- Specialty chemicals producer China XD Plastics delivered strong 1H18 operating results with volume +11% and net income +14%

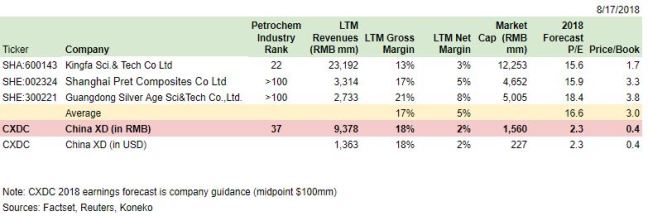

- The company remains over 80% cheaper than China-listed peers

- Liquidity is adequate, but it would be prudent to raise equity at a reasonable price to support growth plans

- The proposed issuance of shares in the Chinese operating business to the son of the company’s chairman unfairly values the business at just $3.46 per CXDC share

China XD Plastics (CXDC) reported satisfactory 1H18 results and operating progress which have been largely ignored by investors due to concerns over the eighteen month old unfair preliminary non-binding buyout offer (LINK) from Mr. Jie Han (CXDC’s founder, Chairman and CEO) and Morgan Stanley Private Equity Asia (MSPEA) and a new unfair offer (LINK) from a company controlled by Chairman Han’s son. This article will refer to the US-listed parent company as “CXDC” or “China XD” and the business as “Xinda,” because that is the name used by its Chinese operating units.

REVIEW OF 1H18 RESULTS

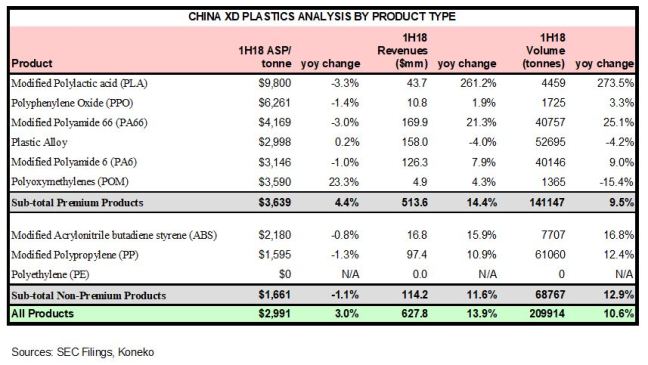

Operating results (press release, 2Q 10-Q, conference call transcript) were in line with expectations. Key points:

- 1H18 Revenue +13.9% and net income +22.0% vs 2017

- 1H18 sales volume of 209,914 tonnes +10.6% vs 2017

- 1H18 Gross margin declined to 17.5% due to absence of higher margin international sales

Xinda has a long-term goal of raising sales volumes of more specialized higher priced and higher margin materials. 1H18 results show success in substantially increased sales of PLA and PA66.

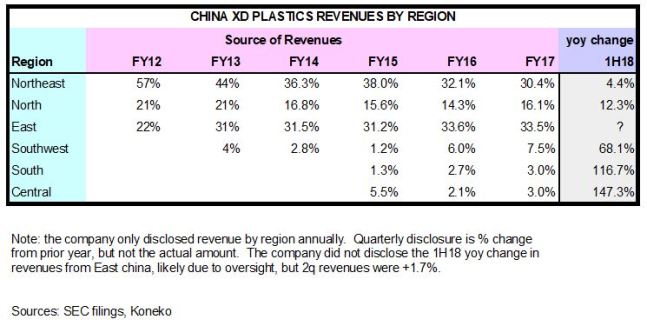

Xinda made progress at raising sales in regions (Southwest, South, and Central) served from the new Nanchong production base.

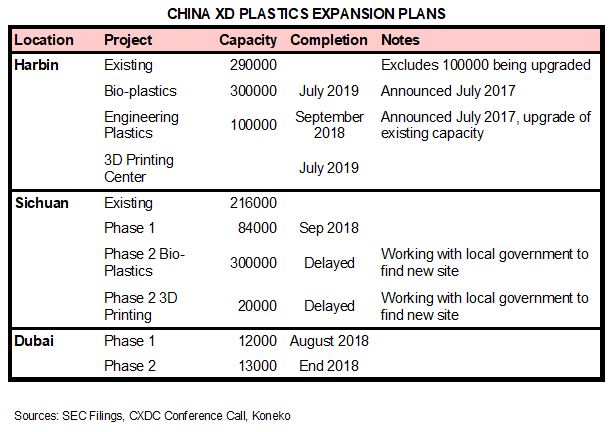

Xinda added 156000 tonnes of production capacity in Nanchong during 2017 and began major capacity expansion projects in both Nanchong and Harbin.

