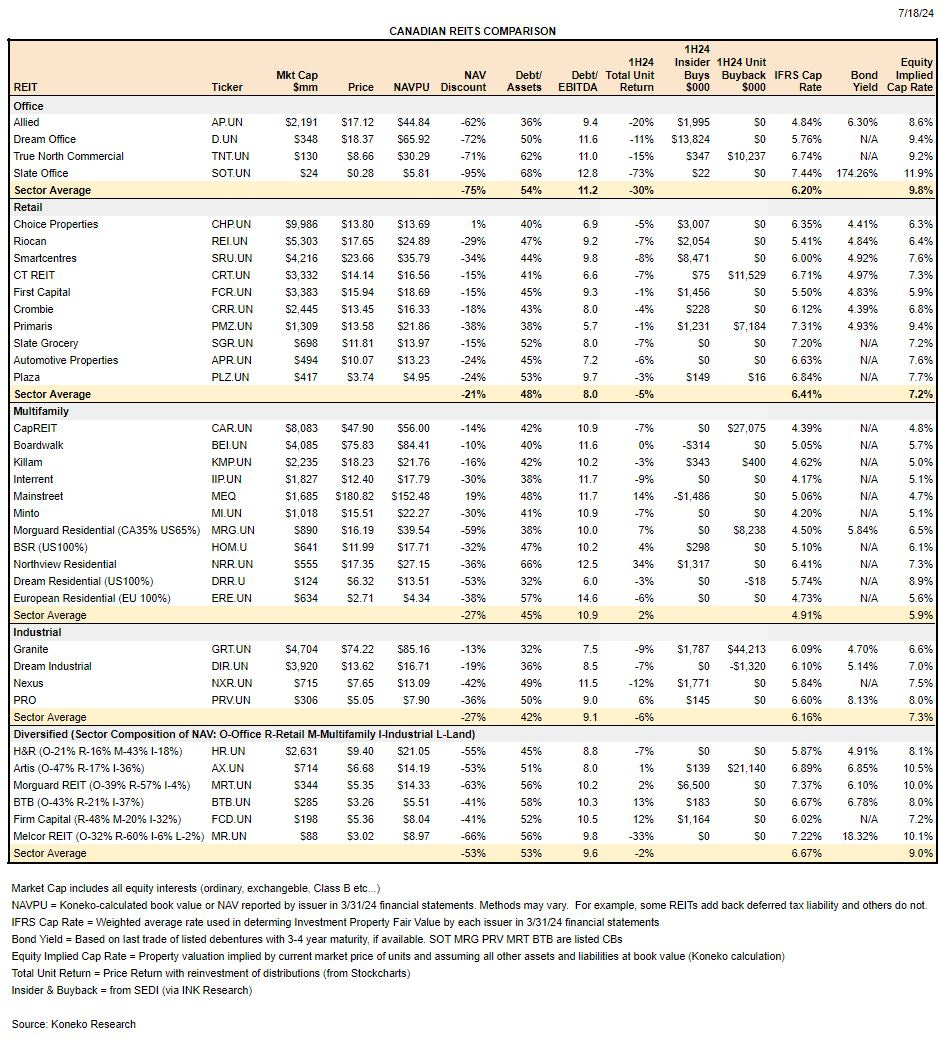

H&R and Primaris offer the best balance of potential return vs risk.

A comprehensive review of all REITs provides valuable context in identifying individual opportunities, especially among the diversified REITs. This article adds comments on companies at valuation extremes or with recent corporate news that has implications for the whole sector. None of these comments provide a complete profile or stock pitch and they are likely to only be of use to investors already familiar with the companies mentioned.

Topics:

Office Section with comments on Allied Properties, Dream Office, and Slate Office

Retail Section with comments on Primaris

Diversified Section with comments on H&R and Artis

Office REITs

The Canadian Office market stabilized in 1H24 with two consecutives quarters of positive absorption and a growing gap between Trophy Property (10.3% vacancy), Class A (16.4% vacancy), and Class B/C (24.9% vacancy).

Allied Properties (AP.UN)

Allied disappointed investors hoping for clarity about how its recent acquisitions would impact financial metrics and long term strategy. On its 1Q24 call, management spoke about increased touring activity, but didn’t provide perspective on how Allied is dealing with market conditions that everybody sees as very challenging.

Positive attitude: “Strong demand continues. I'm encouraged by the high level of tour activity across our portfolio. I'm also encouraged by the ongoing productivity of our portfolio, and that renewals were at healthy spreads to in-place rents.” Conference call answers were brief, short on tangible details, and a contrast from the style of prior CEO Michael Emory who would speak at length and with infectious passion for the business he founded.

Balance Sheet: “we are fully committed to maintaining a strong balance sheet and retaining our investment-grade credit rating”, but in June Allied was downgraded by Moody’s to Ba1.

Residential real estate strategy: No explanation, other than it now exists: “In the past, we've had to joint venture with partners that had rental residential expertise, and now we wouldn't need to do that going forward. We have that expertise ourselves.”

