Highlights from Xinyuan’s recently reported 2Q17 results and Conference Call

- Record quarterly contract sales of $732mm

- SG&A expense declined to 9.9% of revenue (vs 11.4% for FY16)

- Unusually high interest expense of $20.2mm

- Effective tax rate of 56%

- Book Value rose to $14.13/ADS

- Conservative land acquisition budget of 5-7Bn RMB

- No full-year financial guidance

- Achieved a significant milestone in execution of blockchain transactions

These preliminary comments will be expanded when the company releases its complete interim financial statements and MD&A in September.

Overall it was a good quarter for Xinyuan’s real estate operations, but corporate profitability was hurt by high interest expense and taxes.

Record quarterly contract sales of $732mm

Xinyuan’s 2Q17 contract sales rose 54% from one year ago to an all-time high and far above the guidance of +20-25% provided during the 1Q17 conference call.

Xinyuan records a “contract sale” when it has a high degree of certainty over collection of proceeds. The 20-F includes this description of the sale process:

The company has determined that a “contract sale” has occurred when it has received cash deposits and mortgage proceeds greater than 30% of the contract value.

Xinyuan recognizes financial statement revenue using percentage of completion accounting. Even if the company has received 100% of the cash proceeds at the time of a “contract sale”, the related revenue is only recognized in line with the company’s progress towards completion of its obligations under the sale contract. For example, when half of the budgeted construction cost has been spent, half of the “contract sale” revenue should have been recognized. Analysis of Xinyuan’s quarterly income statement revenue is tricky because it combines partial recognition of revenue on newly signed contracts + revenue related to construction progress on contracts signed in prior periods. As a result “contract sales” are probably the most useful metric for assessing the health of Xinyuan’s projects on a quarterly basis.

Key conclusions from examination of contract sales by project:

- Over half of 2Q17 sales were from the Zhengzhou International New City project. This is the first phase of a multi-year project planned in cooperation with the Zhengzhou government. Phase 1 has a total area of 360500 sqm, less than 10% of the total planned area of 4.4mm sqm. Strong sales and gross margin for Phase 1 are very positive signals for the revenue and profit that Xinyuan can earn from this project in the next few years.

- No significant projects stand out as laggards with large blocks of completed but unsold space.

Revenues reported in 2Q17 reflect construction progress towards delivery of sales in prior periods and current period sales at nearly finished projects generate higher current revenues than sales at earlier stages of development. For example, I estimate that Zhengzhou International New City generated 52% of 2Q contract sales, but only 30% of revenues in the quarter.

Xinyuan’s profit margins should improve as older projects with lower gross margins are sold out. Some progress was evident in 2Q17 with a gross profit margin of 22% (up from 20% in 2Q16).

SG&A expense declined to 9.9% of revenue

The company has not explained in detail how these improvements were achieved, but management deserves credit for significant progress.

Unusually high interest expense of $20.2mm

Strong operating income in 2Q16 was significantly offset by interest expense much higher than a typical level of $7-8mm. Xinyuan explained the expense was due to “some debt not yet allocated to real estate projects”. Most of Xinyuan’s interest expense is usually capitalized (and then expensed as part of “Cost of Real Estate Sales”) as shown in this 20-F excerpt:

Xinyuan did not disclose total interest paid in 2Q17 so it’s not possible to know to what extent the higher expense reflected a genuine increase in cash paid or merely a different allocation as suggested in the press release.

Effective tax rate of 56%

Xinyuan has retained a smaller portion of its operating earnings in recent years due to rising tax payments.

Conference call explanations that the tax obligations are a combination of Corporate Income Tax and Land Appreciation Tax seem incomplete because they do not explain why the combined rate has increased so much over time. A detailed breakdown of the tax expense in the 20-F provides some insight:

The biggest reason for higher expense in 2016 was “international rate difference”. I believe this results from the company reporting taxable profits in China and non-taxable losses offshore (Cayman Islands). This problem may have continued in 2017, but we will not know for certain until financial statements are filed. Finding a way to minimize this liability in the future should be a top priority for Xinyuan.

Book Value rose to $14.13/ADS

Updated 10/9/17 using the 06/30 share count disclosed in the financial statements filed on 9/22

It appears that buyback of 952,231 ADS during the quarter was more than offset by issuance of shares in association with employee compensation.

Combined annual dividend payments and share repurchases are now capped at $50mm (following redemption of the 2019 notes in early July which had a $35mm limit). Dividends will use approximately $26mm (assuming an average 65mm ADS being paid $0.40) leaving about $24mm for buyback. Actual repurchases in 1H17 were $11.9mm so the company can continue at about the same level for the remainder of 2017.

