- China XD Plastics’ CEO recently offered to buy all publicly held shares for $5.21, a small premium to their recent market price, but well below their fair value.

- The company is poised to report record sales and profits in 2017 as new plants in Nanchong and Dubai enter commercial production.

- The company has not disclosed a possibly significant expansion plan negotiated with the Nanchong government.

- Alternatives to the unfair buyout offer could unlock significantly greater value.

On February 17 China-based specialty chemical company China XD Plastics (CXDC) received a preliminary non-binding buyout offer (LINK) from Mr. Jie Han (the company’s founder, Chairman and CEO) and Morgan Stanley Private Equity Asia (MSPEA). MSPEA has been a strategic investor in the company since 2011.

This report will cover the major developments since my July 29, 2015, article (China XD Plastics Is Over 80% Cheaper Than Comparable China-Listed Companies). This article will refer to the US-listed parent company as “CXDC” and the business as “Xinda,” because that is the name used by its Chinese operating units. Topics:

- Xinda’s position in the Chinese Chemical and Plastics Industry

- CXDC’s progress over the past year

- CXDC’s 2017 Outlook

- Xinda’s undisclosed Sichuan expansion plan

- History of Buyouts by Morgan Stanley Private Equity Asia

- Are there Alternatives?

- Comments on risks of investing in CXDC

The buyout offer appears to be unfairly timed and at an unfair price, but the needs of Mr. Han and MSPEA suggest that there is an opportunity for a review of strategic alternatives that could bring greater value to all shareholders. This article includes an example of a transaction structure that could provide visibility to a valuation over $30/share.

XINDA’S POSITION IN THE CHINESE CHEMICAL AND PLASTICS INDUSTRY

Xinda rose to #38 on the China Petroleum and Chemical Industry Ranking of the Top 100 companies in the industry (from #35 in 2015 and #53 in 2014).

The companies on the list produce a very broad range of products, from fertilizers to commodity petrochemicals to specialty compounds. Further insight into Xinda’s business can be obtained through comparison with three major listed companies producing modified plastics (Kingfa appears at #19 in the top 100 industry ranking, while Pret and Silver Age were not included):

Kingfa Science & Technology is China’s largest producer of modified plastic by volume. The company began by serving the appliance industry, and expanded into automotive plastics in 2006. Kingfa operates facilities in Guangzhou (Guangdong), Zhuhai (Guangdong), Qingyuan (Guangdong), Kunshan (Jiangsu), Tianjin, Wuhan (Hubei), and Mianyang (Sichuan). The company’s growth initiatives include biodegradable plastics, supply chain finance and logistics services, carbon fiber, and capacity expansion to serve the appliance and automotive industries. Significant recent developments:

- 9M16 Sales +9% yoy and EPS +13%

- Kingfa shares have been suspended in Shanghai since January 7 pending news of a major corporate transaction

- The company noted strong sales in 2016 of biodegradable and other specially engineered plastics.

- The company arranged placement of 157mm new shares at a price of 5.39 RMB/share in December. A majority of the shares were allocated to a newly established employee shareholding plan.

- The company now has annual production capacity of about 1.5mm tonnes

- The company established international units in Michigan (2015) and Bonn (2016)

- The company is participating as a founding investor in a newly formed life insurance company.

Shanghai Pret Composites operates facilities in Shanghai, Chongqing, and Jiaxing (Zhejiang). Over 95% of its production is currently sold to the auto industry. The company’s growth initiatives include increased sales of high-end automotive products and integration of its recent acquisition of US-based Wellman Plastics Recycling. Significant recent developments:

- 9M16 Sales +12% yoy and EPS +8%

- The company is currently raising 370mm RMB by selling 15mm shares at a price of 23.63 RMB/share

- Projects under construction will raise production capacity to 400000 tonnes per year with a further target of 500000 tonnes within 3 years

Guangdong Silver Age operates facilities in Dongguan (Guangdong) and Suzhou (Jiangsu). The company supplies makers of electronics, wires and cables, appliances, lighting, transportation, and household goods. It does not provide any breakdown of sales by end-market, but is not regarded as a significant competitor to Xinda, Kingfa, and Pret in the automotive sector. The company’s growth initiatives include supplying materials for 3D printing and a recent investment in a business that makes sophisticated metal parts for mobile phones and other applications.

- 9M16 sales +21% yoy and EPS +337%

- The company’s current plastics production capacity is 300000 tonnes per year.

- The company is raising 387mm RMB by selling 32mm shares at RMB 12.13 in order to further invest in its electronic components business.