Distribution: Management emphatically stated: “we are absolutely committed to our current level of distribution,” but investors recognize that the distribution inhibits the REIT’s ability to continue the renovation and development strategies that have historically generated sector leading returns through NAV appreciation. A 50% distribution cut would conserve $114mm/year and reduce the need to sell assets in a distressed market, roll over debt at higher interest rates, and delay value-creating investments.

The REIT’s purchases of the 400 West Georgia office building in Vancouver and 19 Duncan office/residential tower in Toronto closed on April 1 so Allied deferred comment on their impact until 2Q24 results. These are extremely attractive assets, but their quality probably meant pricing at cap rates below 5%. Allied’s public bonds maturing from 2026-32 are trading at yields from 6.3-6.6% and its equity at an implied cap rate of 8.6% so capital markets favor deleveraging rather than acquisitions. If this is an exciting counter-cyclical opportunity to add exceptional assets then investors would appreciate a much more detailed explanation - perhaps it will come with 2Q24 results.

One of my concerns about Allied has been its large exposure to Montreal and in particular its 2019 purchase of 700 De La Gauchetiere (DLG) for $329mm from Dream Office. National Bank (NBF) was the primary tenant with plans to vacate its space and move to its own new nearby tower under construction. Allied would take advantage of the vacancy to spend approximately $80MM on an extensive renovation. The risks were 1) could it really transform the building’s unappealing 1980s design 2) large pending vacancy in a market that weakened since acquisition, 3) leasing competition from the immediately adjacent 600 De La Gauchetiere where NBF was also leaving a majority of the space. Note that Allied renamed the building 1001 Boulevard Robert Bourassa. My concerns have significantly eased in recent months:

Renovation looks gorgeous: calm natural elements, abundant light, elegance without ostentation, both spacious and intimate. It could have been designed by the elves. Allied has a created a Trophy quality space.

1001 Boulevard Robert-Bourassa Lobby spaces Demand for premier offices in Montreal has been strong with Trophy class vacancy at just 7.2%

600 DLG is being renovated in a modern creative style that would compete with Allied, but will be largely filled by CN Rail which will relocate its head office from Gare Centrale. High occupancy for the joint properties will invigorate the shared plaza and retail spaces which will increase the appeal of the limited remaining availability in both buildings.

An ongoing concern for Allied is the impact of new supply in the Toronto market for creative workspace, including 560k sf at Portland Commons near The Well and built entirely on spec with no anchor tenant. At The Well, Shopify has not yet filled the large office block is has offered for sublease.

Dream Office (D.UN)

Dream’s portfolio is smaller, weaker, older, and more highly leveraged than Allied, but the REIT has executed well over the past year:

