Canadian REIT Valuations And 2024 Opportunities - October Update

Canadian REITs have delivered a +9.8% ytd total return (XRE to 10/15/24) and offer reasons for cautious optimism:

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall.

Insiders at 23 of 35 REITs were buyers in 9M24. 6 REITs had net insider sales. Buying dropped sharply after prices rose in July.

Financing has remained available with distress limited to development projects and one REIT. Commercial mortgage rates at GOC + 150-200bp leave a positive return on leverage for most properties.

Transaction volume is recovering and REITs that need to sell assets have an opportunity to do so. The GTA multifamily residential land development market has had the most uncertainty. Private Buyers are available for smaller deal sizes (under $100mm). Institutions and public companies have been on the sidelines. Foreign buyers have made a few large strategic purchases in the past year.

H&R and Primaris offer the best balance of potential return vs risk.

A comprehensive review of all REITs provides valuable context in identifying individual opportunities, especially among the diversified REITs. This article adds comments on companies at valuation extremes or with recent corporate news that has implications for the whole sector. None of these comments provide a complete profile or stock pitch and they are likely to only be of use to investors already familiar with the companies mentioned. The comp valuation sheet is getting unwieldy as a graphic insert, hopefully this pdf link works…

Topics:

Leverage skews standard REIT valuation metrics

Office Section with comments on Allied Properties, Dream Office, and Slate Office

Retail Section with comments on Smartcentres

Multifamily Section with comments on Canadian Apartment

Diversified Section with comments on Artis, Morguard, Melcor, and H&R

Leverage

The most common valuation metrics of Funds From Operations (FFO) and Net Asset Value (NAV) are leveraged. Low price/NAV and price/FFO multiples can provide a misleading sense of undervaluation if an issuer has a high level of debt or hybrid securities senior to common units.

“Discounts”: People sometimes describe a 50% NAV discount as an opportunity to buy assets at 50 cents on the dollar, but more accurately it’s the opportunity to buy the equity at 50 cents on the dollar. If the equity has been leveraged then it might be comparable to buying the assets at 80 cents on the dollar, and that might be a great deal, but the margin of safety is lower. True North Commercial (TNT) trades at a larger NAV discount than Allied (AP), but TNT’s very high debt means that its investors are paying closer to full value for its assets that are lower quality properties, in less attractive locations, with less development potential, and weaker long-term returns than those of Allied.

Equity accounting can move significant leverage off balance sheet. As an example, Artis REIT (AX) reports its 32.6% equity interest in the Cominar buyout vehicle as a $42mm asset, but it is a net interest in $657mm in assets and $615mm of liabilities. A pro-forma consolidation of Artis’ stake in its equity interests shows it remains one of the most highly leveraged REITs despite its asset sales over the past 3 years. There’s nothing improper about AX reporting, but the reported NAV discount and CEO’s claims to have a “fortress balance sheet” give a misleading picture of the risk of investing in Artis.

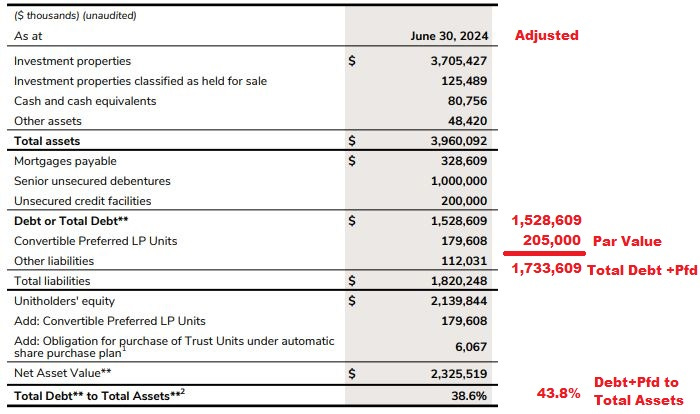

Hybrid securities can skew metrics depending on whether they are reported as debt or equity. As an example, Primaris has issued “convertible preferred LP units”. The conversion prices are slightly below NAV so they are essentially non-dilutive. PMZ’s financial statements say “Convertible Preferred LP Units are considered debt instruments and are classified as financial liabilities at fair value through profit or loss.” The fair value of the unit liability at 6/30/24 was deemed to be $179.6mm, below the face value of $205mm. However Primaris excludes the Preferred units from its non-GAAP disclosure of “Total Debt to Total Assets”. There’s nothing improper about PMZ’s reporting, but the Valuation sheet in this article adds the preferred units to debt in order to compare the degree to which common equity is leveraged by different issuers.