China XD Plastics has 3 facilities in Harbin (Heilongjiang) and newly opened facilities in Nanchong and Dubai described in more detail in the next section. About 90% of Xinda’s output is used by the automotive sector, but the company has a long-term goal of achieving 50% of total sales from electronics, aerospace, high-speed rail, and other applications.

- 9M16 sales +13% yoy and EPS +13%

- The company’s current annual production capacity is 706500 tonnes (assuming full usage of new facilities)

All of the major plastics makers benefit from significant government support under the Made in China 2025 plan (LINK) which encourages domestic production and innovation of new materials.

Xinda’s scale, operating margins, and growth potential are within the normal range for its industry. If Xinda were publicly traded in China then it would be fairly valued at $30-$40/share (a P/E multiple around 25 and a Price/Book ratio of around 3). Mr. Han’s buyout offer of just $5.21/share appears to be an unfair price that would deprive public shareholders of most of the true value of their investment.

CXDC’S PROGRESS OVER THE PAST YEAR

In the past two years Xinda invested over $350mm to build a new production facility in Dubai through a wholly owned subsidiary (AL Composites Materials). As of 9/30/16 the company had completed trial production on Phase 1 production capacity of 2500 tonnes and planned completion of an additional 14000 tonnes of capacity by the end of 2016.

Photo: Xinda Dubai facility

Since 2013 Xinda invested about $400mm to build a major new production facility in Nanchong (Sichuan Province). Auto production is growing rapidly in this region far from Xinda’s existing plants in Harbin (Heilongjiang Province). The company received considerable financial incentives related to the plant including preferential income tax rate of 15%, government grants of $16mm, and loan forgiveness of $52mm. An official commissioning ceremony was held on 07/07/16 (LINK) and initial production guidance of 50000 tonnes for 2016 was provided. The plants full capacity of 300000 tonnes will be activated in line with customer demand.

Photo: Xinda Nanchong plant

CXDC’s 2017 OUTLOOK

Completion of the Dubai and Nanchong projects creates potential for significant growth in CXDC’s sales and profits in 2017. Management offered these comments during conference calls:

11/06/16: “we believe the optimal more time to consider issuance dividends is about to come. Obviously, the goal is to maximize shareholder value and at the right time. “

08/07/16: “in aggregate, we’re looking at a pretty much 30% to 35% topline growth next year “

08/02/15: “[Mr. Han] is very disappointed with the current valuation of the Company and once, after the next couple of years, once we reach a very mature and stable state, return to shareholder will definitely be the top priority to the Company, to the management.”

Demand for Xinda’s products will be dependent on the trend the domestic passenger vehicle market. Car sales rose 15% in 2016 supported by a reduction in the tax rate on smaller vehicles. The tax reduction has been partially removed in 2017 and most forecasts are for sales this year to increase at a slower rate of 5-10%.

The Nanchong facility has increased Xinda’s annual domestic production capacity from 390000 tonnes to 690000 tonnes. A 30-50% increase in revenues (suggested by management) and net income would not be an unreasonable expectation. Unfortunately Mr. Han’s buyout offer has been delivered just prior to this expected increase in company profits and would deprive public shareholders of all the benefits from the company’s recently completed capital expenditures.

XINDA’S UNDISCLOSED SICHUAN EXPANSION PLAN

Chinese media reported (example) that on December 12 Xinda signed an agreement to make a major expansion of its Nanchong facility

Photo: Ceremony celebrating the signing of an investment agreement between the Nanchong city government and Sichuan Xinda Enterprise Reports included the following details:

Reports included the following details:

- 300000 tonnes of new capacity (on top of the existing 300000 tons recently completed)

- Commencement in March 2017

- Completion October 2018

- Total investment 2.5Bn RMB including 2.0Bn RMB of fixed assets

- Annual revenues of 5Bn RMB

- 50 production lines of bio-based materials serving a variety of industries including food packaging

- 5 additional production lines of specialized materials for 3d printing, medical equipment, and other applications

I asked CXDC why no shareholder disclosure had been made about this agreement. The company replied that it received legal advice that disclosure was not required because the agreement was only a non-binding letter of intention. If this advice was sought then it is possible that everything was handled in strict accordance with the letter of US securities laws.

However it was just two months after signing the undisclosed agreement that Mr Han and MSPEA made their buyout offer. The offer was made with full knowledge of the Sichuan expansion plan, government negotiations, and future profit potential. Of course this information was not reflected in Xinda’s share price prior to buyout offer because of a corporate decision not to disclose it.