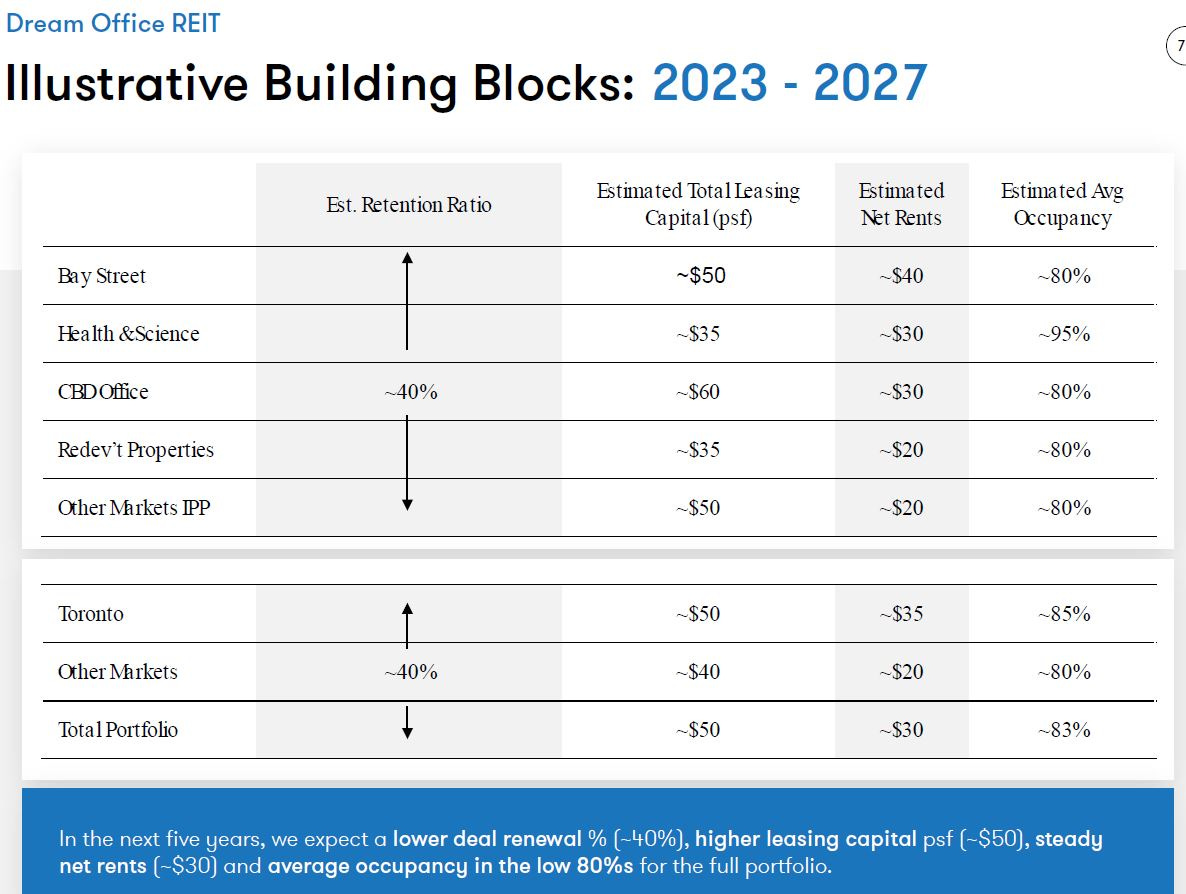

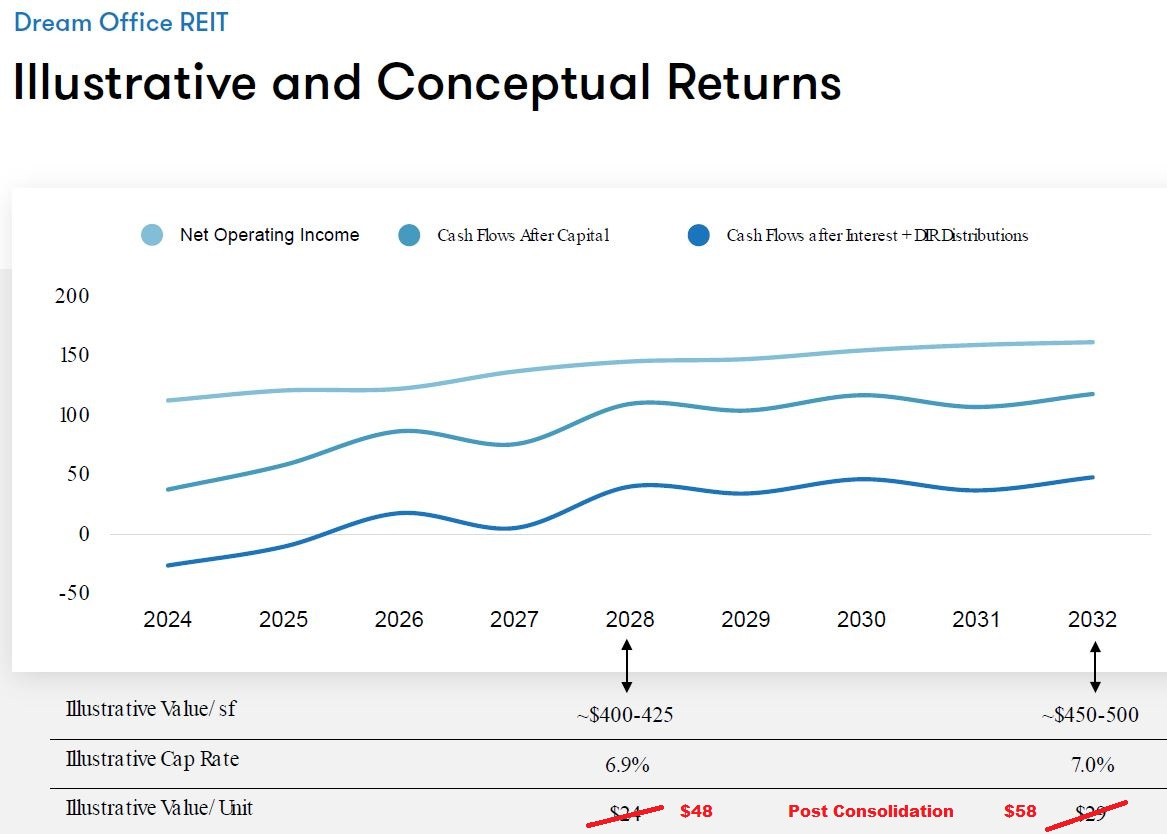

Conservative 5-year outlook from last year’s Dream Investor Day illustrated the potential medium term impact of lower renewals, elevated leasing expense, lower net effective rents, and lower occupancy. It’s not official guidance, but Dream suggested that free cash flow would be negative in 2024-25 before turning positive in 2026. These slides provide helpful context for understanding the impact on Dream of the office sector challenges being reported every day in the media.