Conservative land acquisition budget of 5-7Bn RMB

Xinyuan committed 5Bn RMB to new land acquisitions in 1H17 and suggested in the conference call that another 2Bn RMB might be spent in 2H17. This budget seems reasonable relative to estimated full year contract sales of 15-17Bn RMB. The company provided limited details about most of the 1H17 purchases, but the aggregate cost seems reasonable relative to potential sales at these locations of 20Bn RMB mentioned in a promotional note.

The company also released a promotional note that Oracle Corporation has agreed to take space in a new multi-use development in Zhengzhou which appears very large in the diagram provided:

Xinyuan investor relations told me that land acquisition for this project is still under negotiation with the Zhengzhou government. Successful conclusion of an agreement would be good news considering the company’s long-term record of strong sales and profitability in Zhengzhou.

No full-year financial guidance

Xinyuan’s 54% increase in 2Q contract sales far exceeded the outlook for a 20-25% gain provided during the 1Q17 conference call, but the 2Q press release described results as “in line with our expectations”. If the company expected to post all-time high quarterly sales then that outlook was not properly communicated to investors.

Xinyuan provided an outlook of 4Bn RMB for 3Q17 contract sales which would be about a 20% year-over-year increase. Most peers provide a full year sales target. Xinyuan has not released a 2017 forecast, hinted at 17Bn RMB during the 1Q conference call, but said nothing about the full year expectations during the 2Q call. Clearer communication of the company’s expectations would improve investor understanding, reduce the perceived risk of investing in Xinyuan, and result in a higher valuation for Xinyuan’s securities.

Achieved a significant milestone in execution of blockchain transactions

Xinyuan Chairman Yong Zhang made several speeches to financial conferences over the past year about developments in blockchain technology (example). Sailing the seas depends on the helmsman. If Chairman Zhang believes that blockchain is important then the company’s success (or failure) in this area may have significant implications for Xinyuan investors.

In March 2017 the company achieved a milestone with successful launch of FYIXIN, a blockchain based application through which loans can be taken against real estate equity. In June the company disclosed that completed transactions had already passed 100mm RMB (LINK)

FYIXIN fees will be insignificant in Xinyuan’s current year earnings, but these transactions demonstrate successful integration of technology (partnership with IBM), legal and regulatory guidance (partnership with Tsinghua University), lending partners (Bank of Zhengzhou and other financial institutions) and Xinyuan’s own real estate expertise.

Xinyuan was given an opportunity during the recent conference call to describe the company’s blockchain related activity, but provided only a vague response.

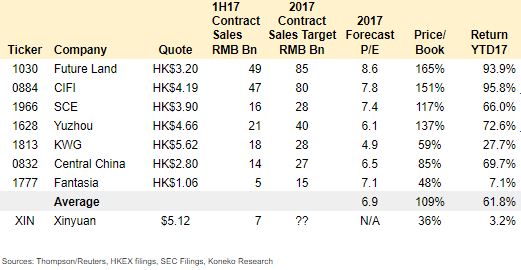

Valuation Comparison

Xinyuan remains significantly undervalued relative to peer companies listed in Hong Kong.

Links for peer results:

| Ticker | Company | 1H Results |

| 1030 | Future Land | Release |

| 0884 | CIFI | Presentation |

| 1966 | SCE | Release |

| 1628 | Yuzhou | Presentation |

| 1813 | KWG | pending |

| 0832 | Central China | pending |

| 1777 | Fantasia | Release |

| XIN | Xinyuan | Release |

A more detailed comparison can be made next month when all companies will release mid-year financial statements. I believe that Xinyuan would be fairly valued relative to peers at a Price/Book ratio of 65%, equivalent to $9.27/ADS

Disclosure

The author is a Xinyuan shareholder and believes that greater public awareness of the facts in this article could be of benefit to himself and other public shareholders. Investors are encouraged to check all of the key facts cited here prior to making their own investment decisions.

Thanks for the insights. This is really helpful. Just one question about the International New City project. You stated that XIN owns 100% for later phases. Do you have a source for this? During the conference call, the CFO didn’t provide any detail about this.

LikeLike

Hi Charlie,

I followed up about the International New City ownership with the company so my source is personal correspondence. Obviously there is a lot of value in this huge high margin project so it was a disappointment to learn that 49% of Phase 1 is held by another company (Shenzhen Pingjia), but a relief to learn that XIN still has 100% of all future phases.

John

LikeLike