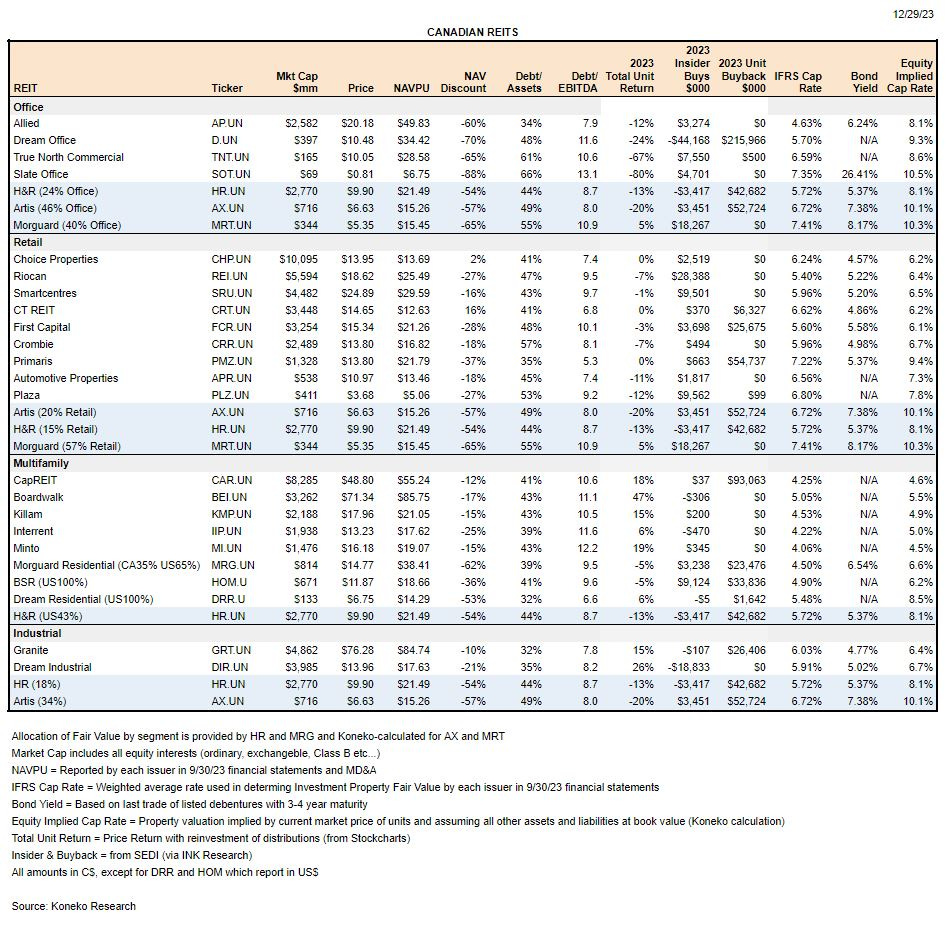

Canadian REIT Valuations And 2024 Opportunities

Canadian REITs are poised to deliver attractive 2024 returns after a -2.6% index price decline in 2023:

Long-term interest rates have fallen sharply with the GOC 10-year yield on 12/28/23 at 3.11% (-115bp from recent peak) and real yield at 1.39% (-83bp from recent peak). Property yield spreads are now comfortably within the range of the past 30 years.

Financing has remained available - even the weakest REIT has been able to extend expiring mortgages

Insiders and Issuers were significant buyers during 2023

H&R and Primaris offer the best balance of potential return vs risk.

Commentary will focus on three perspectives on each REIT’s valuation:

IFRS cap rate shows the real estate market and management perception of asset value. REITS record their investment property assets at “fair value” which can be calculated using several accepted methods (see endnote for additional explanation). Volatile interest rates and an illiquid transaction market made REIT investors skeptical of these valuations in 2023, however they still provide a helpful starting point for understanding portfolio composition, management perspective on valuation, and comparison against data from service providers like CBRE (link to 3Q23 Canada Cap Rate report).