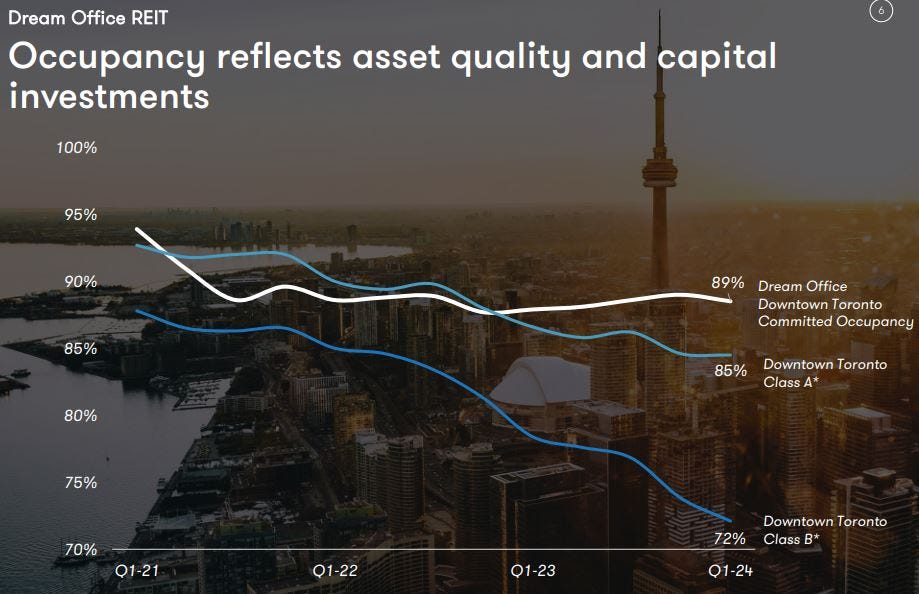

D occupancy has outperformed the Illustrative numbers presented last fall and the downtown Toronto market overall. Dream’s resilience is attributable to its roster of financial and professional services tenants, extensive building improvements over the past five years, smaller boutique spaces (below 10000 sf) and offering of pre-built move-in-ready suites. These factors have also been mentioned as sources of strength by US Office REITs.

438 University: Risks from Dream’s elevated leverage and negative 2024 cash flow would be eased if it were able to complete one asset sale and Green Street recently reported that 438 University may be sold to Infrastructure Ontario, the anchor tenant, for $105mm. For government and agency buyers with access to financing below 4%, the current market provides an extremely attractive opportunity to lock in long-term savings through purchase of offices in lieu of leasing.

212 King West: D indicated in its February conference call that a transaction at the hotel/residential development site at 212 King West would take “another couple of quarters”. A reliable source indicates that the nearby Ritz Carlton is for sale at $447mm (Toronto record price of $1.7mm/room). Dream’s nearby location on the opposite side of David Pecaut Square is outstanding with proximity to the Financial Core and Entertainment district. It’s not clear whether a transaction would involve an upfront cash sale or funding of development costs.

74 Victoria: In February D signaled that the anchor tenant at this building was unlikely to renew its lease expiring 4Q24, but during the June AGM disclosed: “74 Victoria, which was one of the biggest risks in our portfolio, we had budgeted the whole building to go vacant, and we've recently secured and are in some advanced negotiations for a large part of the building.”

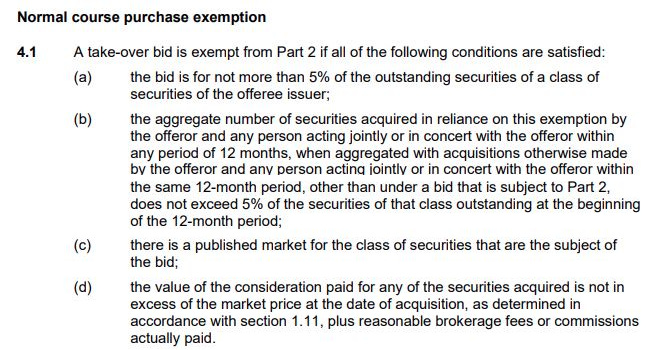

Artis REIT recently reported an increase in its ownership of Dream Office to 20.75%. Any party acquiring 20% of a public company must make a general offer to purchase all outstanding shares, however Artis took advantage of the “normal course purchase exemption” by purchasing less than 5% in the past rolling 12 month period.

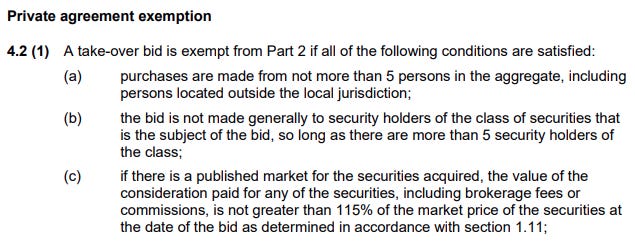

Artis evidently hurried to purchase shares before June 22 when its 12 month prior ownership stake had dropped through participation in D’s substantial issuer bid. I believe that Artis will not be able to use the “normal course purchase exemption” again for any open market purchases until February 2025 when the 12 month change in its holdings would drop below 5%. Artis can still take advantage of the “private agreement exemption” take acquire large blocks:

Artis CEO Samir Manji has given minimal indication of his plans for the stake in Dream Office, simply describing it as “materially undervalued” and a “potential target for M&A activity”. I previously shared my own thoughts on its acquisition appeal. What could happen next?

Bid to acquire all of Dream Office. Artis first disclosed a 10% stake in February 2022 when it had been buying at a split adjusted price over C$48/unit so Manji might be excited by an opportunity to acquire the whole REIT at a significantly lower price. One of Artis’ biggest problems has been that it never had any prime assets - purchase of Dream Office would give it a much stronger long term foundation, however in the short term it would be viewed negatively by Artis’ public investors.

Seek limited board changes. Most of D’s current independent trustees have no career experience in Office real estate. Two of the trustees also serve at the beleaguered Dream Impact Trust where strategic blunders and abysmal long-term return reflect poorly on all involved. New trustees could add M&A related legal and investment banking experience in anticipation that Dream Office could eventually be acquired by a third party.

