Colony Northstar shares have fallen sharply in recent weeks (-18% YTD). I believe the selling pressure comes from ex-Northstar executives. The existing share buyback plan was largely completed by November and had little remaining capacity to take advantage of the falling price.

- In conjunction with the merger Northstar executives negotiated the following equity grants to replace prior Northstar compensation agreements (CLNS DEF14A page 55):

- Shares awarded were subject to a one-year vesting period following the closing of the merger on 1/10/17

- Al Tylis and Debra Hess left in 2017 and presumably their shares became available for sale immediately.

- Ronald Lieberman appears to still be employed by Colony Northstar so his shares became available for sale on 1/11/18

- As shown in the above excerpt, shares held by Hamamoto and Gilbert would be subject to an additional one year holding period. However it appears that Dan Gilbert and David Hamamoto were terminated effective 1/11/18. This appears to eliminate the one-year post-vesting holding requirement. The filing states that they resigned, but I believe that was simply a graceful way to describe the termination.

- David Hamamoto’s Form 4 filing on 12/18/17 demonstrated his willingness to sell CLNS shares over which he already had full ownership. Following his resignation he is not required to disclose any additional sales.

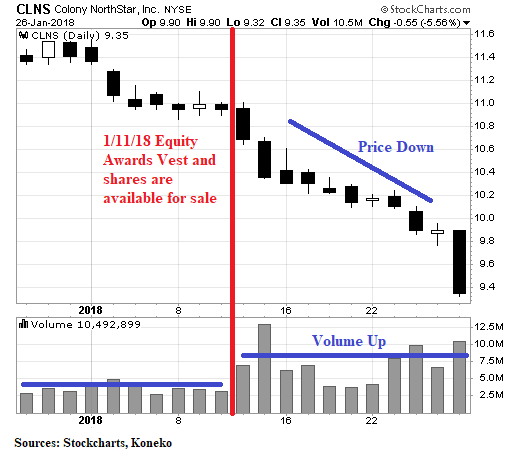

- CLNS volume rose sharply to 7.3mm shares/day after the vesting of the equity awards on 1/11/18 compared to 2.9mm shares/day in the prior sixty trading days.

Fundamentally, Colony Northstar continues to make progress in execution of its strategic plan:

- Spinoff of complex assets into Colony Northstar Credit Real Estate which will begin trading next week as CLNC (see investor presentation). Peers STWD BXMT and ARI are trading at premiums to book value. CLNC provides clarity into the value of CLNS ownership stake and a platform for future growth in assets under management.

- Revised management agreement with Northstar Realty Europe (NRE) better positions that company for growth in assets under management. CLNS recently raised its stake to 10.2% through open market purchases at prices up to $14.60/share

- Execution of $300mm share repurchase plan announced last February. $264mm was acquired through 11/9/17 at an average price of $12.94. The company may not have had enough remaining authorization to buy a significant amount of stock during the recent drop, but liquidity from 2017 asset sales could enable a larger buyback plan to be announced with 4Q earnings next month.

- Expansion into digital infrastructure assets through a $3Bn partnership with DIgital Bridge.

A falling share price draws attention to the company’s weaknesses:

- Successful transition to a co-investment business strategy will take several years.

- Near-term earnings have been relatively weak and dependent on capital gains. Adjustments still play a large role in the company’s calculation of “Core FFO”.

- The company does not normally provide financial guidance. Guidance would help investors measure the success of the business transition.

Disclosures:

On the date of publication the author was a shareholder of CLNS and NRE. Investors are encouraged to check all of the key facts cited here prior to making their own investment decisions. The author believes that a substantial amount of CLNS shares became available for sale on 1/11/18 by former Northstar executives, but did not consult independent lawyers or accountants about interpretation of those equity compensation agreements.

Update 7/11/18:

This post still gets a lot of traffic. In hindsight there was a lot more going wrong than just insider selling. Year-end results and 2018 outlook were much weaker than expected. The Northstar acquisitions were clearly a blunder, but Colony management has avoided detailed comments on what went wrong and has not offered a compelling vision for how the merger-related problems will be solved. These issues were described in more detail in a subsequent article: Colony Northstar Merger Math 2+2+2=3

Revelation of the problems resulting from the Northstar merger does make the share sales by ex-Northstar executives look more suspicious and the sales were noted in Class Action Complaints

Interesting observation! How do you think about CLNS’s intrinsic value now that it’s a combination of traditional REIT/hybrid and asset management.? Also curious to hear your thoughts about how to evaluate the company’s current transition progress.

LikeLike

Well obviously I have been more enthusiastic about the transition than most.

If you haven’t seen it then Tom Barrack made some comments about CLNS in a Bloomberg interview this week:

It appears to me that the company spent 2017 reforming its products to improve their future marketability. NSAM claimed that the high fee and nearly unbreakable contract with NRE was a valuable asset. But it was a terrible deal for NRE investors and put that company on a slow path to failure. CLNS revised the contract and will sacrifice some near-term revenue, but made NRE a more viable entity that could grow to 5X its current size in 5-10 years.

Perception of the company suffered because 2017 FFO was boosted by realization of capital gains. CLNS was slow to reinvest proceeds from those asset sales and reinvestment options appeared to offer lower potential returns. Well what just happened? Having a large amount of unrestricted cash and borrowing capacity doesn’t seem too stupid today. CLNS stock is trading as if the company were in distress when it is actually very well positioned to take advantage of bargains.

One of the potential bargains is CLNS stock. The company has more capital than is required for the co-investment business model and should be able to purchase shares aggressively at these prices.

Several analyst reports came out in the past week with price targets from $9.50-19. That wide range demonstrates that the company is still too complex to earn a high valuation multiple. Analysts independently value each of the company’s “verticals”, add “opportunistic” assets and special situations, and then capitalize the value of investment management. It’s too much work. BAM has an even more complex breadth, but listing of each business unit provides great transparency into the value of the units and the sum-of-the-parts valuation of the parent. The opportunity in CLNS is that the apparent complexity makes it cheap, but there will be significant multiple expansion if/when the company is successful in simplifying the story for investors.

LikeLike

I shared your views, and probably the biggest risk for CLNS now is execution risk. But just to play devil’s advocate, CLNS doesn’t make money on corporate level. Also, analysts use Core FFO for valuation and that’s fine. However, it’s after much adjustments, some of which are true costs and probably shouldn’t be added back. A better metrics would be FFO as traditionally defined, and if you use FFO, CLNS trades ~13x at current price, which is probably fair for company with this level of complexity.

LikeLike

Hey John, do you know any turnaround case studies (both successful and failed) similar to CLNS? Just try to think probabilistically.

LikeLike

I don’t really think of this as a turnaround story. I think BAM is the best example of a similar transformation from being an owner of real estate assets to being a manager of real estate investment funds and companies.

LikeLike

Well obviously I was wrong about that and now it is a turnaround story.

LikeLike