Bond Yield shows the credit market perception of issuer risk. Yields above IFRS cap rates show the business is under stress (cost of capital is higher than return on capital), equity valuation should be discounted, and the REIT should deleverage. Note that liquidity in most of these bonds is limited.

Equity Implied Cap Rate shows the property valuation implied by the current market price of common units, assuming all liabilities and all assets aside from Investment Properties are worth their carrying value. A large NAVPU discount might not truly be a bargain if much of a REIT’s Enterprise Value is represented by debt. Conversely, a large NAV discount at a REIT with low leverage may be an extremely attractive opportunity. Implied cap rate looks through the varying capital structures and leverage levels to see the underlying property valuation at each REIT.

Office & Diversified REITs

Office market challenges are extremely well-known. It’s taking time for tenants to determine their long-term occupancy needs as hybrid work arrangements become permanent. REIT equity prices amply discount the risks, but its hard to forecast when fundamental office demand will improve. Individual REIT bargains are available where they own exceptional assets, have significant non-office development potential, or own significant assets in better-performing sectors.

Allied Properties (AP.UN)

Allied Properties has generated the best long-term return through a disciplined focus on top markets (Toronto, Montreal, Vancouver, Calgary), creative spaces for knowledge-based tenants (TAMI - Tech Advertising Media Information), and conservative leverage. Allied’s initial strategy from 2004-2010 was to buy low-rise heritage buildings at cap rates around 10%. Since then rents doubled, cap rates halved, and potential site density went 3X. The REIT has suffered over the past year from weak demand among its tech clients - Shopify signed a 15 year anchor lease at Allied’s high profile The Well development in Toronto and has now offered its entire space for sublease. The REIT strengthened its financial position during 2023 through the highly profitable sale of the its 3 Toronto data centers.

Allied’s 4.63% IFRS cap rate looks optimistic even considering the high quality and prime locations of its assets. CBRE estimated 3Q23 market cap rates of 5.25-6.50% for Toronto Class AA/A Offices and 6.00-6.75% for Montreal Class AA/A. Allied’s implied rate of 8.2% provides a very generous return for excellent assets, management, and a relatively conservative balance sheet. AP traded at a premium to NAV for many years due to the accretion it generated through acquisition, repositioning, and redevelopment. The current low valuation reflects fear that tech tenant demand has suffered a permanent change rather than just a cyclical downturn. Kilroy Realty has been similarly impacted with its concentration of TAMI tenants in the Bay Area. Successful placement of the 348ksf Shopify space in 2024 could boost investor confidence in AP’s recovery. Allied has potential to nearly double the long-term density at its existing properties, however much of that increase was intended to be office space for which there is no forseeable demand. If AP is no longer able to finance growth through accretive equity issuance and build new offices then its business model will need to evolve. Seven different Allied insiders have made open market unit purchases in recent months.

Dream Office (D.UN)

Dream Office has been rationalizing its portfolio since 2016 leaving it highly concentrated in Toronto’s financial core. Over the past few years D invested in upgrades of amenities and public spaces of its heritage buildings to create a boutique office environment appealing to small-mid financial and professional services firms, the strongest part of the current market. Leasing during 2023 of the entire building at 366 Bay Street validates the strategy, but investors noted that capex and tenant incentives have left D with negative current cash flow. Dream has relatively high leverage and raised liquidity during 2023 through sale of 720 Bay Street and a portion of its equity interest in Dream Industrial. D may be nearing the sale of its hotel+residential redevelopment project at 212 King Street (H&R’s 3Q23 conference call commentary on the market environment mentioned there were 3-4 bidders).