Much of the new capacity (300,000 tonnes each in Nanchong and Harbin) will produce biodegradable plastics. These environmentally friendly materials serve new markets with rapidly growing demand and attractive expected margins.

Xinda recorded minimal overseas revenues in 2018. The company hopes to take advantage of existing supply relationships with China-based automobile joint ventures in order to develop sales to the international parent companies.

PEER COMPARISON

China XD continues to trade at a large discount to its China-listed peers even though their valuations have fallen amid weakness in China’s domestic equity markets.

Additional background on competitive position and strategy of these companies was in prior Koneko articles. Kingfa’s bond prospectus (page 1-1-93) listed its primary domestic competitors as Xinda, Pret, and Silver Age. The limited number of competitors in production of advanced plastics enhances Xinda’s appeal to potential strategic investors or acquirors.

LIQUIDITY IS ADEQUATE

Xinda has committed to capital expenditures of $345mm which could be covered by currently available resources.

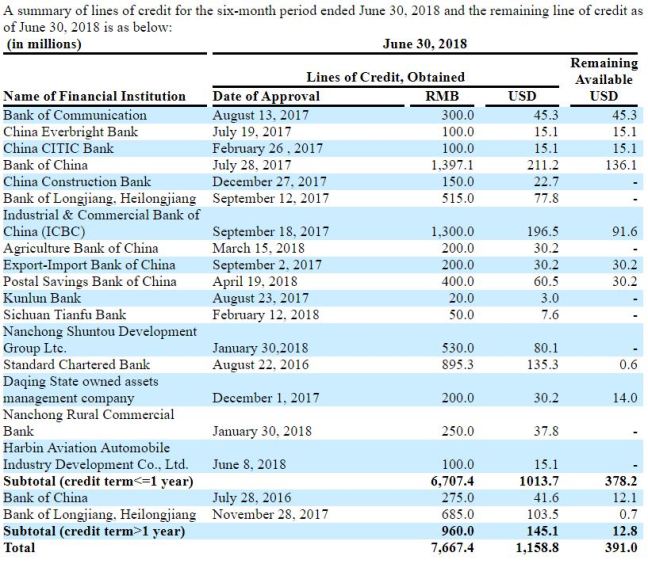

At 6/30/18 the company had $449mm of cash equivalents and time deposits, plus $378mm of unused lines of credit from a strong group of lenders:

Operating cash flow will add about $35mm per quarter based on the $100mm midpoint of net income guidance plus about $40mm of non-cash depreciation. It appears the company could fund its capacity expansion without additional financing, however most of the lines of credit have less than a 12 month term and a cyclical industry downturn could reduce profits. Considering Xinda’s profitability, strong government relationships, and prominent position in a “Made in China 2025” sector, it is very unlikely that banks would decline to roll over existing credit, however it would be prudent for the company to fund a portion of its capacity expansion with new equity.

I suggested over a year ago that a placement of shares by the company’s domestic Chinese holding company (Heilongjiang Xinda Enterprise or “HLJX”) could be an attractive financing option. It was quite surprising to read that CXDC appeared to follow my suggestion.

THE PROPOSED VALUATION OF HEILONGJIANG XINDA ENTERPRISE IS NOT A FAIR PRICE

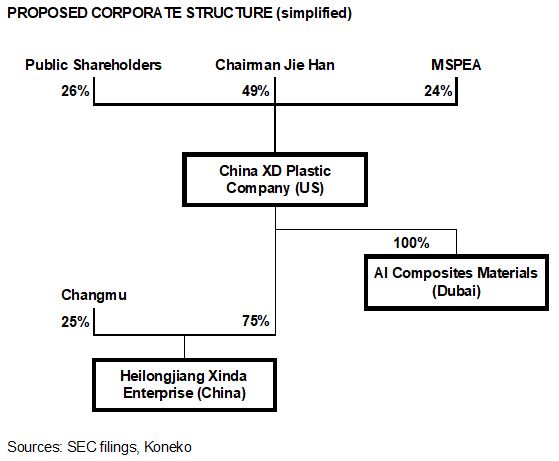

In July 2018 HLJX signed a non-binding letter of intent regarding a potential 500mm RMB (about US$75mm) equity investment from Changmu Investment (a company controlled by the son of CXDC Chairman Han). China XD’s 2Q18 earnings press release disclosed that Changmu’s ownership interest is estimated to be 25% of HLJX. This implies a valuation of US$300mm for HLJX. During CXDC’s 2Q18 conference call CFO Taylor Zhang explained that a final valuation of HLJX would be based on discounted cash flow and peer valuations.