Promote the value of Dream Office. Artis could emulate the approach taken by Land and Buildings which has targeted some companies through proxy fights, but in other cases constructively sought to raise awareness of the value of its investees, such as in this presentation about Tricon Residential. As an independent investor, Artis could speak more directly and speculatively than Dream Office management about the REIT’s value and potential. A campaign would also raise Artis profile and credibility if it wants to persist with its public company investment strategy. Manji has been reluctant to explain his D investment thesis because it might inhibit his ability to cheaply acquire more units, but he may feel freer to speak having reached the limit of the normal course purchase exemption.

Wait until next year.

Slate Office Trust (SOT.UN)

Shite Office defaulted on its credit facility less than two months after these upbeat management comments in the May conference call:

“our team continues to prudently manage the REIT's balance sheet to ensure financial flexibility and stability for the REIT”

“Our team continued to drive steady leasing volumes in the first quarter. We believe this highlights a trend of steadily rebounding tenant demand.”

“we continue to have conviction in the value of our office portfolio and the actions the REIT has taken to retain cash, pay down debt and proactively create value.”

“We're continuing to have good support from all of our lenders, we're thankful for that as we continue to work through the portfolio realignment plan.”

Shite disclosed that asset sales are being made at large discounts to carrying value: “Relative to IFRS, the sales are decently inside, probably on average, 30%, 40% just given where the market is.”

Has it been unprofessional for me to repeatedly refer to this company as Shite? Operational and unit price performance has demonstrated that the label has been accurate. On the contrary, it has been the misleading upbeat commentary from Shite management that has been unprofessional.

Well-known value investor George Armoyan has a market-to-market loss of nearly all the more than $60mm he invested in SOT:

Through G2S2 he first reported ownership of a 10% stake (8.1mm units) in May 2022 when the price was over $4.90

G2S2 reported ownership of a 15% stake (12.8mm units) in October 2022 when the price was over $4.25

G2S2 continued purchasing SOT at prices down to $2/unit (last reported ownership of 15.1mm units) and $12.4mm face value of SOT debentures.

After threatening a proxy fight, Armoyan and one nominee chosen selected by him were added to the SOT Board in February 2023.

Default on senior obligations means that time’s up and SOT needs cash and lender forbearance. 1Q24 Debt/Assets was 67.8% so selling property at 60-70% of carrying value doesn’t help. Operating Cash Flow in 1Q24 was +$5.3mm which was slightly more than offset by $6.1mm spent on capex and leasing. The REIT is not bleeding cash so a $50mm cushion might be enough funding to appease lenders, support leasing, and enable conduct of asset sales in an orderly manner. Some options:

Rights offering: Common unitholders might not approve a highly dilutive issuance of common units.

Preferred Issuance: $50mm preferred equity issued to Armoyan, and perhaps Shite Asset Management and others, with a 12% coupon that steps up after 5 years (to encourage redemption) plus warrants (up to the limit that could be issued without a unitholder meeting) might work. It would preserve some recovery potential for common unit holders, including Armoyan. It would be very favorable for existing debenture holders, including Armoyan.

Sale/Merger: Armoyan or another investor investor could offer to acquire all of SOT (current market cap is only $21mm), but that might take six months, might face resistance from other unitholders, and would still require investment of additional funds to stabilize the balance sheet.

Armoyan or any other investor might decline to invest significant new sums into SOT after conducting detailed due diligence. SOT is in default on its senior debt obligations so any investment in its debentures or common units is highly speculative and at risk of 100% loss. The debentures look like a more rational bet than the common.

Retail REITs

Retail real estate performed well through COVID. Excess capacity resulting from tenant bankruptcies and ecommerce impacts was largely resolved in 2015-2019. COVID demonstrated the resilience of consumer demand for essential services shopping (grocery and pharmacy) and omnichannel became the dominant retail model for maximization of customer convenience, brand awareness, and efficient distribution. Alberta markets that were weak from 2015-2020 are now thriving due to an energy sector rebound and affordability of housing. Financing remains available for Retail property owners and REITs have been able to dispose of non-core Retail assets. Buyers recognize that retail properties provide attractive near-term free cash flow and long-term upside through potential future redevelopment of their large land plots around growing Canadian cities.

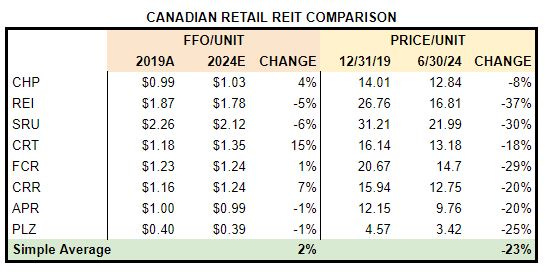

The average Retail REIT has seen FFO/Unit increase by 2% since pre-COVID 2019 results and unit price fall 23%.

There has not been a large variation in 5-year FFO performance between REITs. Unit price returns for the captive REITs (Choice, CT, Crombie, and Automotive) have held up a little better due to their perceived stability. The independent REITs (Riocan, Smartcentres, First Capital, and Primaris) had weaker price returns, but may have more potential to add tenants at higher rents under current favorable retail real estate supply/demand trends. Every REIT looks attractively valued with an implied cap rate well above IFRS rates and cost of debt.