While China XD may have tried to adhere to the letter of disclosure regulations, the NYSE Company Manual provides wise advice to issuers:

- Excessive or misleading conservatism should be avoided.

- Few things are more damaging to a company’s shareholder relations or to the general public’s regard for a company’s securities than information improperly withheld

China XD Plastics Independent Directors may have a responsibility to consider whether management pursued a policy of minimal disclosure in order to depress demand for company shares and facilitate secret plans for a future buyout offer. The company issued only one discretionary press release during 2016 (China XD Plastics Announces Commissioning Ceremony to Celebrate New Manufacturing Facility in Sichuan) and I do not see any record of participation in any investment conferences in 2016. Shareholders cannot fairly evaluate the buyout offer if the company has made incomplete disclosures. If disclosure has been poor then CXDC management and MSPEA may be partly responsible for the problem of CXDC’s low stock valuation for which they have offered the solution of a buyout on terms enormously advantageous to themselves.

HISTORY OF BUYOUTS BY MORGAN STANLEY PRIVATE EQUITY ASIA

Examination of four previous buyouts of US-listed Chinese companies by MSPEA shows that they have considerable experience with the process. They appear to make every effort to maximize their profits by paying as little as possible to public shareholders. The key to one case where they sharply raised their bid was a viable competing offer.

Sino Gas International – natural gas distribution company (link to SEC filings)

- CEO (no MSPEA involvement) made a preliminary buyout offer at $0.48 04/28/12

- CEO and MSPEA made a preliminary buyout offer at $0.50 12/08/13

- Revised preliminary offer at $1.10 following third party expressions of interest 03/25/14

- Competing buyout offer received at $1.45/share 03/28/14

- CEO and MSPEA raise offer to $1.30/share 03/28/14

- Definitive agreement signed with CEO and MSPEA at $1.30/share 04/02/14

- Shareholder meeting 08/06/14

- Merger Closed 11/26/14

Yongye International – producer of crop nutrients (link to SEC filings)

- Preliminary MSPEA buyout offer $6.60/share 10/15/12

- Definitive agreement $6.69/share 09/23/13

- Shareholder meeting adjourned 02/19/14

- Revised buyout offer $7.00/share 03/26/14

- Revised Definitive Agreement $7.10/share 04/09/14

- Shareholder Meeting 06/06/14

- Merger completed 07/03/14

- a class action lawsuit was subsequently settled for an additional payment of $6mm (before fees) to shareholders at the time of the merger

Feihe International – dairy producer and distributor (link to SEC filings)

- Preliminary MSPEA offer $7.40 share 10/03/12

- Definitive Agreement $7.40/share 03/03/13

- Shareholder Vote 06/26/13

- Merger Completed 06/27/13

- a class action lawsuit was subsequently settled for an additional payment of $6.5mm (before fees) to shareholders at the time of the merger

Noah Education – childhood education classes and materials (link to SEC filings)

- Preliminary MSPEA offer $2.80/share 12/24/13

- Definitive Offer $2.85/share 04/02/14

- Shareholder Meeting 07/25/14

- Merger Closed 07/30/14

ARE STRATEGIC ALTERNATIVES POSSIBLE?

Mr. Han and MSPEA stated in their letter (LINK):

“We are interested only in pursuing this Acquisition and are not interested in selling our shares of Common Stock or preferred stock of the Company, as the case may be, in any other transaction involving the Company. “

It seems they are eager to buy public shares at an unfair price, but are not willing to have their own shares bought at an unfair price Expressing unwillingness to sell their 74% stake eliminates possible competition and makes it more difficult for a Special Committee of Independent Directors to negotiate a better price for minority shareholders.

An alternative strategic transaction may still be able to satisfy many of the goals of all parties involved. I offer the following structure not as a fully formed “deal”, but as an example of how new thinking may reveal the possibility of a win-win solution. It begins from speculation about the objectives of various parties with whom I have had no direct contact and readers should understand that these opinions may be completely erroneous:

- Mr. Jie Han founded Xinda in 1985 and deserves credit for the company’s tremendous success. The company has issued equity to finance its growth, but Mr. Han has never sold any of his own shares (LINK to SEC ownership filings). It seems likely that Mr. Han’s goal is to maximize the company’s long-term growth. The company’s success would be enhanced if it were able to raise new equity financing, but that is impossible right now due to the low valuation of CXDC shares. This has put Xinda in a somewhat uncomfortable position relative to major Chinese competitors. Without new equity financing it may be difficult for Xinda to fulfill the (non-binding) commitments of its plant expansion agreement with the Nanchong government.

