Canadian REIT Valuations And 2024 Opportunities - December Update

Canadian REITs have delivered a +1.8% ytd total return (XRE to 12/6/24) and offer reasons for optimism:

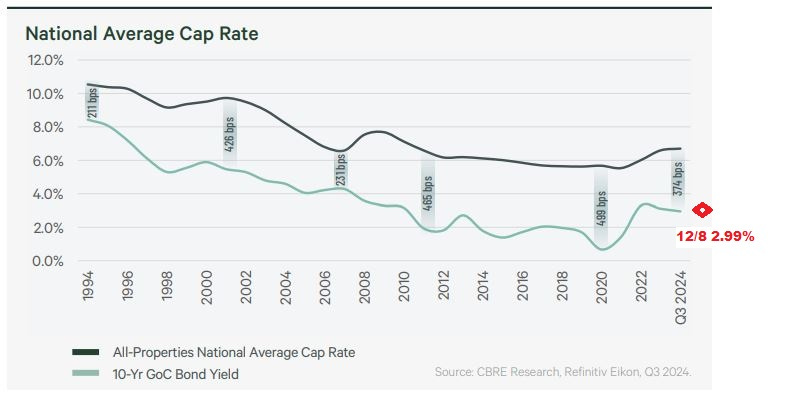

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall. In the past year there has been an impressive narrowing of REIT bond yield spreads. The first publication of Canadian REIT Valuations showed only 4 REITs with 3-4 year bond yields below 5% on 12/29/23. The table linked below shows that as of 12/6/24, 9 REITs had bond yields below 4%. This year’s modest REIT equity return does not fairly reflect the dramatic improvement in financing access and rates for quality issuers. REITs in good financial condition can earn >200bp return on their leverage and invest capital in property improvements and development.

Insiders at 23 of 35 REITs have been buyers in 2024 (to 12/8). 6 REITs had net insider sales. Buying dropped sharply after prices rose in July and has not yet picked up during the recent sector downturn.

Transaction volume is recovering and REITs that need to sell assets have an opportunity to do so. Private Buyers are available for smaller deal sizes (under $100mm). Institutions and public companies have been on the sidelines. The GTA multifamily residential land development market has had the most uncertainty.

H&R offers the best balance of potential return vs risk.

Dream Office could provide an excellent return in 1H25.

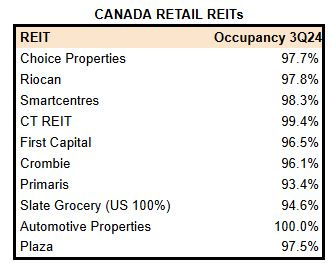

Retail properties have the best fundamental strength.

A comprehensive review of all REITs provides valuable context in identifying individual opportunities, especially among the diversified REITs. This article adds comments on companies at valuation extremes or with recent corporate news that has implications for the whole sector. None of these comments provide a complete profile or stock pitch and they are likely to only be of use to investors already familiar with the companies mentioned. The comp valuation sheet is getting unwieldy as a graphic insert, hopefully this pdf link works…

Topics:

Office Section with comments on Allied Properties, Dream Office, and Slate Office

Retail Section with comments on Choice Properties, First Capital, and Primaris

Multifamily Section with comments on Canadian Apartment, Minto Apartment, and Boardwalk.

Industrial Section with comments on Dream Industrial

Diversified Section with comments on H&R, Artis, Morguard, and Melcor

Immigration/Population

Canada announced immigration policy changes in October that are projected to result in a decline in the national population during 2025 and 2026, following record surges in 2022 and 2023.

REIT managers were digesting the news when asked about it on 3Q24 conference calls. They were unsure of the result, but tried to minimize concerns. Several noted that activity was already slowing prior to the announcement. Conference call excerpts edited slightly for clarity:

CAPREIT said lower rents would lead to a beneficial increase in turnover of rent-controlled units: “what we really take comfort in is we're in the lowest apartment churn period in the company's history and a moderation of rents will follow on with an acceleration of turnover as markets become more balanced.” “ … if our churn was to double, our market rents could fall by 50% and you'd end up in the same place.”