A simplified version of the current and proposed corporate structure is:

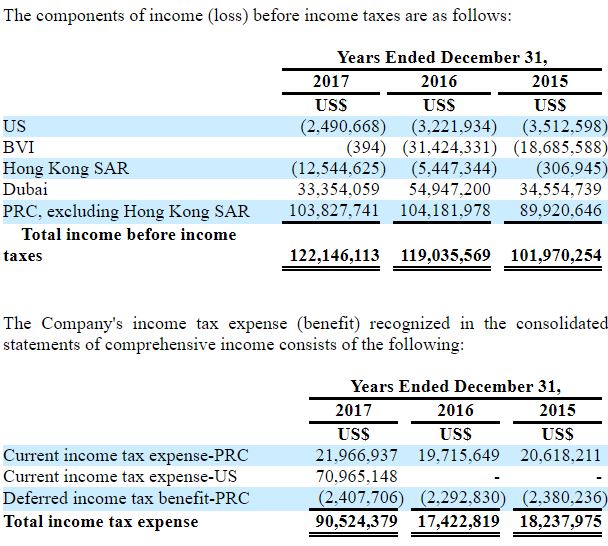

We don’t know the details of management’s cash flow projections for HLJX. but Chinese media recently reported that Xinda projects sales of 20Bn RMB in 2020. This is close to the US$3.65Bn that Jason Cooper of Stuyvesant Capital Management estimated the company could generate in 2021. The company’s sales target adds credibility to Jason’s estimate of 2021 potential net income of US$502mm ($7.66/share) of which $448mm ($6.83/share) was from the Chinese operating business. We also know that net income from the Chinese operating businesses was over $80mm in 2017 and 2016 (excerpt below from 2017 10-K page F-26):

Using a 15 P/E multiple from listed competitors Kingfa and Pret would value HLJX at US$1.2bn (15 times $80mm). Discounted cash flow valuation would be higher due to Xinda’s capacity expansion plan unless an irrationally high discount rate were applied.

It would be reasonable to issue 6.25% of HLJX equity to Changmu for 500mm RMB. Changmu could enjoy substantial appreciation in coming years as HLJX earnings increase and it moves toward a domestic Chinese listing at a higher valuation. The proposed issuance of 25% of HLJX equity for 500mm RMB would constitute an unfair transfer of significant value to a related party.

CXDC has not explained what process it is following to evaluate the fairness of the proposed Changmu Investment. The Letter of Intent says that Changmu will hire an “independent appraiser”, but it seems self-evident that an appraiser chosen by a buyer cannot be considered independent. CXDC’s conference call referred to a “Special Committee”, but it’s not clear whether this is the same Special Committee that was negotiating with Chairman Han over his going-private proposal. The privatization Special Committee did not include Joseph Chow who is the “Audit Committee Financial Expert”.

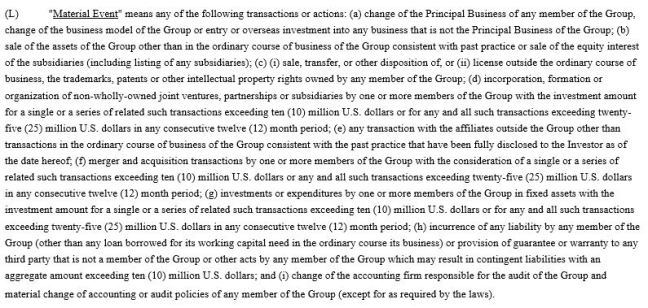

Issuance of HLJX equity at an unfair valuation would be significantly dilutive to both public shareholders and also Morgan Stanley Private Equity Asia (MSPEA). In addition to holding 2 of the 8 seats of CXDC’s Board of Directors, the Certificate of Designation of the Series D Convertible Preferred Stock through which MSPEA holds its ownership in CXDC provides significant veto rights over proposed corporate transactions (“Material Events”) with a value over $25mm:

It’s hard to imagine that MSPEA would acquiesce to the Changmu investment at the proposed valuation unless MSPEA had an undisclosed private agreement with Chairman Han to be compensated for the dilution of its equity interest. Even if that were the case, the MSPEA directors still have a fiduciary obligation to act in the best interest of all shareholders.

The proposed $300mm valuation for HLJX would mean CXDC’s retained 75% interest was worth $225mm (about $3.46/share). CXDC would also retain full ownership of the Dubai subsidiary.

RECOMMENDATIONS

Chairman Han made several comments during the 2Q18 conference which suggest that he would benefit from new advice and new advisors:

- He explained that he has had primary responsibility for raising the funds required for the privatization proposal. Obviously he has not done a good job since there has been no apparent progress.

- He explained that he has been trying to raise funds from state-owned banks. These lenders have provided generous lines of credit to support the company’s capacity expansion in China, but are not likely to provide the equity financing required to buy out CXDC’s internationally listed shares. Chairman Han said he has not had any discussions with potential private equity investors.