Dream’s 5.7% cap rate in its financial statements looks realistic (combining 5.34% for Toronto downtown and 7.73% for other). CBRE gave a range of 5.25-6.50% for Toronto Class AA/A, H&R recently sold a property at 5.7%, and 720 Bay Street sold at 5.3%. It might be prudent for D to cut its distribution ($1/unit annualized), however D’s largest shareholder (Dream Unlimited) may want to continue receiving the capital for deployment elsewhere in its portfolio. D’s concentrated Toronto core assets make it an appealing potential acquisition for a very long-term investor such as a pension, sovereign fund, or family office. A deal might be structured whereby DRM retains an equity interest (maybe 10%) and manages the assets (similar to the GTA Industrial Development partnership and the Summit Industrial partnership). DRM owns 33% of D after selling 7% of the shares into the Substantial Issuer Bid at $15.50 last June. I believe that DRM would seriously consider a D privatization offer at a price above $20/unit. Dream’s Investor Day presentation suggested that extended office market stress (lower renewals, high capex and incentives, and neutral rents) could result in a 2028 NAV of $24/unit. Two years ago Zara founder Amancio Ortega paid C$1.2Bn for Royal Bank Plaza (about C$800/sf). A buyer of D at $20/unit could acquire its entire portfolio at an EV of about $350/sf and a cap rate of 7.4%. Will there ever be a better opportunity for a well capitalized long-term holder to acquire a portfolio of Toronto core real estate?

H&R is into the third year of its Strategic Repositioning Plan which will transform its diversified portfolio to 85% Residential and 15% Industrial. The REIT met its disposition target for 2023, but delayed residential development plans due to the unfavorable market environment. H&R’s financial strength gives it flexibility in adjusting the pace of divestitures and new investments.

H&R’s blended cap rate of 5.72% seems reasonable for its mixed asset base. The REIT recently sold a Toronto office for 5.7%. The yield on its public debt fairly reflects the strength of its properties and balance sheet. The yield also means that H&R can earn a positive return on its leverage and corporate actions are not constrained by debt pressure. The 8.1% implied cap rate of H&R’s units is in line with high quality Office REITs even though Office only accounts for 24% of its IFRS fair value. The valuation is a bargain compared to every other sector where H&R owns property, including US Residential which will be H&R’s primary long-term focus and where US-listed REITs traded at an average implied cap rate of 6.3% at year-end. Lower interest rates and absorption of the 2024 Sunbelt apartment supply bulge could set up H&R to move forward in 2024 with its pipeline of multifamily projects (the REIT suggested that 2025 Sunbelt market rents could be +10% after a flat 2024) and also provide an opportunity to monetize some the development potential at its downtown Toronto properties. Note that 2023 insider sales were all in 1Q23 by former Trustee Ronald Rutman who was replaced in March.

Artis (AX.UN)

Artis is at the end of its failed 3-year Business Transformation Plan and is now considering Strategic Alternatives. CEO Samir Manji needs to salvage some sort of positive outcome for his Sandpiper Asset Management which owns 17% of the REIT. Unfortunately there’s no obvious strategic buyer for Artis’ diversified non-prime assets. The REIT is also burdened by its poorly timed 2022 investment in the highly leveraged privatization of Cominar (currently carried at a valuation of $209mm). Artis says Cominar is seeking to reduce its cost of capital which implies a recapitalization that would be dilutive to Artis existing holding. Excluding the high risk Cominar position, Artis would have an implied cap rate of 9.2% and NAVPU would drop to $13.24. The most likely outcome of the Strategic Review is a continued orderly liquidation that would deliver $12-13 per unit over 2-3 years. The recent Central Bank policy pivots should stabilize real estate asset values and give buyers more confidence to execute transactions. Over half of Artis 9/30 NAV was in Industrial and Retail properties where sales should be achievable. Where might things go wrong for AX holders:

AX might opt to continue with its current plan to build a best-in-class real estate asset management company. Even if Artis were to achieve some success, it’s not evident there is public equity investor interest in the strategy so the REIT (which might not remain a REIT) would probably continue to trade at a discounted valuation.