Interrent said the adverse economic impact of the immigration change might lead to policy reassessment and also mentioned upward pressure on operating costs: “It was a whipsaw with the increase in the targets and then a decrease. If all goes planned, the policy shift will result in negative population growth, a scenario that we haven't experienced since the population record started back in World War II. Will the government meet these ambitious targets? Can the targets be met on schedule? What happens if there's a change in government? Even what's impacting the labor market, the capacity to build housing supplies, right? So all of a sudden trades are decreased. And then there's also the whole potential unwinding of the 640,000 household formation that the PDO office talks about in their report. And that's essentially just a doubling up, tripling up, quadrupling up impact. So how that all impacts the overall rental demand is yet to be seen. I think we're going to all appreciate, we've never experienced as a country negative population growth. There's going to be a lot of industries impacted. And we really don't know if the government will remain committed to it. And we don't know what pace that this change will happen.” “But the big question now on the immigration side is going to be how this maybe impacts some of the workforce. When you think about maintenance, when you think about cleaning, when you think about some of those roles, you could see some impact, you could see some pressure on wages there. So I think I would probably be looking at 4% to 5% for 2025 versus 3% to 4% at this point given those.”

Minto emphasized the existing housing shortage: “In Canada today, we do not have enough housing to support the existing population, let alone to support new immigration. In addition, housing starts remain well below target levels since the development math simply doesn't work at this time. And even with the implementation of government programs to spur housing development, it is our belief that the housing shortage will persist for many years. Therefore, even if our population growth temporarily stalls, an acute housing shortage, combined with the relative affordability of renting will provide a constructive backdrop for our business over the long term”

Boardwalk emphasized that its affordable apartments in affordable markets would continue to benefit from strong local economies and migration within Canada : “In Alberta, our proportion of population that are temporary residents in Alberta is already at that 5% target that is being targeted nationally. I recognize that it's likely not going to be split on a regional basis. But this is another reason why Alberta going to have an advantage here where a proportion of temporary residents is already lower. On a student basis, I believe we're below allocation at a federal level for international students. On the interprovincial side, Alberta has been a winner on informational migration over the last couple of years because of that Alberta advantage that Samantha had in her prepared remarks. We've had the lowest taxes in the country. We've had affordable housing. We have job availability. All of those conditions still exist. And so we are optimistic that Alberta is going to continue to be a winner here on a relative basis.”

Morguard said tech companies in Mississauga had slowed recruiting even before the federal announcement: “over the last couple of years when immigration was very strong, we did have an influx of tenants. We were increasing rents about $50 to $100 every month. I think that's all kind of plateaued now and we're still holding rents and achieving high rent growth on turnover. the pace of occupancy is not as strong as it was prior. The immigration in the Mississauga area, it's the young professionals that are coming in. We had relationships with a few IT companies. And we were getting a handful of residents from these companies quite frequently over the last couple of years. And now that's all tapered off. We talk to their HR group often, and they're just afraid of bringing candidates in here and being rejected eventually. So some of their people are still in the U.S. or abroad.”

Riocan said it was unaffected : “I mean, the type of tenants that we are attracting, we're typically not going to be affected by those change in policies. I think it does cast a bit of a pall over the entire residential space or the multires space. But I think, again, the types of units that we were curating and the type of experience we were curating wasn't significantly geared towards the same people who would be impacted by that legislation.”

First Capital said retail rents were still catching up to improved fundamentals: “There's just been such tremendous population growth, no supply, inflations benefited tenants top line sales. We know that largely profit margins have been protected. So the rent paying capability is up, the value of the space there is up and the replacement cost of the space that they're in is up. So yes. And we're really well positioned. It'd be near impossible to recreate the quality of the portfolio that we've assembled, the neighborhoods that we're in. So we continue to feel that we're very well positioned, notwithstanding the government's change in immigration policy.”

Primaris also noted that retailer occupancy cost as a percentage of sales has fallen so there’s ample opportunity for rents to rise for several years, but also noted that sales have plateaued: “when you look through our business to basically the NOI production of our portfolio relative to the sales that our tenants are producing, our GROC ratio has dropped over the last few years to a 200 basis points below the normal. So we're in the 12% range. And we think in the fullness of time, we can get that back up to 14%, 15%. And so it really isn't a function of immigration. And when immigration was running hot, I think it was good for Canada and good for most businesses. But certainly, the multi-res businesses definitely benefited from that. Our business is a lot more lagged, and it takes time. So we're not really anticipating a lot of an impact in terms of NOI. But sales certainly, we've noticed sales are flattening out.”