Primaris (PMZ.UN)

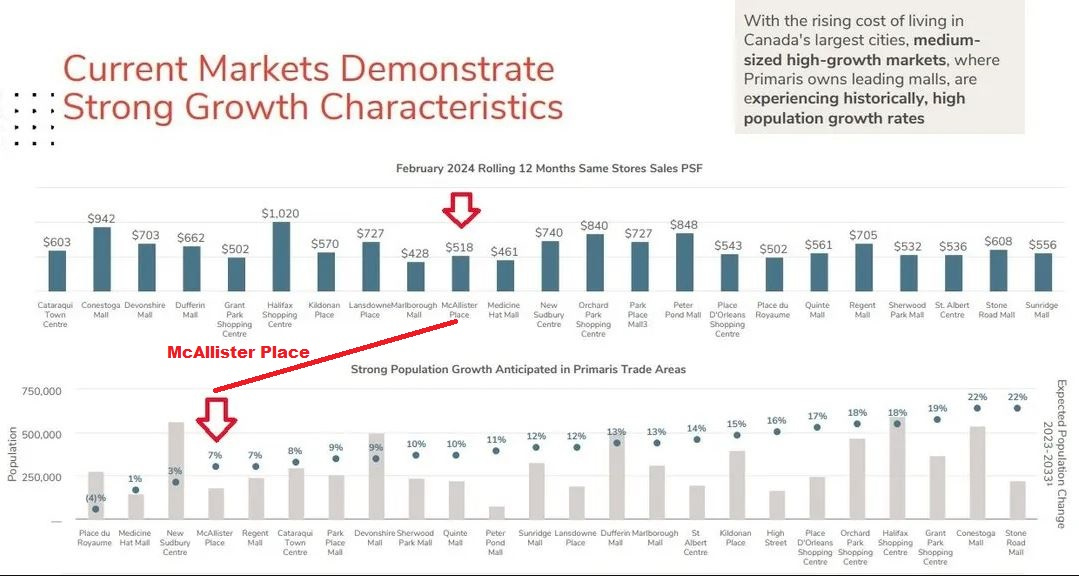

Primaris continues to stand out among Canadian REITs for its strong financial condition, strong operating performance, and distressed valuation. The REIT slightly raised its full-year guidance when it announced 1Q24 results.

Primaris CEO Alex Avery was once a leading REIT analyst and drew attention to the same valuation metrics I have highlighted in my sector comp table:

“It is worth looking at the detailed metrics used in our IFRS values, including a 7.16% going-in cap rate, an 8.34% discount rate, and a 7.31% terminal cap rate. Notably, these metrics provide a very healthy 150 to 200 basis point positive cap rate spread over Primaris' current cost of debt. This level of cap rate spread over financing has historically been a very attractive spread for real estate investors. Users of our financial statements should be aware that we have seen the metrics embedded in our IFRS NAV move more significantly than our peers and currently reflect very conservative values. If you look at our units, they're implying somewhere in the mid to high 9% cap rate and that's a 400 to 500 basis point spread over our cost of financing. It's just a really remarkable return.”

“Primaris' differentiated financial model eliminates the incentives for Primaris that other organizations face, making them reluctant to reflect higher cap rates to value their properties, a fact highlighted in the public markets by the scarcity of Canadian REITs with IFRS values that offer significant positive cap rate spreads over the cost of financing.

The incentives I mentioned include compensation tied to IFRS NAV and asset fair values, as well as the hurdles that arise for refinancing properties where fair values have been reduced, as well as executive compensation benchmarking based on total assets.”

Green Street recently reported that Primaris is marketing its McAllister Place mall in Saint John NB with expected proceeds of $75mm. The mall is performing well with 98% occupancy, but sales/sf and area population growth are below the REIT’s average. The long-term development of the 80-acre site still makes it appealing to buyers. A potential transaction would be consistent with Primaris’ goal of recycling capital to strengthen its core mall operations in locations with high sales and high growth.

Multifamily REITs

Canadian Residential REIT returns have been muted as market rents in major cities (Toronto Montreal Vancouver) have been flat due to affordability limitations in spite of the widely recognized housing shortage. Alberta and smaller market rents have been rising, but these markets have less likelihood of long-term scarcity. Low property cap rates are justified by availability of attractive CMHC financing, but without long-term growth from rent increases or development, the absolute return is not especially appealing to equity investors I will examine the Canadian multifamily sector in more detail in a separate article.

Industrial REITs

The surge in Industrial real estate demand and rents over the past 10 years is well-known. Extreme scarcity of space in major Canadian markets is easing, but the financial outlook for REITs is supported by large premiums of market rents over existing leases (DIR Canadian properties +44%), and new long-term (5-10 year) leases being signed with annual rent escalation of 3-5%. With continued strong fundamentals and institutional interest in the asset class, I believe any of the remaining 4 Canadian industrial REITs could be privatized at an attractive premium to current prices if they were willing to sell.