- He said he was unaware until recently that the Consortium Agreement with MSPEA had expired one year ago (details of the agreement explained here). This suggests that he has not engaged competent international advisors regarding the legal and regulatory obligations associated with his privatization offer and has not satisfied SEC expectations that: “Investors are entitled to current and accurate information about the plans of large shareholders and company insiders”.

- He said he was puzzled by the low price of CXDC shares. This suggests he is oblivious to the negative impression he created by making what appeared to be a bad faith offer to deprive public shareholders of the value that will be created by the company’s expansion plans.

Seeing that Chairman Han has embraced my suggestion of an equity placement by HLJX, I offer these additional suggestions that would be of long-term benefit to all interested parties:

- China XD should retain its own independent legal and financial advisors for consideration of any share placement by HLJ Xinda.

- New independent investors should be provided the opportunity to invest in HLJX alongside Changmu at a company valuation of at least US$1.2Bn. Placement of a 25% equity interest would raise US$300mm. Investors would profit from the company’s rapid growth and a future domestic equity listing. The new equity would leave CXDC and HLJX well capitalized to take advantage of opportunities in new materials and new end markets. CXDC’s retained 75% interest in HLJX would be valued at $13.84 per CXDC share.

- The going private offer should be withdrawn. It was a bad idea at a bad price. It’s time to move on.

- Chairman Han should work with Morgan Stanley to find a strategic investor to acquire the equity interest held by MSPEA’s liquidating fund.

- CXDC should re-launch its investor relations program including regular press releases announcing meaningful developments, an updated investor presentation, participation in investor conferences, and hosting investor visits at CXDC facilities.

- CXDC should engage advisors to prepare for a secondary listing of its shares in Hong Kong.

Disclosures & Notes

At the time of publication the author is a public shareholder of China XD Plastics. The author believes that it would be in his best interest if the facts in this article were widely understood. The author does not make any recommendation to any other person about investment in China XD Plastics shares. The author may adjust his own investment in China XD Plastics at any time.

Conditional terms used in the article such as “may” “could” “seem” “suggest” and “appear” indicate the author’s subjective opinion based on the facts presented. Readers are encouraged to check the facts themselves rather than relying on the author’s opinion. Descriptive terms such as “unfair” and “bad faith” indicate the author’s subjective judgment based on the facts presented. These descriptions are made according to the common usage of these words rather than any specific legal standard of unfairness or bad faith that may be applied in any legal jurisdiction.

The author has made his best effort to accurately summarize facts publicly available as of the date of publication (08/17/18). The author does not want to spread errors or misinformation. A link to this article has been sent to CXDC CFO Taylor Zhang using his email address in company press releases cxdc@chinaxd.net. If CXDC, or anybody else, can provide public information as of 08/17/18 which shows there are errors in the text then corrections will be made as promptly as possible.

A copy of this article has been mailed to each of the members of CXDC’s Audit Committee.

Aside from corrections to any errors discovered in this article, the author assumes no obligation to release any updates on the topics described above or make any other new public commentary about China XD Plastics. His willingness to do so will depend on future developments which cannot currently be predicted.

Hi John,

It seems to me that your diluted value estimate of $3.46/share does not include the $78m added cash.

By the way, I appreciate your analysis very much.

Any updates on CXDC available since then?

Best regards,

Walter

LikeLike

Under the proposal HLJX would have retained the 500mm RMB investment. So if Changmu had paid 500mm RMB (about $75mm) for 25% of HLJX then the implied value of the 75% held by CXDC would have been about $225mm (about $3.46/share).

LikeLike

wouldn’t you need to add the $75mm to the $225m to calculate the corresponding value for the 75% held by CXDC?

LikeLike

I don’t see your point. CXDC would not have received the $75mm.

LikeLike

Shouldn’t you divide the $225mm by the 50m shares currently outstanding?

LikeLike

You have to add the 16mm shares issuable in exchange for the Series D held by MSPEA

LikeLike

But these 16mm shares should add $6.25 per share to equity, no?

LikeLike

Conversion of the Series D would add $100mm to CXDC shareholder’s equity. This will not affect HLJX. I suggested that CXDC (and HLJX) should be valued based on peer P/E multiples.

LikeLike

On another note, in the quarterly filing, CXDC uses current stock price to set the fair value of stocks granted in stock-based compensation transactions. Shouldn’t that be challenged given the current controverse over share valuation? Using current market value as an estimate of the stock’s fair value seems erroneous to me as the current market shows a very low level of activity, is highly asymmetric and does not assume market participants that are knowledgeable and fully informed on the company’s situation.

LikeLike