US Exposure

The macro outlook for the US economy is highly uncertain. Animal spirits are high due to optimism for business friendly tax cuts and deregulation. Investors are complacent that immigration and trade policies will not be disruptive. The outcome of Trump’s threatened 25% tariff on imports from Canada could significantly affect the USD/CAD exchange rate. Canadian REITs with a high US exposure (will benefit from strength in the US economy and/or US dollar (shown by IFRS fair value):

Slate Office 23%

Slate Grocery 100%

Morguard Residential 63%

BSR 100%

Dream Residential 100%

Granite 52%

Dream Industrial 4%

H&R 68% (mostly residential)

Artis 56% (mostly suburban office)

Office REITs

Workplace occupancy policies are finally normalizing with major corporations recognizing that office environments can contribute to long-term employee productivity. JLL noted that companies are still reducing space at lease renewal, but that vacancy is heavily concentrated (in the US 7% of buildings account for 50% of vacant space). Again, this favors landlords with well-located attractive space, Allied and Dream better are better positioned than True North, Slate, and Morguard.

In additional to the structural changes in the post-pandemic environment, the Downtown Toronto office market has a cyclical challenge from the completion of pre-leased trophy towers (CIBC Square and TD Centre) that pulled tenants from older buildings and several speculative Class A buildings which have yet to attract any tenants (Portland Commons, T3 Bayside, T3 Sterling).

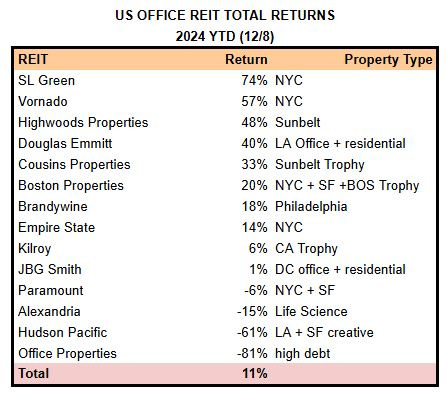

Canadian Office REIT prices have severely lagged US peers this year. Leading factors in the US have been trophy properties in Manhattan near transit centers. Lagging US factors have been LA/SF creative markets and DC non-creative due to slower return-to-office.

Allied Properties (AP.UN)

Allied expects to continue its current distribution rate for 2025 and has made good progress on non-core asset sales. The REIT’s tech and creative tenant base has been a source of weakness in US Markets (e.g. KRC and HPP). Demand could be affected by a reduced labor pool of immigrant professionals. Allied’s Toronto Downtown West locations have weaker mass transit access than Dream’s Downtown Core buildings.

Dream Office (D.UN)

Dream is best positioned among the Canadian office REITs for the factors leading the sector recovery: distinctive properties in central locations with excellent transit access and a FIRE tenant base. Two weeks ago news emerged that Ernst & Young had signed the largest office lease in Toronto this year, adding 50,000sf at 100 Adelaide Street West - it’s not a Dream building, but it’s right in the middle of Dream’s property footprint and demonstrates the appeal of the immediate neighborhood for professional services tenants. I recently visited Dream’s Bay Street Collection properties and commented on its business.

Artis REIT has not made any meaningful comment about its plans for the 20.75% stake in acquired (with partners) in Dream Office. The normal course purchase exemption permits acquisition of up to 5% of a public issuer in a rolling 12 month period without a requirement to make a tender offer. Artis has not bought any Dream units since reaching the 5% limit in June 2024, but will be able to resume purchases in March 2025, and by June 2025 the Artis group could add up to 947k units which would be 10% of the float (ex Dream Unlimited and Artis). Dream Office still has relatively high short interest of 1.0mm units (11% of the float). By June Artis could hold 25.75% (nearly as much as Dream Unlimited at 31.3%) and could push for a sale, could seek to acquire all of Dream Office, or could push for a combination of Dream Office with Cominar (the Montreal-based REIT privatized by Artis with partners in 2022). It’s unlikely that Artis plans to simply hold its Dream units as a passive long-term minority investment.