AX might sell a financial buyer who could offer a discounted price (e.g $8-9/unit) and then realize the full proceeds of an orderly liquidation for itself. I don’t believe Sandpiper has the capital to privatize Artis on its own, but it might be able to assemble a consortium.

AX might continue selling assets but invest the proceeds in a new business plan rather than returning funds to shareholders. Acquisition of the 68% of Cominar held by the buyout consortium partners is a possibility.

AX has high exposure to the Office market in Winnipeg (8 buildings) where the REIT recently disclosed that its Net Effective Rents on new leases are beginning in the “low single digits”. CBRE estimated 3Q23 cap rates for Winnipeg Class A office at 6.75-7.75% and Class B at 7.25-8.25%. The spreadsheet valuation of Artis’ properties looks OK, but is there a real money buyer for 8 Offices in Winnipeg?

AX has high exposure to the Office market in Madison Wisconsin (15 buildings) which has been relatively strong with Cushman & Wakefield reporting 3Q23 vacancy of 10.6% and positive ytd absorption for Class A property. The risk in selling these assets could be that there may be few/no buyers in the current market. National Association of Realtors estimated 3Q23 office cap rates in Madison were 10.6% . Artis may have to wait for an extended time for demand to recover or accept significant price impairments.

Morguard REIT (MRT.UN)

Morguard REIT has struggled for a decade due to Retail exposure (ecommerce impact and bankruptcies of the Canadian operations of Sears and Target), Western Canada exposure (extended slump following the energy sector crash from 2014), Office exposure (COVID and remote work), and low dynamism of the Morguard Group. I will post a separate detailed profile of the REIT in January.

MRT’s IFRS cap rate of 7.41% seems reasonable for its diverse portfolio. The Retail properties are performing well and include Malls (CBRE estimates 3Q23 national average cap rate 6.25%), Power Centres (CBRE 6.86%) and Neighbourhood Centres (CBRE 6.75%). Only a few MRT Offices face significant challenges (weak properties in weak markets). MRT has a lot of hidden potential at properties it has held for many years. Unfortunately the REIT has high debt and weak cash flow so it’s not well-positioned to take advantage of its redevelopment opportunities. Value investor George Armoyan accumulated a 10% stake in 2023 and a corporate transaction is possible, however the controlling 65% interest held by Morguard Corporation and its high cost of capital (2023 debt financing at 9.5%) makes a near-term transaction unlikely. Armoyan has also been buying MRC so my guess is that he has invested in both for their long-term value rather than in expectation of an MRT privatization.

BREAKING 1/8: Morguard Corporation just announced the sale of its hotel portfolio for net proceeds of $361mm. This makes a privatization of Morguard REIT more feasible, but not a sure thing because MRC has many other potential uses for the capital (e.g. redevelopment of “The Doomed Centerpoint Mall”).

True North Commercial (TNT.UN) and Slate Office (SOT.UN)

True North and Slate appear cheap on an NAV basis, but their high debt levels mean their equity implied cap rates do not provide a large margin over IFRS cap rates which are higher than peers due to weaker asset quality. Both have poor-performing third party managers who remain in place.

Retail REITs

Retail real estate performed well-through COVID. Excess capacity resulting from retailer bankruptcies and ecommerce impacts was largely resolved in 2015-2019. COVID demonstrated the resilience of consumer demand for essential services shopping (grocery and pharmacy) and omnichannel became the dominant retail model for maximization of customer convenience, brand awareness, and efficient distribution. Financing remains available for Retail property owners and REITs have been able to dispose of non-core Retail assets.

Choice Properties (CHP.UN) CT Real Estate (CRT.UN) Crombie REIT (CRR.UN)

Choice (Loblaw), CT (Canadian Tire), and Crombie (Empire/Sobeys) are captive REITs with a dominant shareholder/tenant. These relationships ensure stable business and access to financing so the REITs generally trade at a fair valuation. I can’t add any new information or perspective.