Granite’s diverse portfolio (53% US, 22% CAN, 9% AUS, 9% NED, 7% GER) may complicate valuation analysis but also creates strategic options for sale of part or all of the REIT’s assets. US Industrial REIT peers all trade at equity implied cap rates below 6%.

Dream Industrial mentioned increased US investor interest in Canadian Industrial properties: “we continue to see more and more capital looking at Canadian industrial from abroad primarily from the United States because the fundamentals are strong, and we have pretty low supply low availability especially in the GTA. And so we continue to see more interest from specifically U.S. institutional investors in the Canadian market”.

Diversified REITs

REIT investors reward clarity, stability, and predictability. Diversification limits risk, but also makes a REIT harder to analyze and more likely to have at least one underperforming thing that becomes the primary focus of investor and analyst attention. Lower equity valuations mean a higher cost of capital that inhibits long-term growth potential. H&R should be able to deliver an attractive return by simplifying its complex business.

Artis (AX.UN)

Artis units trade at a discounted valuation due to the continuing lack of investor interest in the REIT’s vague vision. The REIT is selling assets to reduce its excessive leverage, but plans “to be opportunistic and pursue investments we believe are in line with our strategy, which may include equity securities and real estate acquisitions or developments” and has given no indication of what those might be. Recent developments:

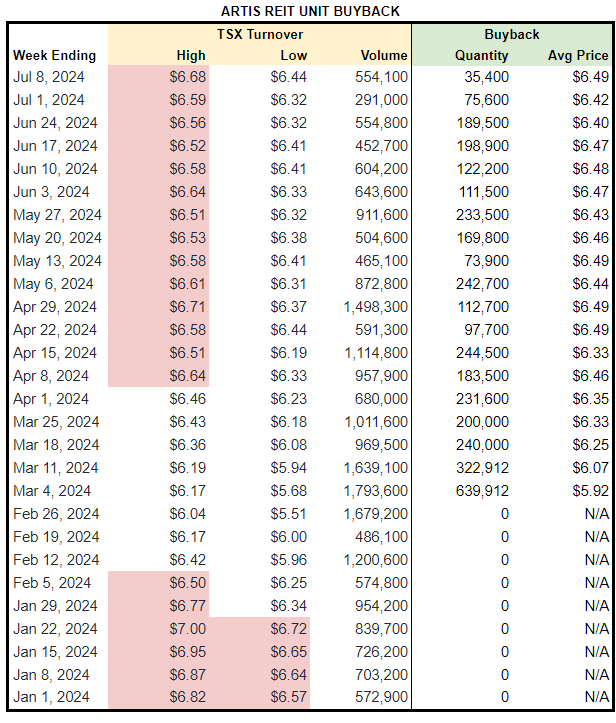

NCIB: Artis has generated meaningful NAV accretion through repurchase of 3.7mm units so far in 2024 at an average price of $6.29. I believe the repurchase program has been capped at a price of $6.50/unit (a 54% discount to reported NAV of $14.06). No repurchases have been reported at a weekly average over $6.50 and repurchase volumes have dropped in weeks that the trading price exceeded $6.50.

Cominar: Artis balance sheet includes $75mm of equity and $153mm of PIK preferred equity in the poorly timed and highly leveraged buyout of Quebec focused Cominar REIT. The equity of IRIS, the buyout vehicle, is valued at a cap rate of 6.4% which is too low for its mediocre portfolio of suburban office and retail properties. Cominar hopes to generate gains through redevelopment of a couple of core Montreal properties such as the Gare Centrale. Redevelopment is a great idea and the plan was to add 2 residential towers over the existing structure. In May CN Rail announced that it would be leaving the station’s existing office tower and moving to 600 De La Gauchetiere (mentioned above in connection with Allied Properties). Cominar will be left with a vacant Class C office building that could provide an opportunity to reimagine the entire site, but the buyout leverage severely limits Cominar’s financial capacity to execute any new vision. Any construction on this site will be complex and expensive because it’s the second busiest train station in Canada serving over 11mm passengers per year. It would make sense for Artis and its partners in the buyout consortium to recapitalize Cominar. It’s safe to assume that the fair market value of Artis existing Cominar investment is close to zero - that would reduce Artis NAVPU to $12.07 and its Equity Implied Cap Rate to 9.1%.

Dream Office: As described above, there are several paths available to Artis in handling its stake in D. A constructive or activist approach that realized a higher value from the investment would raise Artis’ NAV, however the benefit to Artis investors would be limited if Artis chose to retain the capital for future opportunistic investments. An acquisition of D by Artis itself or as part of a consortium could be justified from a long-term perspective, but would be viewed negatively in the short-term. If you like Dream Office then buy Dream Office, if you like Artis then buy Artis, but investors that see Artis as a discounted vehicle for buying Dream Office could be disappointed.

A new wave of investors has become enthusiastic that Artis is worth substantially more than its trading price, however without any clear plan to deliver that value to unitholders I believe the units will continue trading at a persistently wide discount similar to other TSX-listed investment companies such as Morguard Corporation, EL Financial, Dream Unlimited, and Senvest Capital, all which which have excellent long-term track records that Artis does not. It’s also possible that Artis “value investing” plan could disappoint investors, such as happened with Bill Ackman at Howard Hughes, Sam Zell at Equity Commonwealth, Eddie Lampert at Sears, and Philip Mittleman at Aimia.