If Dream delivers favorable news on leasing and deleveraging (as I expect), Artis buys (as I expect), and shorts cover their losing positions, then Dream Office could be a top performer in 1H25. A $30 unit price would still be an equity implied cap rate of 7.7%. A privatization could be feasible at $39 where the equity implied cap rate would be 7.0%. However, D has high leverage so disappointing leasing or failure to sell any asset could result in unit price weakness, and Artis might do nothing and say nothing.

Slate Office (SOT.UN)

Shite Office is out of money and out of time. At 9/30/24 the REIT was in default on $859mm of debt. The 3Q24 MD&A included a Going Concern Warning and described a Recapitalization plan that could restructure existing debt, convert existing debentures into equity, and issue new equity. They probably need to agree on a deal and get an initial cash infusion by year-end.

Retail REITs

After surviving a decade of retailer bankruptcies and ecommerce competition, retail real estate is thriving. Shopping centers and malls are nearly fully occupied, giving landlords the power to upgrade their tenant base and renew leases on improved terms (higher starting rent and higher annual escalators). Despite strong demand, almost no new retail centres are under construction due to the difficulty of finding large vacant sites with good transportation access and a substantial nearby population. The Retail REIT investment thesis in recent years has been the redevelopment potential of underutilized property, however that should shift to strong fundamentals of the core business.

While greenfield development is minimal, REITs are achieving strong returns from small intensification projects at existing centres.

Choice Properties (CHP.UN)

Choice explained: “ I would say that we've been adding acreage retail for many, many quarters in addition to, call it, the anchor we see ourselves continue to do that. Our big competitive advantage is that we work closely with Loblaw and try and help them with their store growth plans. And right now, we're working on 26 potential locations with Loblaw. Some of those would be new ground of developments but most of those would be at-grade retail where we're adding a shoppers drug mart and even some instances actually a new grocery store to an unanchored grocery center.”

The 3Q24 MD&A showed an average stabilized yield of 7.4% from these completed development projects (note the small average size)

And an expected yield of 6.25-6.75% from projects under development (again note the small average size of these additions to existing centres)

First Capital (FCR.UN)

First Capital commented on the extremely favorable leasing conditions: “we have been successful in negotiating contractual rent steps beyond the first year and throughout the renewal term. Historically, those rent steps typically averaged between 1% to 1.5% per annum. Year-to-date in 2024, those growth rates have more or less doubled.” “our lease renewals are super clean. We typically have absolutely no deal costs, no free rent, no tenant inducement, no leasing commissions. So in almost every case, it's a pure rent negotiation with no deal cost whatsoever.”

Primaris (PMZ.UN)

I almost never listen to podcasts, but this Commercial Real Estate Podcast interview with Primaris REIT CEO Alex Avery was exceptionally good. He mentioned that it would cost $1000/sf to build a new mall in Canada ($200 for land and $800 for construction) while Primaris is being valued in the market at only $240/sf. Retailer rents would have to rise 3X to justify construction.

Multifamily REITs

Multifamily REITs talk about the “housing shortage” the way gold miners talk about a rising gold price - it’s an article of faith for investment in the sector. Investors are likely to be cautious about this group for at least several quarters until the impact of the immigration change becomes apparent. Even before this change rents have been dropping - Rentals.ca shows national average 2BR rent -0.8% yoy with Toronto -9.7%, Vancouver -9.2%, and even Calgary -7.0%. The “housing shortage” thesis is undercut by widespread leasing incentives - Apartments.com shows 1-2 months free rent is common in Toronto. These negative signals may worsen over the next two years as supply is boosted by a surge of condo completions. Weak demand makes it very difficult to model potential returns from multi-year development projects.

Canadian Apartment REIT (CAR.UN)

CAPREIT is hopeful that increased household formation will offset some the decline in immigrant demand. Lower prices may attract tenants who have been living with roommates or family: “I think that there is such a backup of people that are co-living, whether they be at home or whether they be in our apartments, we have seen a rapid, rapid increase in the number of people that are roommating just to make ends meet, whether it be in homeownership or whether it be in the rental market. So I'll say the core legacy part of the portfolio remains strong. There's high, high demand and a huge runway. I think CAPREIT of all the apartment REITs has the longest runway for mark-to-market rents. I feel good about that. And the type of new construction product that we're buying generally is serving the mid-market, which I think will again remain strong. And with those rents being slightly higher, I think, again, the mid-market reality of less homes to buy and less options of places to live, we may see an easing in co-living, but will remain strong demand in that segment.” “But when you see these moderation of mark-to-market rents, you'll typically see additional churn. And I think the CAPREIT will definitely benefit from this. Our single biggest hurdle amongst even our peers has been our low turnover rate because of our ideal locations.”