Equity Implied Cap Rate is an unleveraged metric that avoids most of these distortions by looking at property NOI (before interest expense) and underlying asset value. This month’s valuation table introduces a new column, EV Discount.

Office REITs

The Canadian Office market stabilized in 9M24 with a growing gap between Trophy Property (10.1% vacancy), Class A (16.7% vacancy), and Class B/C (25.1% vacancy). Colliers noted the outperformance of move-in ready space. This favors landlords that have completed renovation programs and have capital to invest in improvements, Allied and Dream are better positioned than True North, Slate, and Morguard REIT.

Workplace occupancy policies are finally normalizing with major corporations recognizing that office environments can contribute to long-term employee productivity. JLL noted that companies are still reducing space at lease renewal, but that vacancy is heavily concentrated (in the US 7% of buildings account for 50% of vacant space). Again, this favors landlords with well-located attractive space, Allied and Dream better are better positioned than True North, Slate, and Morguard.

In additional to the structural changes in the post-pandemic environment, the Downtown Toronto office market also has a cyclical challenge from the completion of pre-leased trophy towers (CIBC Square and TD Centre) that pulled tenants from older buildings and several speculative Class A buildings which have yet to attract any tenants (Portland Commons, T3 Bayside, T3 Sterling).

Allied Properties (AP.UN)

Allied’s 2Q24 conference call provided greatly improved clarity about the company’s recent strategic actions and operating outlook.

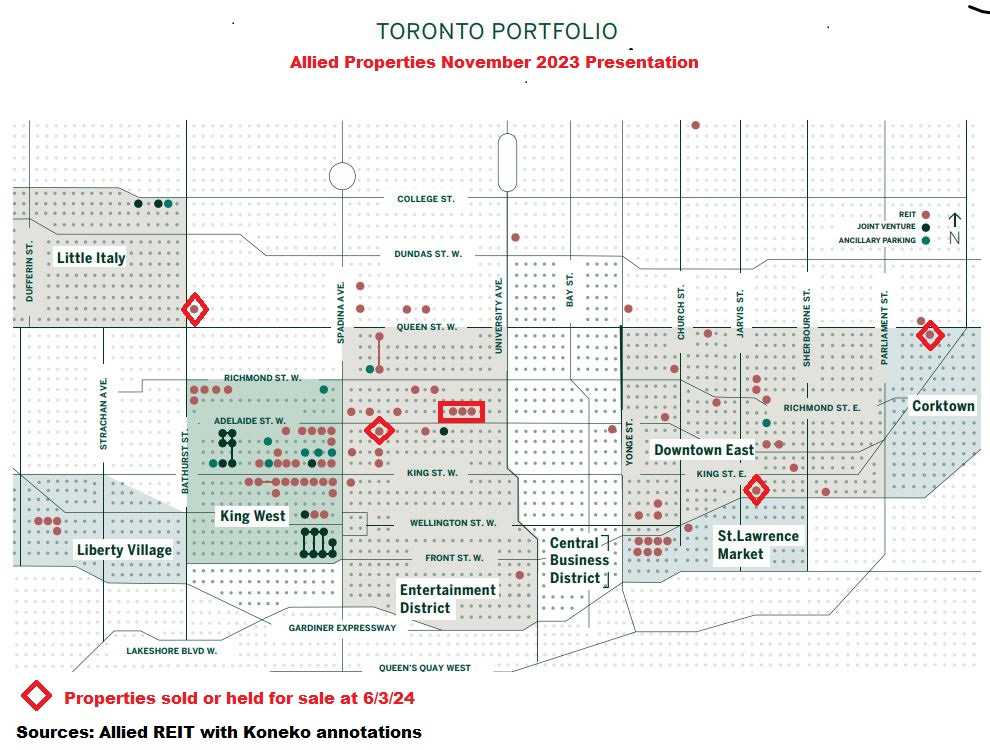

Disposals. I was wary that AP’s plans to divest $400mm of properties might erode its ability to execute the redevelopment strategies that have contributed to its peer-leading long-term value creation. Comparing the “Property Table” in Allied’s 2Q24 MD&A against 4Q23 suggests that the 13 properties no longer included are “held for sale:

Toronto 183 Bathhurst Toronto 116 Simcoe Toronto 200 Adelaide West Toronto 208-210 Adelaide West Toronto 331-333 Adelaide West Toronto 106 Front East Toronto 489 Queen

Montreal 4396-4410 Saint Laurent Montreal 4446 Saint Laurent Montreal 480 Saint Laurent Montreal 740 Saint Maurice Montreal 85 Saint Paul W

Vancouver 1220 Homer

None seem to be core assets for Allied, but they could be core assets for buyers pursuing a different strategy. The reported buyer of 4446 Saint Laurent in Montreal sees its high-traffic trendy location as attractive to service businesses like hairdressers, nail salons, and tattoo parlours. Private buyers are acquiring smaller buildings for current return, long-term redevelopment potential, or for their own use (cheaper to buy than rent). When AP was a buyer of property in 2020 Chairman Michael Emory said that he did not expect any bargains, but that market conditions could create opportunities to acquire sites that would not otherwise be available. Now that AP is a potential seller in 2024-25, it may not offer properties at bargain prices, but it may hold sites adjacent to a land assembly that a buyer had been working on for many years. This could explain the “unsolicited offers” the REIT has received.

Leasing: Allied’s 2Q conference call provided encouraging details about increased demand from tenant renewals and expansions. AP’s King West Village marketing presentation shows how the concentration of neighborhood properties creates greater value for the REIT and its tenants than individual buildings. None of Allied’s potential dispositions are within this area.

Several elements of Allied’s financials are still in transition with acquisitions, developments nearing completion, disposals, refinancings, deleveraging, and ongoing anxiety over office demand. Recovery of the unit price may be more likely in 2025.

Dream Office (D.UN)

I previously wrote in detail about D.

January 2024: “Will there ever be a better opportunity for a well capitalized long-term holder to acquire a portfolio of Toronto core real estate?”

March 2024: Dream Office core portfolio is at “the heart of the city at the heart of the national economy”. I commented on the redevelopment potential of several assets, and in particular 74 Victoria Street, where “The existing 1968 design is unattractive and its 10-storey height makes low use of the large plot”.

July 2024: Reviewed Dream’s resilience performance during challenging market conditions and analyzed the possible consequences of Artis (and joint actors) raising their ownership interest to 20.75%

A few recent developments:

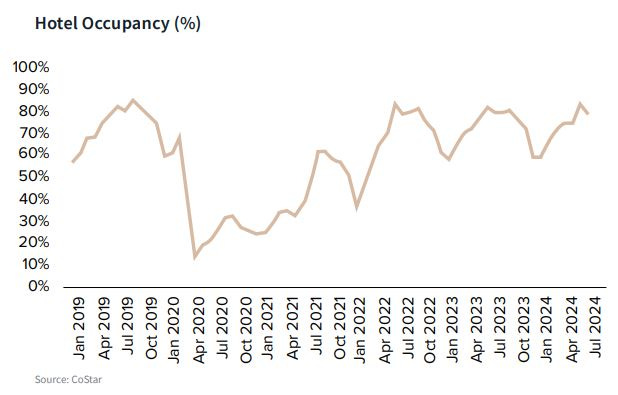

D’s 212 King West hotel deal fell through according to H&R CEO Tom Hofstedter: “as you all know in the downtown Toronto, there was supposedly going to be a deal for 212 King that never happened.” This was news to people who were relying on Dream’s own disclosures and 2Q24 conference call that never mentioned 212 King. Nevertheless, the property is at an extremely attractive location and the Toronto hotel market remains strong.

438 University sale status has not been updated. D CFO Jay Jiang explained: “The discussions we're having are an all-cash deal with no structuring. But it would be uncomfortable for our counterparty to provide any more detail.” The Globe & Mail recently reported that the Ontario government is evaluating purchase of downtown office buildings of 200-600ksf near transit and priced below $500psf. This sounds like an exact description of 438 University where Infrastructure Ontario is already the primary tenant. Purchase of the building at a cap rate of 6-7% using government financing at 3% would generate significant long-term public benefit relative to renting. Prior to acquisition it’s prudent for the government to conduct a transparent study documenting the savings and the fairness of the process (i.e. not inappropriately benefitting any building owner).