Artis could surprise the market at any time by announcing a clear business plan that would deliver value to its investors. They should do it, but after 3 1/2 years under the current management it’s hard to predict that they will do it.

H&R REIT (HR.UN)

H&R continues to execute its five year plan to transition its diversified portfolio to 80% US Residential and 20% Canadian Industrial. Significant 2Q news:

Corus Quay sale closed on time in April for $233mm of proceeds. The buyer, George Brown College, was not deterred by the change in international student visa rules. Considering the weak financial condition of Corus Entertainment ($770mm loss in quarter-ended 5/31), it’s a relief to have them off the tenant roster.

Kingsway property sale in Burnaby closed in July for $83mm of proceeds

ECHO JV interest (grocery-anchored shopping centers in US Midwest) is likely to be sold within the next 12 months. H&R’s 33% interest had a 1Q24 carrying value of $518mm based on a cap rate around 7%.

Quarterra multifamily assets recently purchased by KKR from Lennar at an estimated cap rate of 5.3% provide a benchmark for the potential private market value of H&R once its business transformation is completed.

H&R’s strong financial condition and asset quality have enabled it to continue executing its strategic plan despite challenging market conditions. Ongoing property sales should allow the REIT to resume unit repurchases which have been paused since September 2023. If H&R trades at an equity implied cap rate of 6.0% in 3 years when its portfolio repositioning is complete then units will appreciate to $18.50. If H&R’s valuation remains low after the repositioning then there will be abundant private buyer interest in the high quality Lantower residential assets. H&R’s attractive development sites, including prime downtown Toronto residential locations, will be a source of additional value.

Subscriber Survey Feedback

Thanks to everybody who completed the brief survey and shared feedback! Key points:

Residential REITs were the sector that readers were most interested in reading more about. This is great idea. I have not commented much about the group in the past, but the multifamily REITs would provide insight into broader real estate trends since REITs in other sectors often see residential development as a path to building additional value. However, not having commented in the past, I should begin with a separate article examining differences between the REITs and their relative regional and operational strengths. I hope to publish that in August.

Retail and Industrial REITs attracted relatively little interest. Both seem to offer attractive risk adjusted returns at current prices.

Can owners forfeit mortgaged property to lenders? No, in Canada nearly all commercial mortgages are recourse loans. This has preserved credit availability and prevented a flush of distressed property onto the market. Foreclosures have been mostly limited to development sites where a company formed to develop a project is unable to proceed due to reduced return expectations.

Melcor? I commented on Melcor REIT in March. I may examine Melcor Development in August.

Private transactions? Most of the disclosed REIT divestitures have been to private buyers. Reports from some of the major real estate brokers list sales that have closed, but across all asset types most are smaller deals and each one may have special factors that make it difficult to generalize conclusions about valuation metrics like cap rate or price psf. Example:

IFRS Value vs Market Value? There are different acceptable ways to calculate IFRS value. It’s a spreadsheet number that could be biased by overly optimistic assumptions about future occupancy, rents, and cap rates. It’s useful to compare IFRS valuations against real estate broker reports and peer valuations to get a sense of whether the numbers are realistic. Subscribers know that I like to add eyewitness observations. When a REIT decides to offer a property for sale it engages a broker and gets a good sense of the market value likely to be realized. If that’s below the last IFRS carrying value then a fair value loss should be recorded. When an actual sale is realized around the impaired level the REIT then boasts that the price was in line with carrying value and many investors mistakenly assume that implies all of the remaining IFRS valuations are probably close to market value. No, because they haven’t been marked down for sale. As mentioned above, Slate Office says it is negotiating sales at 30-40% below IFRS values - I suspect that SOT was reluctant to recognize impairments earlier because they would have placed the REIT in violation of debt covenants.

Public vs Private Valuation? Comparing Equity Implied Cap Rate against market rates from real estate broker research is a good guideline. Unfortunately there have been few large deals that would serve as reference points for the value of larger assets (>$100mm). Valuation of US REITs provides some insight.

NRR CAR MI IIP? I’ll examine the Canadian multifamily market in a separate article. I added NRR and also MEQ and ERE to the table.

Thanks again for the feedback! Feel free to add comments below and I’ll probably send another survey in September.

Disclosures & Notes

At the time of publication the author held units of Dream Office, Primaris, Dream Residential, Nexus, H&R, Artis, and Morguard REIT. This disclosure should not be interpreted as a recommendation to purchase any of these securities and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Good article!

long $HR.UN

Great article! In regards to Dream Office and Allied, for the same price I think it's natural to invest in Dream Office over Allied. Downtown Toronto locations are worth way more than Montreal and the office market in Toronto is much better than in Montreal, especially around core which all access the TTC (metro stations). From what we seen the smaller buildings are more liquid and easily sold for good prices and Dream Office has another advantage over Allied, which has massively large buildings in Montreal which I believe would be very hard to sell for a good price. Allied also is using majorly fake cap rates in the 4s and Dream and others have already moved cap rates. I think it's a no brainer to add Dream Office over Allied in the s/t if bullish office.