Minto Apartments (MI.UN)

Minto said its buildings are not as weak as media reports indicate: “We think we have a strong portfolio, notwithstanding some of the weakness we're seeing in the Toronto market, in particular, you got rentals.ca, which everyone is latching on to saying rents in Toronto are going down 8%, 9% year-over-year. Our portfolio is down 0.7%. So we don't have the same portfolio composition as the rentals.ca information.”

Boardwalk Real Estate (BEI.UN)

Boardwalk suggested there is a problem of housing affordability rather than availability and advocated income support from government rather than development incentives: “If you can forward $3,000, $4,000 a month, there is no housing shortage for you. Where there is a housing shortage, however, is in the affordable space.” “with respect to the supply of more than enough, more expensive housing, one of our public policies, which works instantly is rent supports. Instantly a Canadian with a smaller, more limited budget can access more expensive housing and reduce that barrier to housing instantly. That targets Canadians that need help now. So that would be a phenomenal best case example, public policy to help Canadians that need more affordable housing today, rent supports. And our builders are really quick to adjust. We're already seeing having discussions on how difficult it is to make the numbers work. With the higher cost, higher interest rates, higher underwriting requirements, it's getting really, really tough. And we're beginning to hear why and how can we build any more housing. There is more than enough of it at the higher end. We're seeing incentives in new delivered higher price rentals in Calgary, in particular. So why build more expensive new rental housing?”

Industrial REITs

The Canadian industrial market has weakened with availability at a multi-year high of 4.4%, but close to the longer-term average. In 2020-2022 it seemed too easy to develop property at a yield on cost of 7% that would be valued at a cap rate of 4%. New supply surged and now there’s a bullwhip effect as some users realize they secured more space than they need so they offer it for sublease.

Dream Industrial (DIR.UN)

Dream Industrial’s recent Investor Day (presentation link) revealed extensive preparation for data centre development on up to 30 existing DIR properties with potential 11% returns on related capex. I’m surprised these plans have not received more attention.

Despite the surge of industrial property supply from speculative developments, DIR continues to sign long-term leases with substantial annual rent bumps: “So this quarter on our Ontario leasing which is about 400,000 square feet. We signed 3.9% escalators. In Quebec, escalators were around 3.3%. And in Western Canada 2.5%. And last quarter, for example, we had 4%, 2.7% and 2.8%, so very consistent levels in terms of rental steps that we're achieving.” These contracted increases provide stable long-term growth attractive to investors.

I would comment enthusiastically about DIR’s equity valuation and growth initiatives, however insiders have only sold units over the past year. The block of redeemable units held by Dream Office are a potential overhang (D sold DIR units in 2023 through a public offering at $14.20). DIR continues to invest accretively through its Summit JV and GTA Industrial JV, but does not have an NCIB. I would like to see DIR reinvest in the existing business through unit repurchase, as Granite has been doing.

Diversified REITs

REIT investors reward clarity, stability, and predictability. Diversification limits risk, but also makes a REIT harder to analyze and more likely to have at least one underperforming thing that becomes the primary focus of investor and analyst attention. Lower equity valuations mean a higher cost of capital that inhibits long-term growth potential. H&R should be able to deliver an attractive return by simplifying its complex business.

H&R REIT (HR.UN)

H&R’s core Lantower Residential business continues to perform well and provides a solid foundation of earnings, cash flow, and growth while the REIT executes its multi-year plan to divest from other assets. The complexity of that process may overwhelm investors:

Toronto downtown redevelopment is “wait and see”. CEO Tom Hofstedter said: “anything is better than Toronto”. HR has revised the planning proposals for its 4 prime downtown sites to eliminate the prior mixed-use office space and shift to entirely residential. The properties are carried at a reduced value of $140 per buildable square foot, less than half the market value of a few years ago. Hofstedter still intends to sell, but cautioned that development could be as much as 10 years away.