FIRST Tower Calgary VTB mortgage receivable with a balance of $45.1mm matured 7/10/24, but the property owners (Hines/Oaktree) probably exercised their option to extend maturity to 4/10/25. D sold the building to them in 2018 for $53.5mm. It’s at a good location right behind The Bow, but appears to be about 50% vacant. Hines managed a premium renovation of the public spaces in 2019-2020. It still seems viable. D will either receive $45mm in April, or get back the improved building at an attractive basis of $127/sf.

True North Commercial (TNT.UN)

Trust North has a differentiated position in the post-pandemic workplace environment with its BeeSG strategy:

Slate Office (SOT.UN)

Shite Office is apparently still in business even though CEO Brady Welch was reported to have written privately in July that the REIT was “at present in the zone of insolvency”. He still seems to be CEO, although he resigned from the board and his Shite Asset Management will cease to be the REIT’s external manager. SOT will now be in the hands of its largest shareholder George Armoyan. A twitter contact noted that he probably received at least US$100mm this month from sale of his 12% interest in the Ottawa Senators. SOT debentures over +400% from their low, outperforming the common units with lower risk.

Retail REITs

Several Canadian Retail real estate markets have the lowest availability in North America. As a consequence retail rents have risen and have a favorable multi-year outlook. Outside of Alberta, space under construction is falling as most potential new developments are part of mixed-use communities where economic returns are unfavorable due to rising construction costs and poor housing affordability (i.e. buyers or renters can’t pay enough to provide an attractive project return).

Investors have viewed the return potential from Retail REITs as substantially dependent on redevelopment and intensification, but in coming years they should also benefit from improved core operating earnings.

Modest long-term returns from Canadian retail REITs over the past 10 years reflect the challenges of ecommerce and tenant bankruptcies (especially Sears Canada and Target Canada).

Smartcentres (SRU.UN)

Smartcentres deserves attention due to its below average valuation despite better than average long-term returns. Since 12/31/22 Founder and Chairman Mitch Goldhar has purchased 736,200 units at prices from $21.60 to $24.25. The current valuation reflects investor wariness over the above average debt and high distribution payout ratio. On the 2Q24 conference call the company indicated a goal of $250-$300mm in proceeds from sale of development sites. Goldhar said one year ago there was no buyer interest, now there might be conditional interest at prices 50% below peak, but lower rates and anticipation of a condo market recovery could lead to transactions in 2025. SRU has the largest development portfolio of any REIT (86mm sf of projected density compared to existing 35.2mm of rental property) and would provide significant upside in a housing market recovery.

Multifamily REITs

Canadian Residential REIT returns have been muted as market rents in major cities (Toronto Montreal Vancouver) have been flat due to affordability limitations in spite of the widely recognized housing shortage. Alberta and smaller market rents have been rising, but these markets have less likelihood of long-term scarcity.

The challenge for the GTA market is that potential yield on new developments of 4.5% provides only a modest absolute return, a modest return when completed properties achieve stabilization and can be valued at a cap rate around 4.0%, and modest return over CMHC-backed mortgage financing (GOC +60-80bps). The potential for transactions and development brightened when GOC rates dipped under 3% in September, but now we’re back at 3.2%.

I intended to write a comparison of the Canadian residential REITs, but ended up covering the main points in my article about Melcor Developments because it seems to be the most interesting residential investment opportunity.

Canadian Apartment REIT’s 2Q24 conference call had the most informative market commentary. Points of interest:

CAR is selling older rent-regulated affordable housing properties to non-profit organizations

GTA condo deliveries will be at a record high in 2025, followed by a record low in 2026, and likely to be even lower in 2027

Rent-to-income ratios are “exceptionally low” at the top end of the market. And “incredibly high” for the lowest priced “affordable” units.

GTA deliveries are going from 40,000 to 7,000 in 12 months. With a five-year development cycle, four-year if zoning is in place, “you’re looking a perfect time to build now”. “The prospects for land value are actually quite good”.

CAR is offering upgrade options to rent-regulated residents. A new kitchen, or a new bathroom, or a move to a larger rent-regulated unit can result in a negotiated rent increase above the 2.5% limit.

Acquisitions of completed properties from merchant developers have been more attractive than investment in new construction.

Industrial REITs

The Canadian industrial market has weakened with availability at a multi-year high of 4.4%, but close to the longer-term average. In 2020-2022 it seemed too easy to develop property at a yield on cost of 7% that would be valued at a cap rate of 4%. New supply surged and now there’s a bullwhip effect as some users realize they secured more space than they need so they offer it for sublease.