First Capital (FCR.UN) Riocan (REI.UN) Smartcentres (SRU.UN)

First Capital, Riocan, and Smartcentres have active programs to build value through mixed-use redevelopment of their existing Retail properties. FCR and REI have very attractive locations. These strategies have been well-executed and are also well-understood by investors and I can’t add any new information or perspective.

Primaris (PMZ.UN)

Primaris stands out from FCR REI and SRU with its focus on growing its core mall operations and conservative financial profile. PMZ owns Regional Malls that dominate their primary trade area, are anchored by value-oriented retailers (CT Tire, Walmart, Loblaws, TJX), and provide attractive occupancy costs for tenants. PMZ does not own Super-Regional Malls that are dependent on luxury sales, tourism, CBD office workers, and have higher tenant costs. Primaris sees an opportunity for accretive growth through mall acquisitions due to favorable pricing (minimal buyer competition) and operating improvements (expense efficiency and major tenant relationships). In the past year PMZ acquired two malls using a combination of cash, preferred and common equity. I presume that some sellers are willing to accept PMZ’s discounted equity because they have confidence in PMZ’s long-term outlook and over a long holding period the growth in value that PMZ could generate is more important than the market price discount at a point in time.

PMZ’s IFRS cap rate of 7.22% appears conservative compared to CBRE’s estimate of a national average Regional Mall cap rate of 6.25%. The yield on its public debt signals confidence in the quality of its assets and financial profile. In contrast, the implied yield on the common equity shows distressed pricing for a business which is performing strongly (growth in occupancy, rent, SPNOI, and FFO/unit). Markets suggest the company should take on additional leverage to purchase more property (it earns a positive return over cost of debt) and repurchase more equity. For the time being PMZ believes that its conservative balance sheet provides access to superior accretive transaction opportunities.

Residential REITs

Canadian Residential REITs performed well in 2023 led by Boardwalk with its high Alberta exposure. REITs with US assets underperformed due to a supply surge in Sunbelt markets.

The investment thesis for the Canadian multifamily owners is well-understood and I can’t add any new information or perspective. Note that they have access to a variety of favorable CMHC financing programs with terms more attractive than would be available through public debt issuance.

Dream Residential (DRR.U)

Dream Residential came public in Spring 2022 near the peak in US apartment rent growth. Despite the subsequent market slowdown DRR has met all of its projections from its conservative portfolio of affordable apartments in Cincinnati, Oklahoma City, and Dallas. DRR has delivered internal growth by allocating free cash flow to unit upgrades. The REIT is below its target leverage but demonstrated patience through 2022-2023 by avoiding acquisitions. On the 3Q23 conference call, DRR said it was looking at opportunities to invest in good assets at discounted prices from distressed sponsors, possibly in partnership with third-party capital.

DRR’s IFRS cap rate of 5.40% might have been low when mortgage rates were peaking in September. The National Association of Realtors estimated 3Q23 multifamily cap rates for Cincinnati (7.4%), Dallas (5.4%), and Oklahoma City (7.0%). With agency multifamily mortgage rates moving to the low-mid 5s, a positive return on leverage for property owners is being restored and asset values should be stabilizing. DRR’s implied cap rate is the highest of any US multifamily REIT (maybe there’s an obscure microcap that’s cheaper), provides a large margin of safety, and seems reflective of low liquidity and investor awareness. Some suggest a discount is appropriate for DRR’s external management, however management fees are low (0.25% of assets) and the quality of management is high (PaulsCorp has $2Bn of multifamily AUM and $825mm under development, and Dream Unlimited has $24Bn of AUM). Their highest return as managers will come from successfully growing the business as they have done at Dream Industrial REIT (Brian Pauls is CEO of Dream Residential and served as CEO of Dream Industrial as it enjoyed phenomenal success from 2017-2023 and assets grew 4X).