ECHO retail JV sale prospects have been improved by the Couche-Tard acquisition of Get-Go convenience stores, many located at ECHO properties. HR explained: “The Couche-Tard is a game changer. Not only do we get the covenants on the GetGos. We also -- Giant Eagle disposes of an asset class within their portfolio that was not a lag in earnings but was hurting their ability to sell Giant Eagle as a company because the supermarket chains don't want to take on environmental responsibility nor do they want to get into the gas business, oil and gas business. So it now cleans up Giant Eagle. It pays off all the debt of Giant Eagle. Giant Eagle becomes debt-free. Our covenant then becomes a very high investment-grade tenant, although it has no debt. That's a shadow rating. And Couche-Tard now goes to -- will trade like a Wawa in the market, probably 5-ish cap as opposed to probably 6.5%, which it was under the GetGo banner. So it improves all of the metrics. It improves the ability for Giant Eagle to be sold. And therefore, the attractiveness of ECHO is a lot better. Our value of our assets is a lot better because the covenants of our tenants is better. And as I said previously, I do expect something to occur by the end of -- no later than the end of next year.” H&R carried its ECHO stake at a 9/30/24 value of $469mm, but that does not seem to reflect the positive factors just described and the sale should realize over $500mm in net proceeds.

Gowanus land parcel should sell in 2025: “There's a lot of institutional and large big money managers looking for sites that can build 1,000 units in prime locations. So Gowanus, our plan is to sell it probably in 2025. We're just waiting for some not zoning issues but more environmental issues to finish off over there. That will be in high demand and will sell for a significant dollar amount. There won't be any issue with that at all.”

The Cove is a huge waterfront development in Jersey City that may launch in 2025: “Jersey is a very strong residential market, there is some development but Jersey is going to have to wait a little bit for purchase rates to come down. It's a large project. We haven't made a decision to pull the trigger on the first phase of Jersey, which will be finished as far as planning goes within around 4 or 5 months. At that point in time, we'll decide how we want to launch it”

2 Gotham office tower in Long Island City can be sold following lease renewal and H&R expects New York market strength: “The New York office market is getting stronger. There is 30% of the office product that will be in New York to residential, and that will happen sooner rather than later. expect the United States market to pick up dramatically. 2 Gotham, it's not going to affect it's salability, it's a tenant that's using -- in the building completely. It's a perfect location for them. I think we'll have to wait for visibility as to -- our plan would be to wait and have patience as the market recovers. We expect the tenant to stay there. It's just a question of what the rental rate would be. So we're in no hurry to dispose 2 Gotham. We'll wait and see on that market.” Note that the tenant is NYC department of Health and Mental Hygiene and government agencies are solid tenants, but they don’t pay top rents.

Hess Tower in Houston can’t be sold while the outlook for Chevron’s acquisition of Hess will not be resolved until 2H25. Hess has 2/3 of the building leased until 2036. Chevron is moving its HQ from California to Houston, but has not disclosed its intentions for the Hess Tower space. HR explained: “We just don't know the final outcome. Until you know the final outcome, you can't rally sell the asset, because every buyer is going to be asking the same question as you did, where is Hess going to be located? It has a strong impact on the long-term value of the asset.”

REIT investors dislike complexity. H&R is working on all of the above issues, and more, and as they get resolved one by one the story should simplify and give confidence for the equity to appreciate. The market is valuing H&R at an 8.2% cap rate while Lantower would be valued at about 6% as a public REIT (based on US peers) or 5% in a private sale.

Artis REIT (AX.UN)

Artis has freed a lot of capital through divestitures, but investors who imagined that it was destined for privatization or quiet liquidation were disappointed by CEO Manji’s excitement over potential new investments, possibly financed with equity issuance: “we have a lot of flexibility, whether we want to acquire directly a property or group of properties, whether we want to acquire an interest in a property or a group of properties in the form of a joint venture that Artis would then be the managing partner in, those are a couple of options as it relates to hard assets. We continue to look at the broader public securities environment. And again, from a value perspective, identifying opportunities that we think could provide on a risk-adjusted basis, better returns on our capital for our unitholders. And then we continue to have existing investments that we're continuing to manage and assess as we keep going. And the outlook, again, there's a lot of optionality. Whether there could also be M&A in the future, could be an interesting area as Artis' unit price continues to strengthen. And looking at sort of the universe of other players in the market that may not have that same benefit and to see if there are scenarios out there where 1 plus 1 equals 3. And that, again, on a risk-adjusted basis, we'd be comfortable with. I think it's a full gamut, Jonathan, in terms of the spectrum of opportunities and areas where we're going to consider growth, and we're going to do it in a very thoughtful, strategic and diligent manner.