Diversified REITs

REIT investors reward clarity, stability, and predictability. Diversification limits risk, but also makes a REIT harder to analyze and more likely to have at least one underperforming thing that becomes the primary focus of investor and analyst attention. Lower equity valuations mean a higher cost of capital that inhibits long-term growth potential. H&R should be able to deliver an attractive return by simplifying its complex business.

Artis REIT (AX.UN)

Investors have celebrated the absence of news from Artis about any “opportunistic” new investments. The REIT removed the apparent prior $6.50 price cap and its NCIB and has aggressively repurchased units at prices up to $8.05. Twitter poster @alphafortuna10 has been closely tracking the activity. This year Artis’ unit price has significantly outperformed the REITs where it reported large stakes (First Capital and Dream Office).

Artis will face significant capital allocation decisions in 2025 as it has a $200mm debenture maturity in April, Cominar has a $150mm debenture maturing in May, and the IRIS (Cominar buyout vehicle) junior preferred held by Artis is redeemable after 3/1/25. IRIS has over $600mm of other debt with unknown terms, but some may be maturing in 2025 since the original expectation at the time of the 2022 buyout was for a much faster pace of property sales and deleveraging.

Morguard REIT (MRT.UN)

I wrote in detail about MRT and its relationship with Morguard Corporation (MRC) in January. Belief that MRC was on the verge of privatizing MRT received two recent blows:

George Armoyan’s G2S2 sold $350k of MRT debentures on 10/7. Now that Armoyan is a director or MRC he would be restricted from trading if there were any active privatization effort. Then on 10/11 MRC itself bought 24,400 MRT units.

MRC spent approximately $100mm to buy a 20% stake in a Vancouver trophy office building. That leaves less financial capacity for a buyout of MRT.

MRT has many underutilized assets and locations. In January I concluded: “If you buy MRT units at their current discounted price then they are highly likely to be worth more in 5-10 years, but if you are anticipating a catalyst such as privatization to quickly unlock that value then you may be disappointed.”

Melcor REIT (MR.UN)

In March I wrote that it was unlikely that Melcor Developments (MRD) would privatize MR, but in September MRD offered to privatize MR anyway. Telsec, a large REIT unitholder opposes the deal which requires approval by a majority of the publicly held (non-MRD) units. It doesn’t sound like Telsec would be satisfied with a 25c price bump. It also doesn’t make sense for MRD to pay full value. Maybe I was right all along and there will be no privatization. If the deal breaks and MR drops back to $3 then it would be an attractive buy ahead of probable dividend resumption in 2025.

H&R REIT (HR.UN)

H&R signaled that it would be patient with asset sales while market conditions were weak and would only sell at attractive prices (“no sales or higher sales”) that it anticipated could emerge in 2H24 with lower interest rates. The 1Q24 conference call indicated hope to sell HR’s interest in the ECHO grocery-anchored retail business “within 12 months” (carrying value $471mm).

Investors are taking a similar “wait and see” approach regarding the REIT’s strategic transformation. The unit price has appreciated in 2024, but has not substantially narrowed the discount attributable to its diversified portfolio. If the discount persists after a successful portfolio realignment then in 3-5 years it seems inevitable that HR’s remaining Lantower residential business will be acquired.

Disclosures & Notes

At the time of publication the author held units of Dream Office, Primaris, Dream Residential, H&R, Smartcentres, and shares of Melcor Developments. This disclosure should not be interpreted as a recommendation to purchase any of these securities and these holdings could change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Very good article as always. A couple of my own points here about TNT: their properties are strategically located in my opinion and likely more easily sellable. Some of their smaller markets don't have the competition you speak of (flight to quality). Their largest Toronto buildings are either immediately next to public transportation or the main highways. They bought back around ~12% of all units and reduced debt in the past year by selling assets at above acquisition prices. The CEO has added millions worth as well which is not the case most elsewhere. Also they use higher cap rates, likely realistic and took big witedowns which Allied hasn't.

Find it interesting that Morguard Corporation is buying Morguard REIT in the past couple days, absent George Armoyan continuing to buy at higher levels, there seems to be a new level of support. I should probably add that. Love how the residential space is out of favor for some of the reasons mentioned and started to re-add some exposure there in addition to my very large position in DRM. Prefer to play Alberta thru DRM on a residential [land sales] development front rather then REITs for the reasons you mentioned. Boardwalk was a good trade for me a couple years ago, sold way too early.