- MSPEA invested in CXDC in 2011 through MSPEA III LP, a fund established in 2007 with an expected life of ten years – five years for investing, followed by five years for harvesting. P/E fund expirations can typically be extended by 1-year increments with the approval of a majority of the LPs. MSPEA’s investment was made through a security that is now convertible at the option of the company into common shares at a price of $6.25/share. Xinda has achieved tremendous growth during the time of MSPEA’s involvement, but the low share valuation is a serious problem because MSPEA needs to recover its capital, realize a gain, and pay back its investors.

- Public shareholders have diverse backgrounds, but all want the maximum possible return from their investment. Unlike MSPEA the public is not under any pressure to realize a gain within any particular time frame. Unlike Mr. Han the public is indifferent to the growth of the business unless it directly increases the return per publicly held share.

The buyout offer from Mr. Han and MSPEA would serve their own interests, but harm the public.

- After privatization new investors could be brought in at a higher valuation enabling the company to finance growth projects such as the secret Sichuan expansion

- After reorganization and growth in profits MSPEA could sell its stake at a higher valuation privately or through a future public offering in HK/China. MSPEA’s return would be greatly enhanced if it were able to eliminate the public shareholders at a bargain price.

- The public shareholders would suffer the loss of most of the fair value of their investment if their shares were sold at a bargain price.

Rejection of the offer is a viable and appealing option for the public shareholders. Mr. Han’s letter requested that the Board of Directors permit third parties to conduct due diligence for potential investment in his buyout. Given what appears to be the unfair price of Mr. Han’s offer, the Board of Directors may conclude that accommodating his due diligence request would be an irresponsible waste of corporate resources. In that case Mr. Han would have an opportunity to submit a new preliminary offer that might be more likely to fairly compensate the public shareholders. The Board may also consider whether it is fair to permit third party access to confidential corporate information when news about a potentially significant company development (the Sichuan Phase 2 plan) has been withheld from existing shareholders.

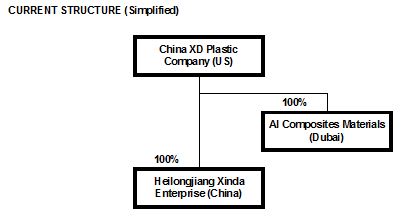

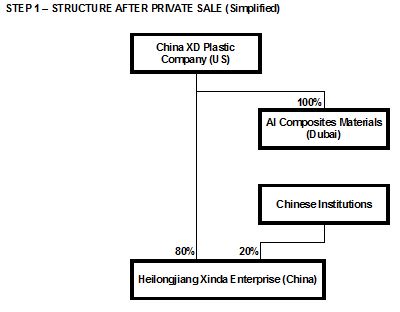

The time pressures faced by Mr. Han and MSPEA may encourage consideration of other strategic options that could bring benefits to all parties. Below I describe one possibility, a domestic equity fundraising by Heilongjiang Xinda Enterprises (the onshore holding company for most of Xinda’s assets within China). For reference here is the full corporate structure as shown the 2015 10-K (LINK) And a simplified form illustrating a possible domestic fundraising in two stages:

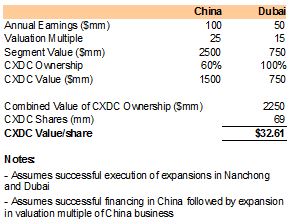

Xinda’s main Chinese competitors trade at high valuations on Chinese exchanges. It is not currently possible for CXDC (a Nevada corporation) to directly list its shares in China, but I believe that Heilongjiang Xinda Enterprise could sell shares privately to domestic institutions and obtain a domestic listing in 1-3 years. Advantages of this structure would be:

- Fast execution of step 1 (perhaps within 6 months) would allow fast movement on domestic investment opportunities (such as the Sichuan Phase 2). If 2016 Net Income of Heilongjiang Xinda Enterprise is $70mm (note the 10-K showed 2015 PRC pretax income of $90mm) then sale of a 20% interest at a 15 P/E would provide $210mm of new equity capital. Those terms would be highly attractive to buyers because investment would not need the government approvals required for investment in foreign securities such as CXDC stock and buyers could anticipate a valuation of 25X earnings after a domestic listing. This fundraising combined with operating cash flow and modest new borrowing could fully finance the Nanchong expansion.