If you invest in Artis then you don’t own the current asset profile and financial risk; you own whatever Manji is going to do next, and he is going to tell you absolutely nothing meaningful about what that will be.

Morguard REIT (MRT.UN)

Morguard REIT continues turtling along. My January profile described many attractive opportunities in the REIT’s portfolio, but the ability to realize that potential is hampered by weak cash flow which limits capacity to invest in property improvements. MRT cautioned that 2025 NOI would be reduced by $13-15mm due to rent reductions and incentives at Penn West Plaza in Calgary. Operating cash flow was only $34mm in 2024 and did not cover distributions of $10mm plus capex of $30mm. The REIT’s tight financial condition could even require suspension of the distribution.

The unresolved status of the provincial government lease at the 315,000sf Petroleum Plaza complex in Edmonton is concerning. The lease has been on overhold (paying month-to-month) since December 2020. It’s a great location for the government at the center of the city’s government district, but if the government leaves then Morguard is screwed. An ideal win-win outcome would be for the government to take advantage of its low borrowing cost to acquire the property from Morguard.

Colliers reported that the Association of Professional Engineers and Geoscientists of Alberta (APEGA) will be vacating 50,000sf at MRT’s 20% owned Rice Howard Place. MRT does not have enough capital to compete in a tough leasing market.

Morguard Corporation (MRC) has been acquiring units of Morguard REIT since September. Curiously MRC and new MRC Director George Armoyan (who owns 13% of MRT) have not been acquiring MRT units at the same time. My guess is that there is a mutual respect and alignment of interests between Armoyan and Morguard CEO Rai Sahi. I do not see Armoyan as playing the role of activist at Morguard, however he might be able to encourage Morguard to be more active in management of its property portfolio and equity securities. That could increase the possibility of a Morguard REIT privatization, however as a large investor in MRC Armoyan would benefit from minimizing the privatization price. As shown at Melcor REIT, when there is only one possible buyer, an offer comes at the lowest possible price and at the lowest point in the business cycle. I would not invest in Morguard REIT on the basis of privatization as a catalyst, however Morguard Corp may become more interesting and I will try to write a detailed profile at some point in 1H25.

Melcor REIT (MR.UN)

Melcor Development raised the price of its privatization offer to $5.50/unit with a new 90-day go-shop period that will expire 2/24/25. Bagholders Telsec and FC Private Equity continue to demand $6.94/unit, however if they want to access non-public data and possibly submit a counterbid then they will have to sign an NDA and make no further public comments. If FC/Telsec truly believe in their valuation then they should vote no, but hope the merger goes through so that they can realize “fair value” through dissent rights.

I think a competing bid is unlikely because a buyer would have to pay the $5.8mm termination fee, pay to terminate the Melcor management contract, and then figure out what to do with the properties.

If FC/Telsec vote against the privatization then it is very unlikely that it will pass. The agreement has a “majority of the minority” provision and FC/Telsec hold 28.7% of the public units.

Disclosures & Notes

At the time of publication the author held units of Dream Office, Primaris, Dream Residential, Dream Unlimited, H&R, Smartcentres, and shares of Melcor Developments. This disclosure should not be interpreted as a recommendation to purchase any of these securities. These holdings vary greatly in size and could change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Comments are welcome on Substack

And Bluesky https://bsky.app/profile/konekoresearch.bsky.social

Great article. I'm all in on the Space: Nexus, H&R, Dream Office, Dream Residential, Dream Unlimited, Northview Residential, Artis to name a few. Small positions in MPCT & MRT for now but I think both of those names might move a lot when they do bust loose. Want to start buying back into Plaza which I discarded given elevated yield and falling payout ratio. Really the space is overly compelling right now. Gotta do something about IIP too... 5.7% implied cap rate is pretty crazy given recent evidence of sales in the lowest of 4s on old buildings.

Hi Koneko - noticed a possible error in the "Canadian REITs Comparison" chart. Slate Grocery is listed as having a 25% discount to NAV but a 9% premium to EV. I don't think it's possible to have both a NAV discount and EV premium, and my calculations seem to imply a 12% discount to EV based on the $14.65 unit price in the chart.