Phoenix New Media (FENG) announced that a Yidian shareholder is seeking to exercise co-sale rights in FENG’s pending transaction. FENG disputes whether the co-sale notice was validly submitted, but Phoenix TV (PTV) is going ahead with a shareholder meeting seeking approval of the revised sale agreement. The EGM Notice includes background information which was not included in FENG’s press releases. Key points:

- PTV Shareholder Meeting will be held 10/22/19

- Closing of the first tranche of the sale agreement will be within 5 days of shareholder approval

- Yidian transaction value unaffected by the co-sale dispute

- If the co-sale notice is accepted then the number of Yidian shares sold by FENG would be reduced by 7.5%, gross proceeds would be reduced from $448mm to $414mm, net proceeds would be reduced from $404mm to $373mm, and FENG’s retained interest in Yidian would rise from 3.6% to 6.2%.

- The asset value of Phoenix New Media will not be affected. FENG would receive slightly less cash, but retain a larger stake in Yidian and larger potential gains from a future A-share IPO.

- Estimated Net Proceeds after transaction costs have been revised slightly lower to $404mm ($409mm previously), prior to exercise of any co-sale rights.

The co-sale notice introduced a new uncertainty into the closing of the Yidian sale, but the financial impact will be minor. This detailed explanation of the co-sale dispute was provided on page 13 of the PTV EGM Notice:

On 5 August 2019, Long De Cheng Zhang Culture Communication (Tianjin) Co., Ltd. (龍德成長文化傳播(天津)有限公司) and Long De Holdings (Hong Kong) Co., Limited (collectively, the “Long De Entities”) sent a joint notice to PNM purporting to exercise their co-sale right under the Eighth Amended and Restated Shareholders Agreement of the Cayman Company dated 8 August 2018 (the “Shareholders Agreement”). The Long De Entities are independent third parties of the Company and PNM, while the Long De Entities and PNM are both shareholders of the Cayman Company.

Pursuant to the terms of the Shareholders Agreement and the articles of association of the Cayman Company, when PNM as an existing shareholder of the Cayman Company seeks to transfer its interest in the Cayman Company to a third party, the Long De Entities as existing shareholders of the Cayman Company have a right to demand a co-sale of their interest in the Cayman Company to such extent based on a pre-determined formula such that the number of Cayman Company shares to be sold by PNM shall be reduced correspondingly. Any such co-sale notice shall set out the amount of co-sale securities and be delivered to PNM and the Cayman Company within the specified period, as accompanied by transfer documents duly executed by the Long De Entities together with relevant certificates.

On 20 September 2019, the Long De Entities wrote to PNM stating that the total number of shares which they presently seek to co-sell shall be 16 million shares for a total consideration of approximately RMB240 million and that the number of their co-sale shares may change. Based on discussion with its legal advisers, PNM is of the view that the initial notice does not constitute a valid notice under the terms of the Shareholders Agreement, thus the co-sale right should not be considered as properly exercised within the exercise period specified in the Shareholders Agreement.

If the Long De Entities continue to assert their co-sale right and a settlement has not been reached between the parties, legal proceedings may take place to resolve the matter and the outcome of such proceedings may or may not be favorable to PNM. As far as the Disposal is concerned, it is possible that there may be a reduction in the number of the Updated Sale Shares to be sold by PNM and the corresponding amount to be received by PNM. If the Long De Entities are able to validly exercise their co-sale rights for the tentatively requested 16 million shares, PNM preliminarily estimates that the Updated Sale Shares to be sold by PNM will be reduced to approximately 196,358,165 shares in Cayman Company and the proceeds to PNM from the Disposal will be reduced to approximately USD414,245,706.

PNM will continue its discussions with the Long De Entities for an amicable resolution of the disagreement between the parties, and the Company will make a further announcement as and when appropriate in accordance with applicable requirements of the Listing Rules.

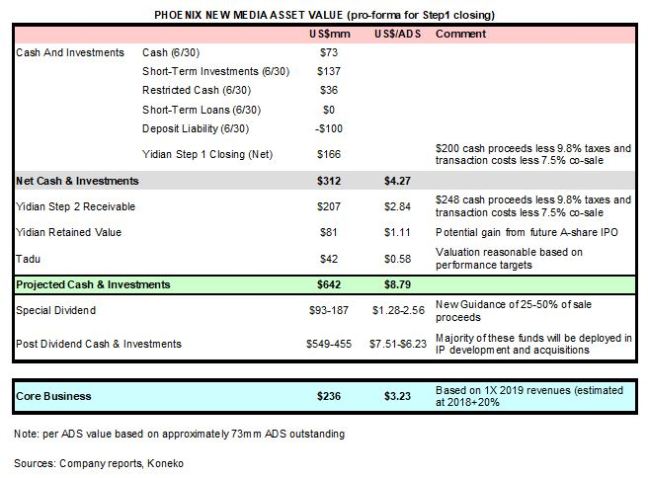

Prior Koneko articles described Phoenix New Media’s 2Q results and future guidance, and the revision of the Yidian sale agreement into a two step transaction. If Long De Holdings is permitted to co-sell the entire 16mm shares requested in its 9/20/19 notice then FENG would still have approximately $4.27/ADS in cash and short-term investments after the Step1 closing.

The revised transaction terms, co-sale, and revised dividend guidance would return 50-100% of FENG’s current price in cash within one year and leave shareholders with a business and assets potentially worth $9-11/ADS.

FENG shares have fallen to an all-time low amid disappointment and uncertainty over the Yidian sale delays. Closing of the first sale installment is still likely to occur within weeks and put FENG in a very strong position to deliver value to shareholders through special dividends and re-invest in its business.

DISCLOSURES

The author is a shareholder of Phoenix New Media. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEC and HKEX filings and other sources prior to making any investment decisions.

So…they just announced a $100mm US special dividend on the call…finally. That’s about $1.40 per share. Board meeting Thursday to formalize then likely announce Friday for payment to shareholders of record mid-December. Stock should lift.

LikeLike

Do you care to update us on your current thoughts?

LikeLike

Stock will be trading ex-dividend today (12/16). A price of approximately $2 is backed by about $3 of cash+ST investments, about $4.50 of LT investments, and about $3 of value for the core business.

Trade truce should be supportive for Chinese business sentiment and the outlook for some depressed advertising sectors (autos and property) is improving.

If FENG shares remain around this level then it would not be surprising if it gets privatized by the HK parent.

LikeLike