- Chinese regulators would probably look favorably on a listing application by Heilongjiang Xinda because it is a leading company in a favored industry and a public offering would be priced at a reasonable valuation. If the company is able to execute a reverse merger with an already listed company then the process might take one year (done by the end of 2018). If Heilongjiang Xinda applies for an IPO then it might take 2-3 years (done by the end of 2020). Assuming higher net income ($100mm) and a higher multiple (20 P/E) then the public offering at the time of listing could raise $400mm of new capital.

- A domestic financing would provide CXDC investors with greatly improved visibility into the value of the business.

- CXDC’s 60% ownership of Heilongjiang Xinda after these two steps would be valued at $1.5Bn ($100m earnings, 25 P/E, 60% ownership) plus the Dubai business possibly worth $0.75Bn ($50mm earnings, 15 P/E, 100% ownership).

- These estimates are just for illustrative purposes. If Xinda’s domestic capacity grows from 390000 tonnes 2015 to 690000 tonnes (Sichuan Phase 1) and 990000 tonnes (Sichuan Phase 2) and utilization and margins remain at current levels then Xinda’s annual net income could exceed $200mm. Dubai results carry significant uncertainty because the plant is still in its initial production phase but potential profits could also reach $100mm.

- A domestic financing would free capital at the parent company level for distribution as dividends, share repurchase, and international expansion.

This series of transactions would meet most of the assumed goals of Mr. Han, MSPEA, and public shareholders. The company would have the potential for strong growth and the potential gains would be fairly shared among all parties. However the gains received by MSPEA and Mr. Han would be smaller than if they were successful in an unfair buyout offer. Their conflict of interest means that the Special Committee of Independent Directors must have expert independent financial advice in evaluating potential strategic alternatives.

COMMENTS ON RISKS OF INVESTING IN CXDC

My prior article (LINK) included a lengthy review of company risks including the possibility of a MSPEA buyout below fair value. I stated “ As time passes, this risk probably diminishes, because private equity funds have a 3-7 year expected holding period, so MSPEA is likely to be looking to exit its investment by 2017-2019”. But here we are…

New risks associated with the buyout and any potential review of strategic alternatives are:

- The buyout might be completed at $5.21/share or another price far below fair value

- The buyout might not be completed if Mr Han and MSPEA are unwilling to offer a fair price. If no other plan is developed to deliver value to shareholders then the short-term impact on CXDC shares would be negative.

- The company may take actions that make it look less attractive in order to decrease the negotiating power of the Special Committee. For example, the company may withhold information about significant developments, the company may not follow through on past promises to pay dividends in 2017, the company may defer signing beneficial agreements with third parties, and the company may offer unexpectedly weak guidance for future sales and earnings.

- There may be legal obstacles to the specific example of a possible alternative transaction outlined in this article. The author did not receive independent expert advice on the structuring of this idea. It should be considered only as one example of potential new ideas that may deserve review by experts employed by the Special Committee.

- Industry conditions may deteriorate while strategic alternatives are under review and the fair value of the company may decline. Expansion plans by Xinda and its domestic peers may result in excess capacity and lower profit margins. Passenger vehicle sales may decline and lead to lower demand for Xinda’s products.

CXDC has suffered along with many other companies due to investor perception that management of Chinese companies will not fairly share the value of company successes with public investors. Sadly, the buyout offer may prove that investors were right not to trust Mr. Han.

Disclosure: The author is a public shareholder of CXDC seeking the maximum possible return from his investment. Interested parties who wish to communicate privately about CXDC may contact the author at konekoresearch (at) gmail.com

Somebody suggested that the article I linked about the Nanchong Phase 2 signing ceremony could be fake news because it was from a low profile industry website. But the same story was widely covered elsewhere. Here is a link for google search results for Nanchong Xinda 南充鑫达 in a time period from 12/10/16 to 12/31/16.

http://bit.ly/2mtuAok

LikeLike

CXDC claims that its Nanchong expansion plan was just a non-binding letter of intention that did not require shareholder disclosure until this week, however, equipment purchase contracts for this expansion were signed on January 3:

Additive Manufacturing Used Composites (3D Printing Materials) Project Equipment Purchase Contract (197mm RMB)

http://bit.ly/2mzgvDv

Xinda 300,000-Ton Bio-Composite Project Equipment Purchase Contract (1241mm RMB)

http://bit.ly/2n47xBb

LikeLike

Great article. Many thanks

LikeLike

Hey, I want the right insight with this. I highly recommend you contact me directly: frans.wikman@gmx.com

LikeLike

Hi Frans, my contact is konekoresearch (at) gmail.com. I try to avoid giving anything resembling advice publicly or privately.

LikeLike