Industrial REITs

The surge in Industrial real estate demand and rents over the past 10 years is well-known. Extreme scarcity of space in major Canadian markets is easing, but the financial outlook for REITs is supported by large premiums of market rents over existing leases, and new long-term (5-10 year) leases being signed with annual rent escalation of 3-5%.

Dream Industrial (DIR.UN)

Dream Industrial has delivered tremendous growth since it was launched in 2012 with $601mm of properties. The REIT’s IFRS cap rate appears reasonable comparable to CBRE estimates of 5.53% for Class A, 6.30% for Class B, and Cushman & Wakefield’s estimate of 5.12% for European Logistics. DIR has access to unsecured bond financing at attractive rates that provide a positive return on leverage. The equity implied cap rate appears to be a bargain compared to North American peers, however sales by insiders and by connected party Dream Office send a cautionary signal.

Disclosures & Notes

A the time of publication the author held units of Dream Office, H&R, Morguard REIT, Primaris, Dream Residential, and shares of Dream Unlimited. This disclosure should not be interpreted as a recommendation and these holdings could change at any time. The author does not make any recommendation regarding any investment in any company or security mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

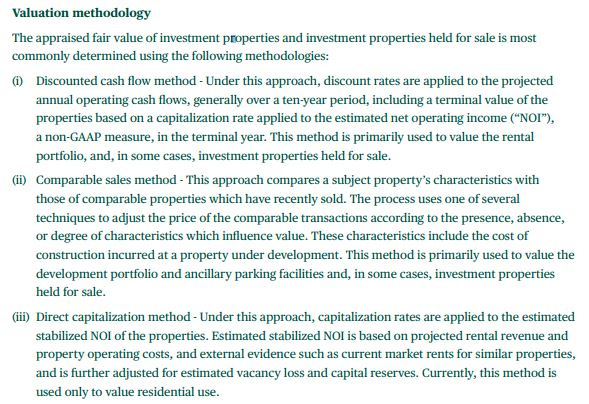

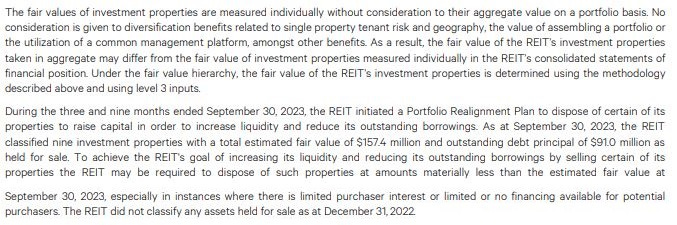

IFRS “Fair Value” of properties held for investment can be calculated 3 ways as explained by Allied Properties:

Each method relies on assumptions and estimates that carry more uncertainty in current market conditions. Different REITs may be using different assumptions and also different valuation methods. For example, AP primarily uses DCF while peer Dream Office primarily uses Direct Capitalization.

Slate Office directly warns that current market value may be “materially less than the estimated fair value”.

I described IFRS as a “helpful starting point”. Management provides these numbers, but valuation methods and assumptions may vary from one REIT to another and may be different from what could be realized in a sale.

BNN reports that Dream Office Discovery District buildings are being marketed.

https://www.bnnbloomberg.ca/toronto-office-tower-goes-up-for-sale-in-sign-of-a-market-thaw-1.2027104#:~:text=(Bloomberg)%20%2D%2D%20A%20Canadian%20landlord,up%20nearly%20two%20years%20ago.

Dream Office Real Estate Investment Trust has hired CBRE Group Inc. and Toronto-Dominion Bank to market 438 University Ave., according to marketing documents. The company also remains open to offers for another building at 655 Bay St., which was put up for sale more than a year ago.

Excellent work, as usual. Thank you. If I may, why are you not holding or swapping with D.UN, Allied Properties?